Thechartstore.com does not promote the use of the information contained herein for any specific purpose, and makes no representations or warranties that the information contained in this publication is suitable for the particular purposes of the subscriber or any other party. Thechartstore.com assumes no responsibility or liability of any kind for the use of the information contained herein by the subscriber or any other party. Reproduction of any or all of the Weekly Chart Blog without prior permission is prohibited.

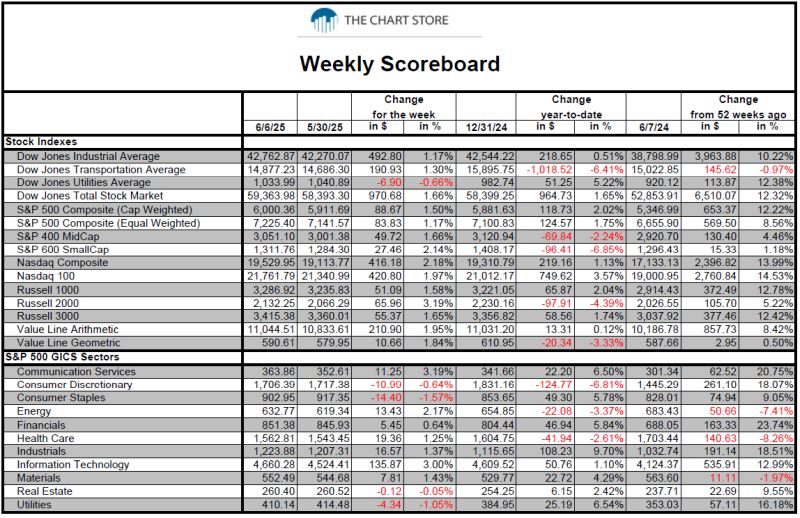

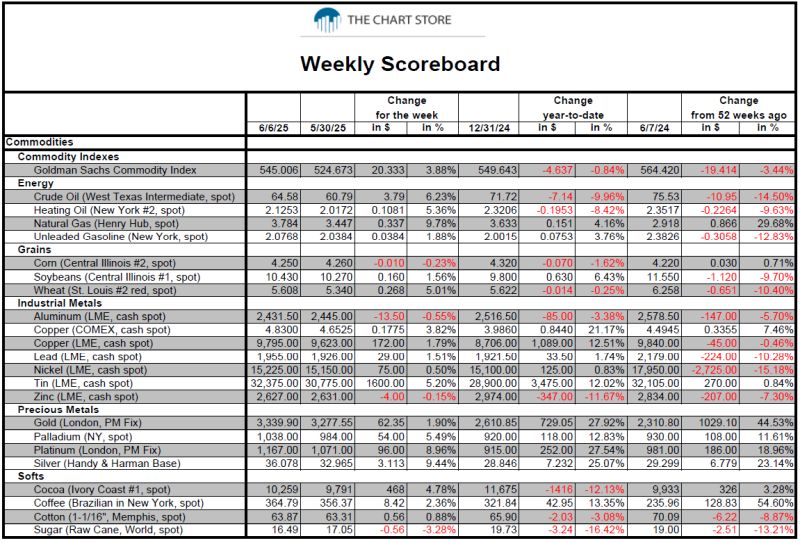

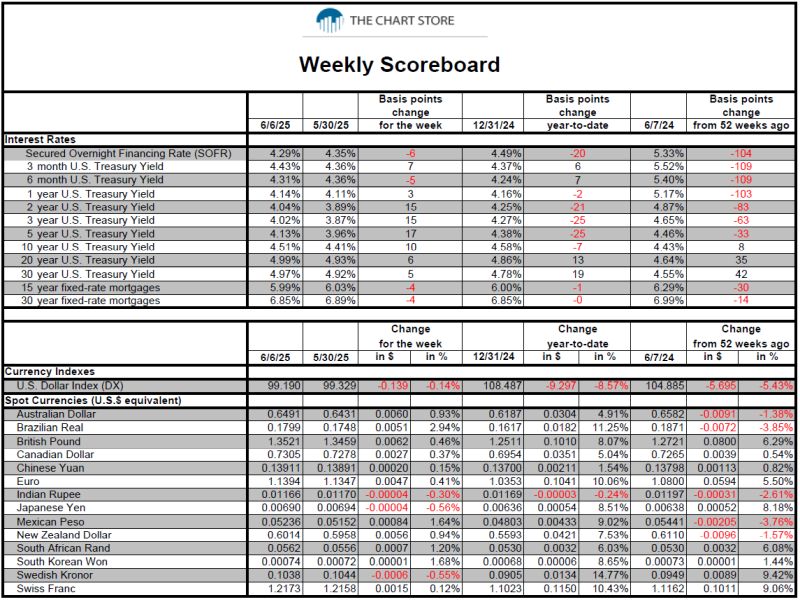

- The Weekly Scoreboard.

- Charts 1 through 11 - Major U.S. Stock Index Watch.

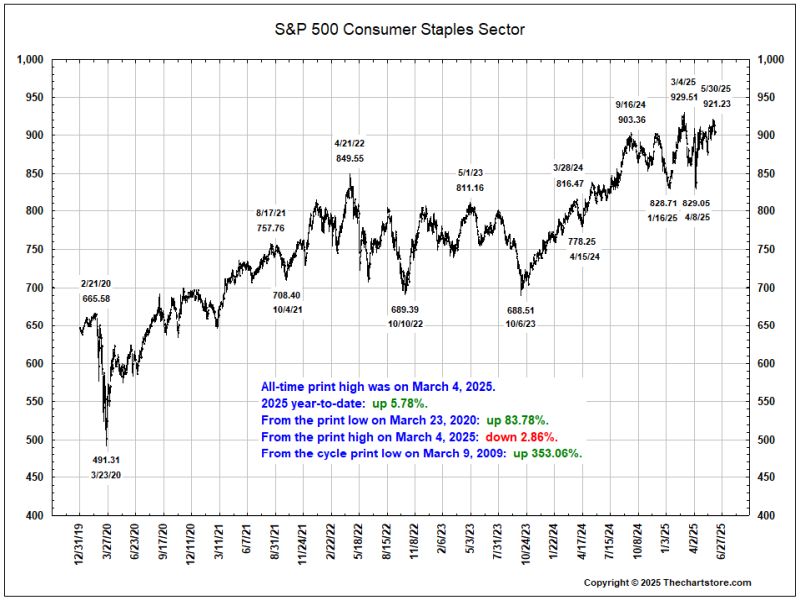

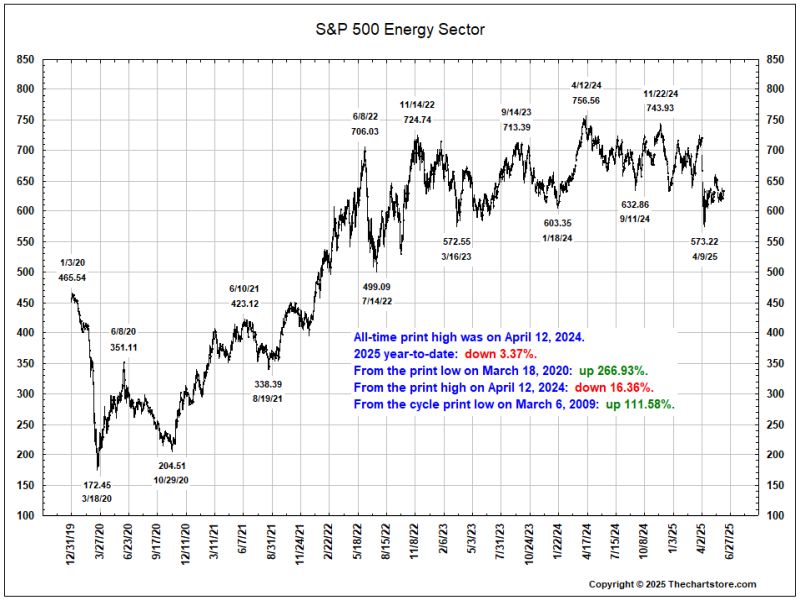

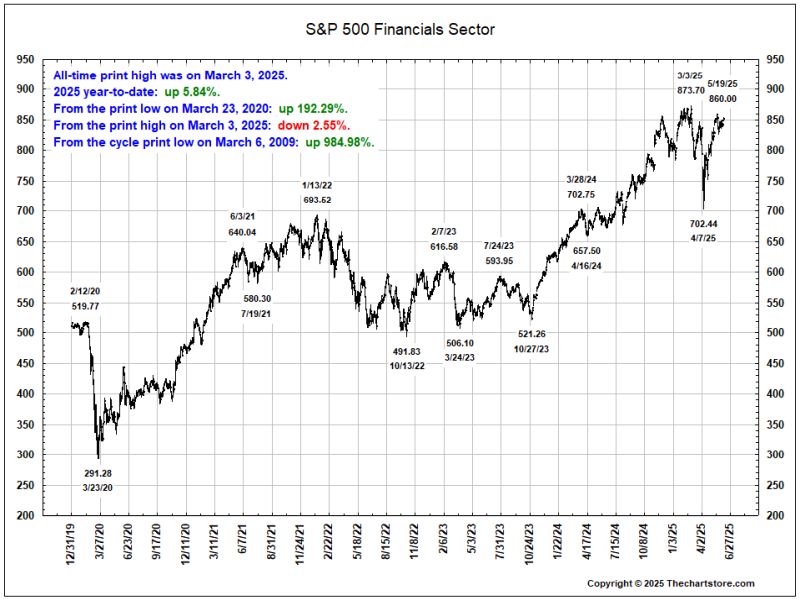

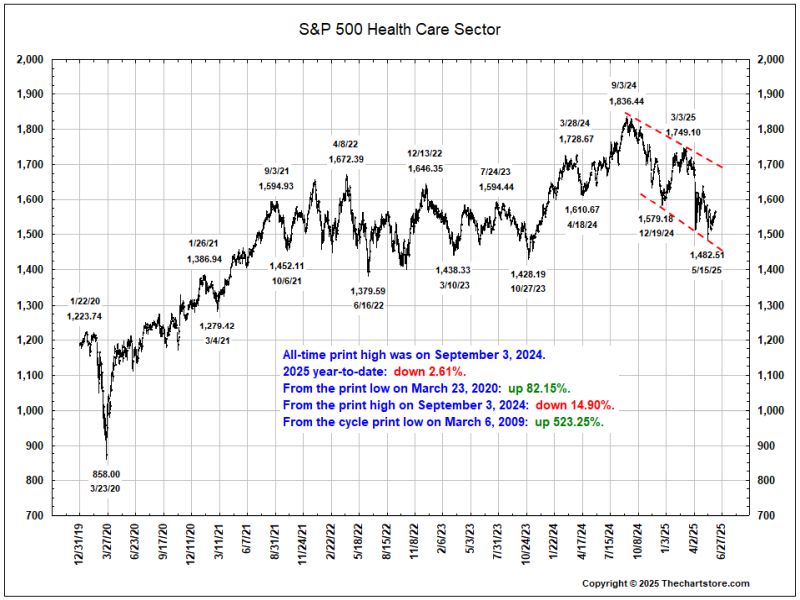

- Charts 12 through 22 - S&P GICS Sector Watch.

- Charts 23 through 36 - Stock Market Indicator Watch.

- Charts 37 through 46 - Analog Chart Watch.

- Charts 47 through 66 - Interest Rate Watch.

- Charts 67 through 74 - Currency Watch.

- Charts 75 through 97 - Commodity Watch.

- Charts 98 through 107 - Fed Watch.

- Charts 108 through 109 with Table - ISM Manufacturing Purchasing Manager's Index Watch.

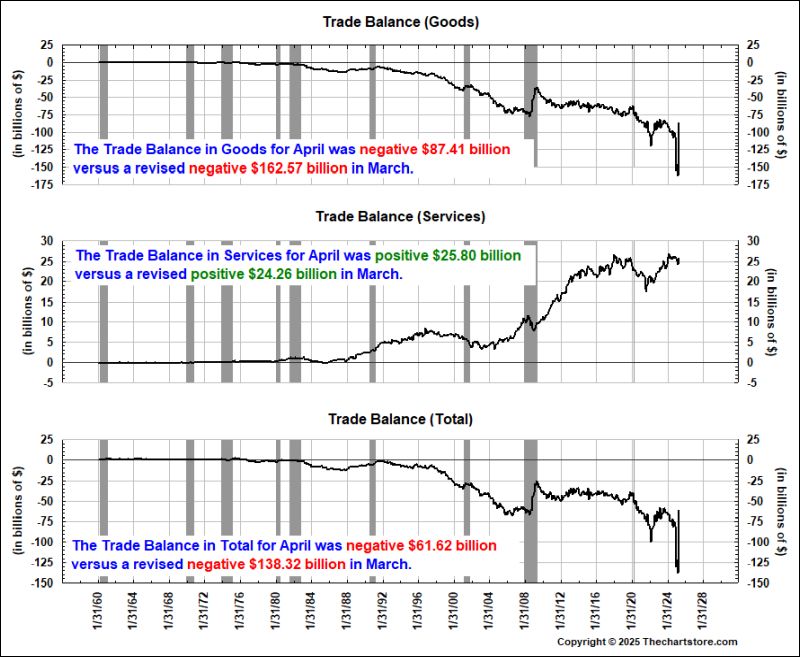

- Chart 110 - Trade Balance Watch.

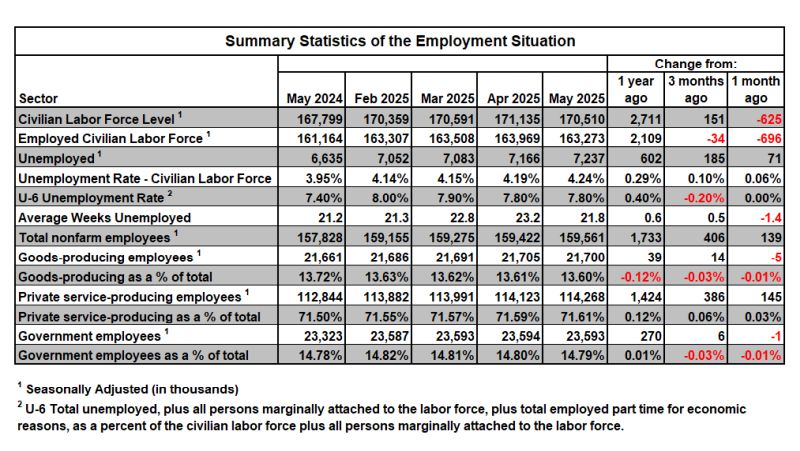

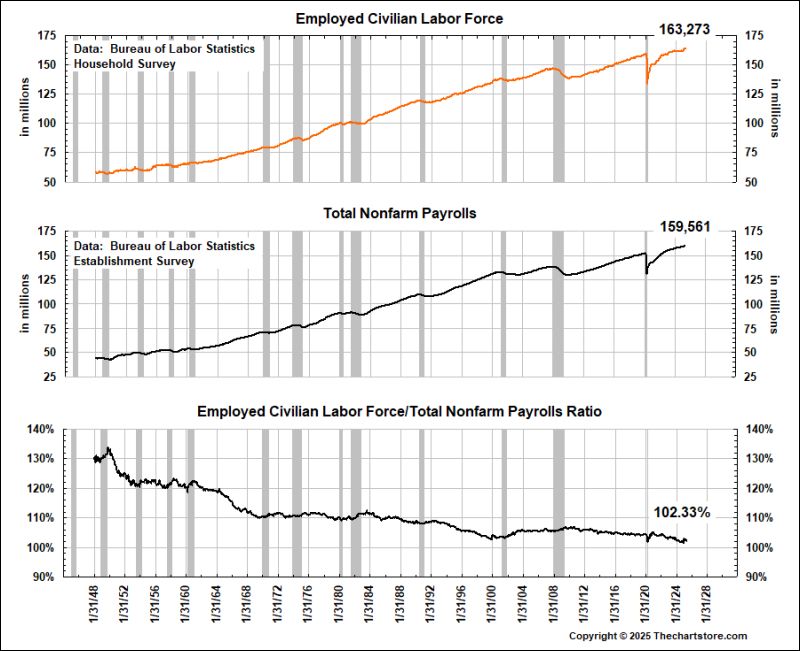

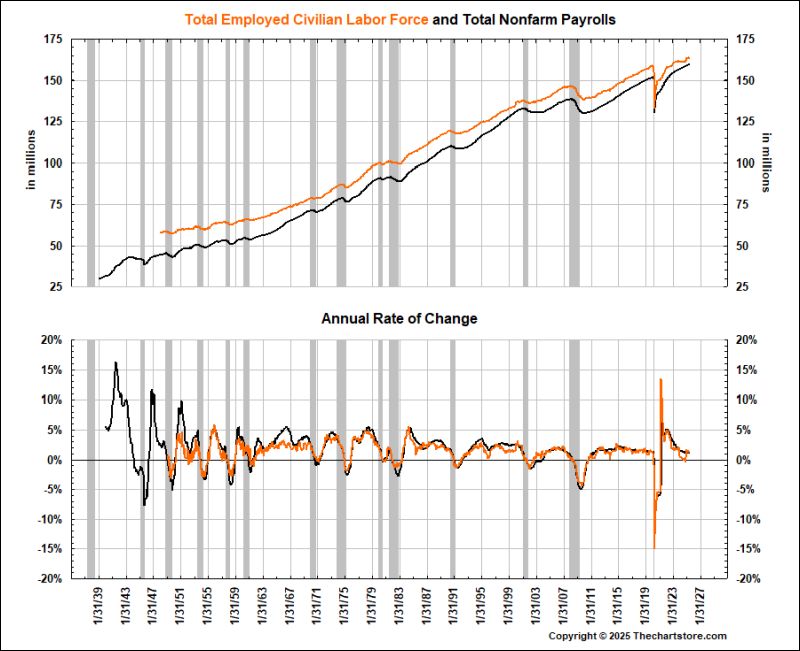

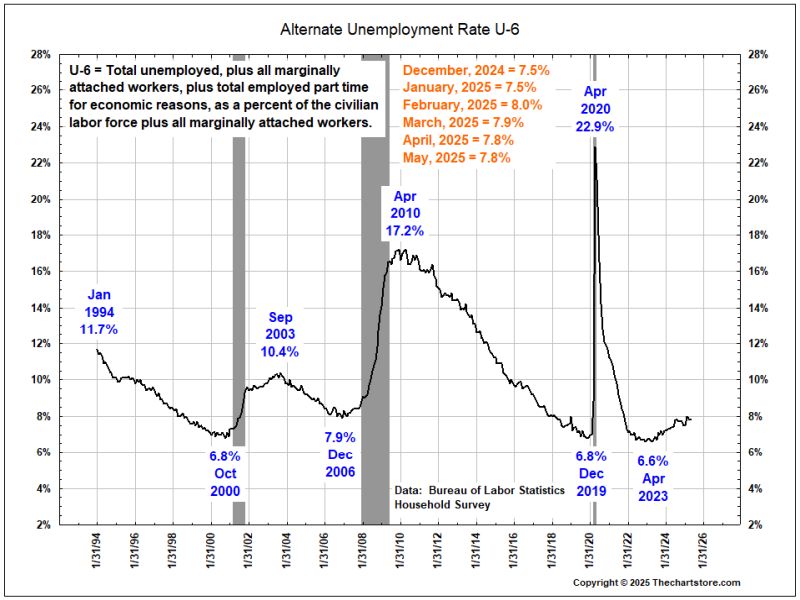

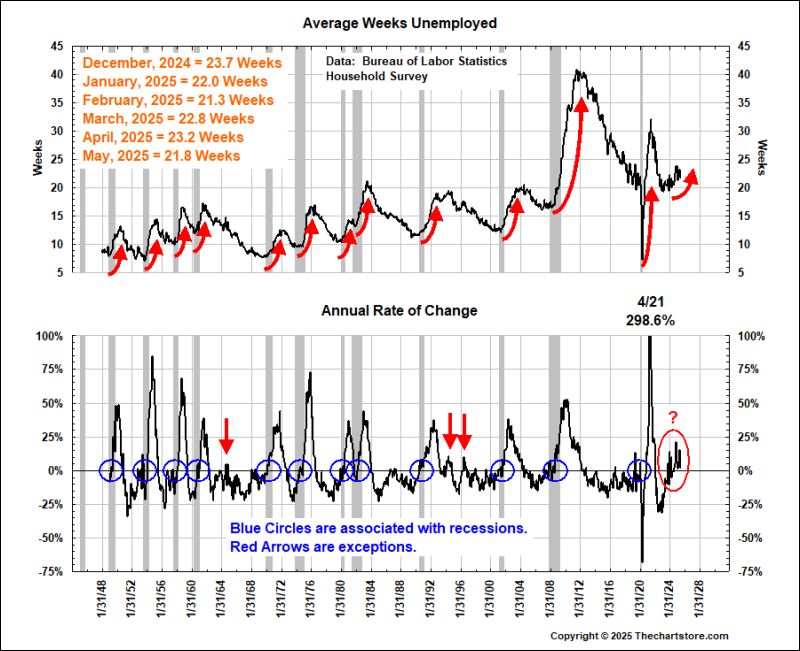

- Charts 111 through 118 and Table - The Employment Situation Watch.

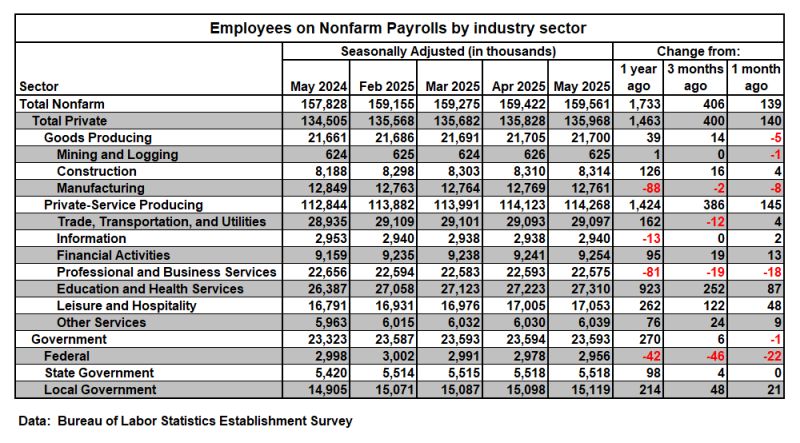

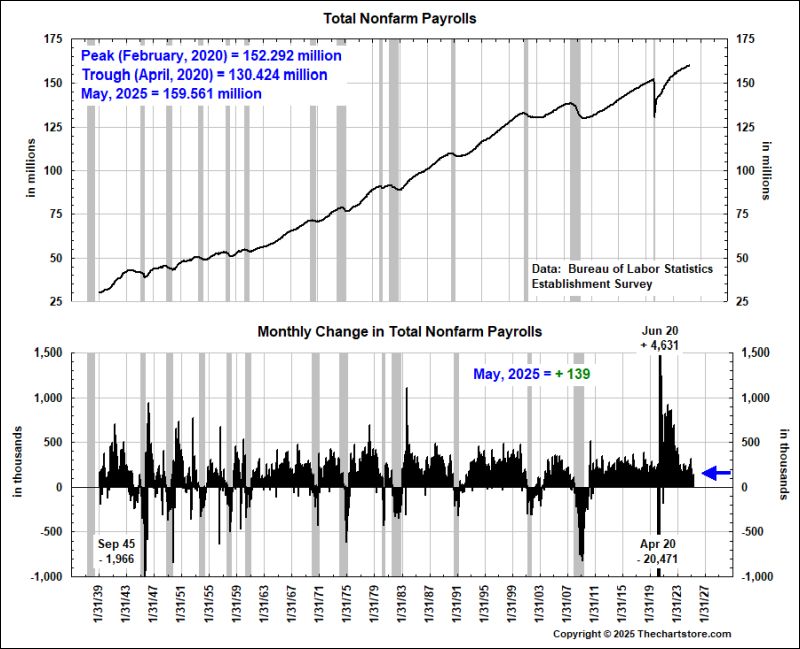

- Charts 119 through 123 and Table - Nonfarm Payroll Watch.

- Charts 124 through 126 and Table - Employee Compensation Watch.

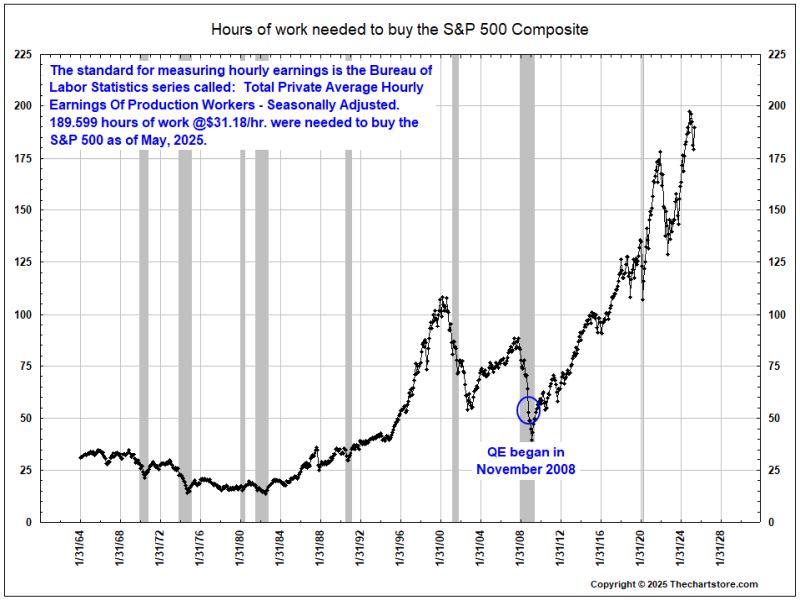

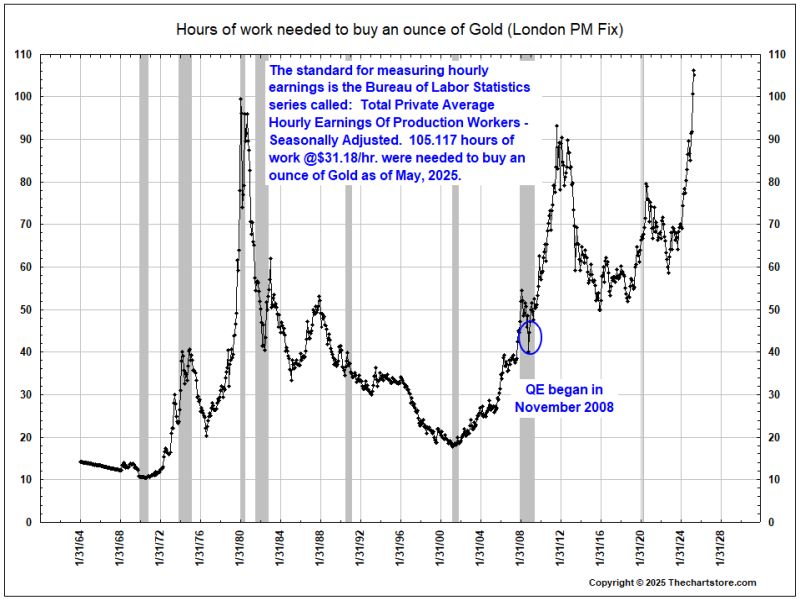

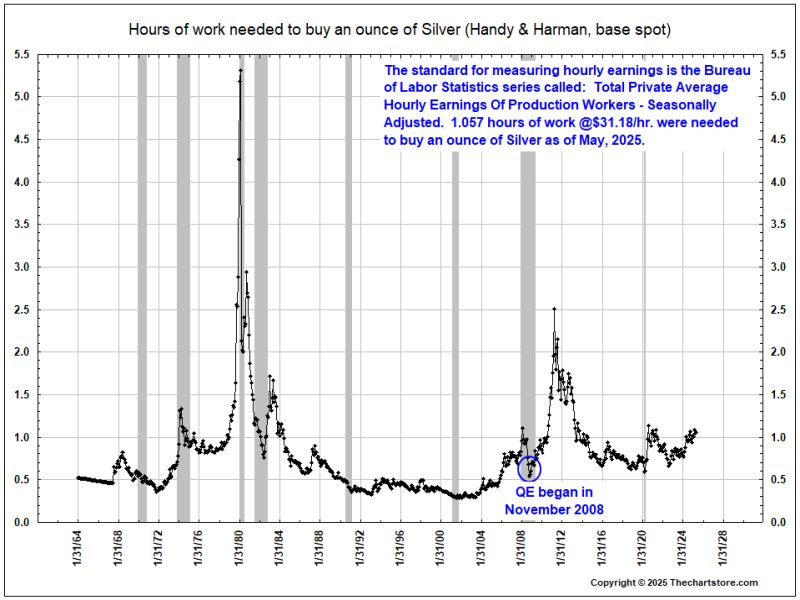

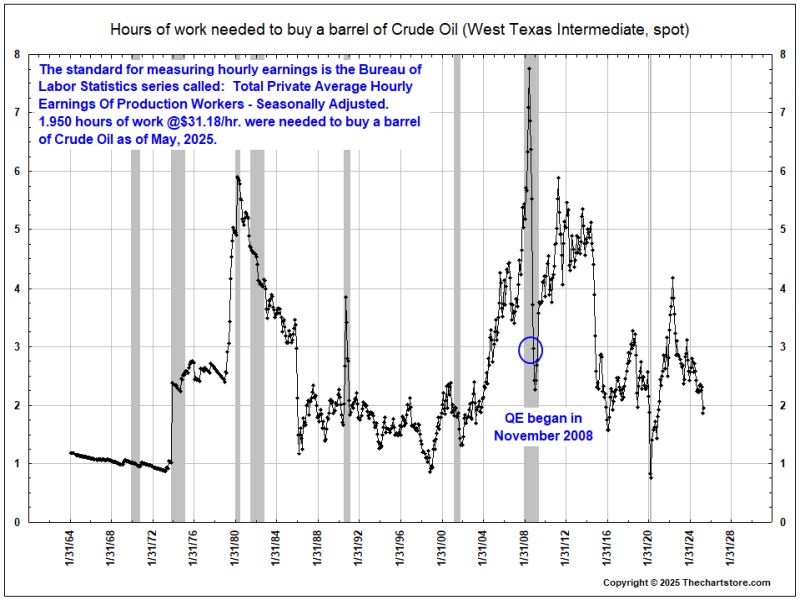

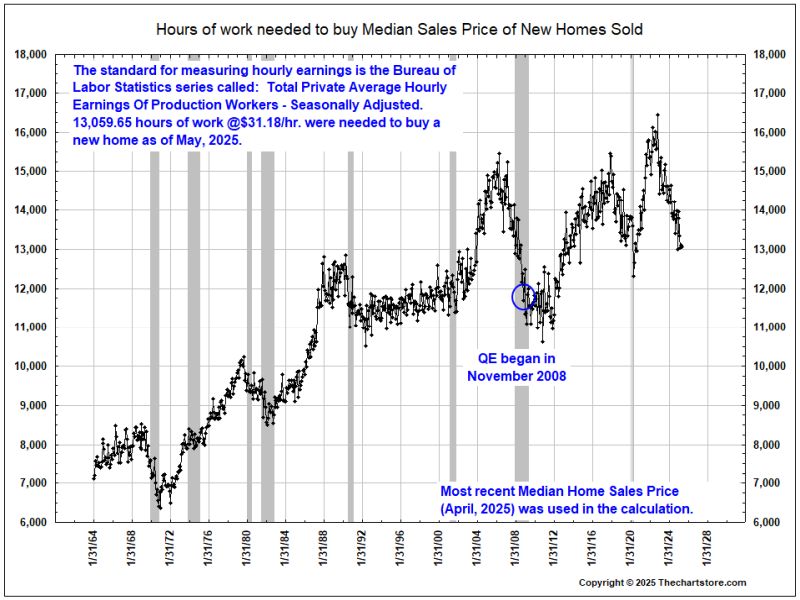

- Charts 127 through 135 - Hours of Work to Buy Watch.

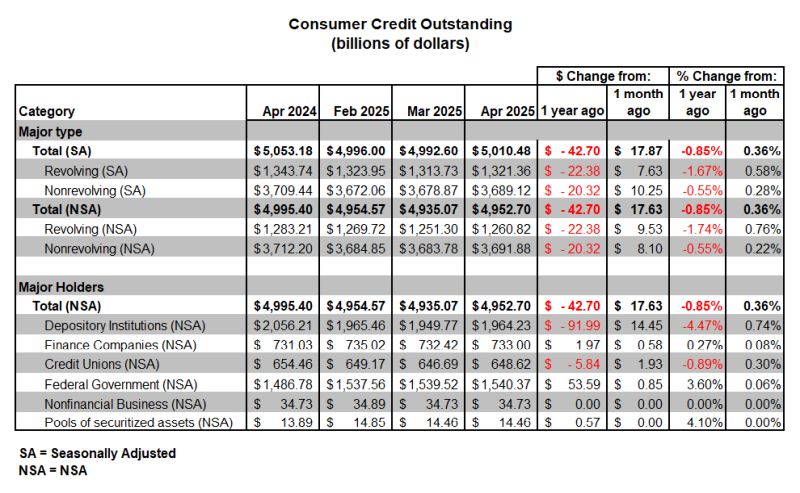

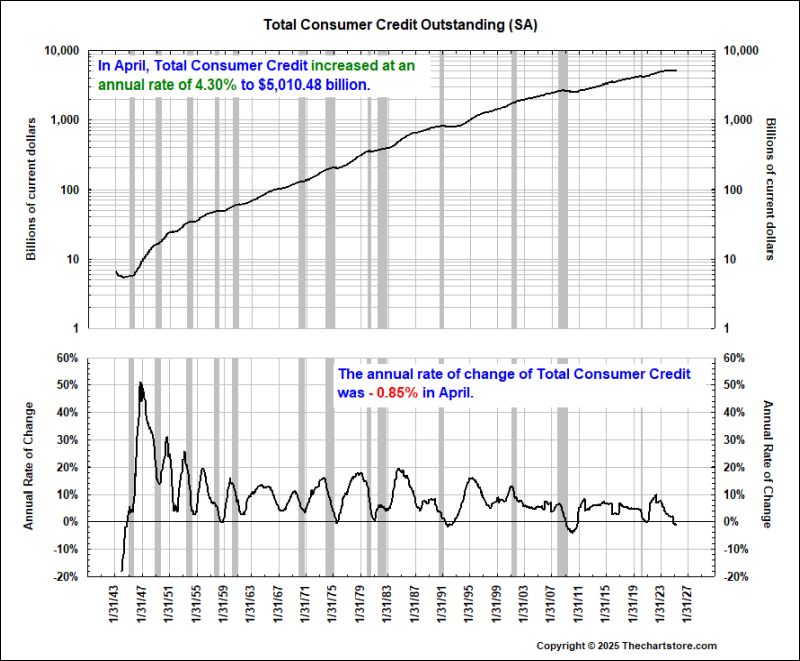

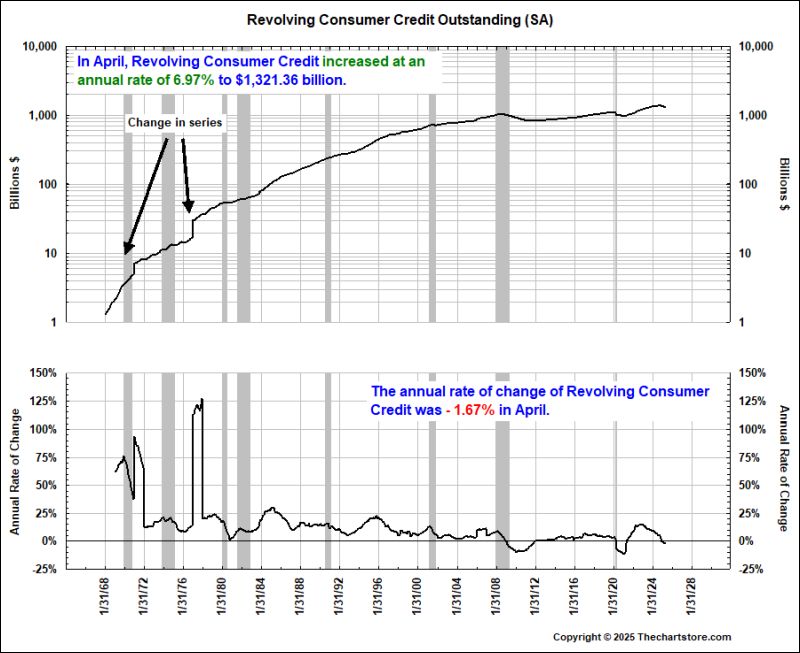

- Charts 136 through 139 with Table - Consumer Credit Watch.

For the Weekly Scoreboard in .pdf format, click here.

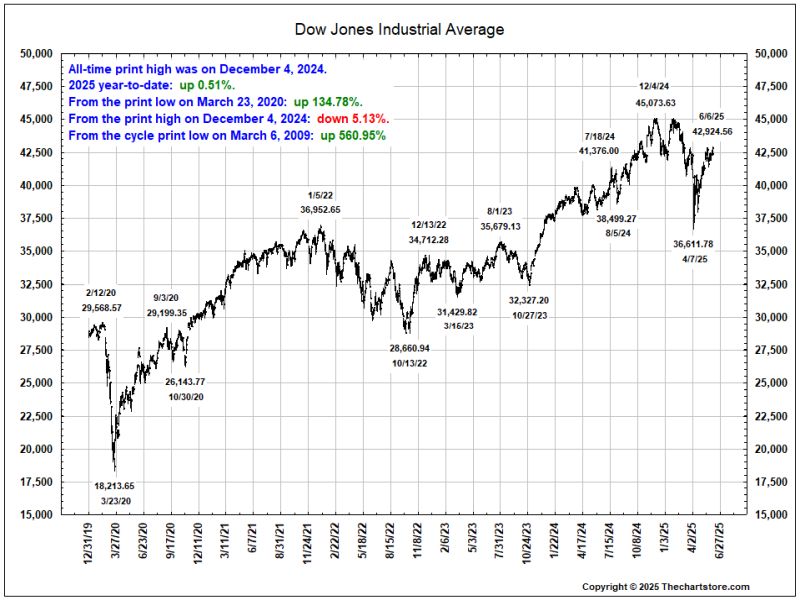

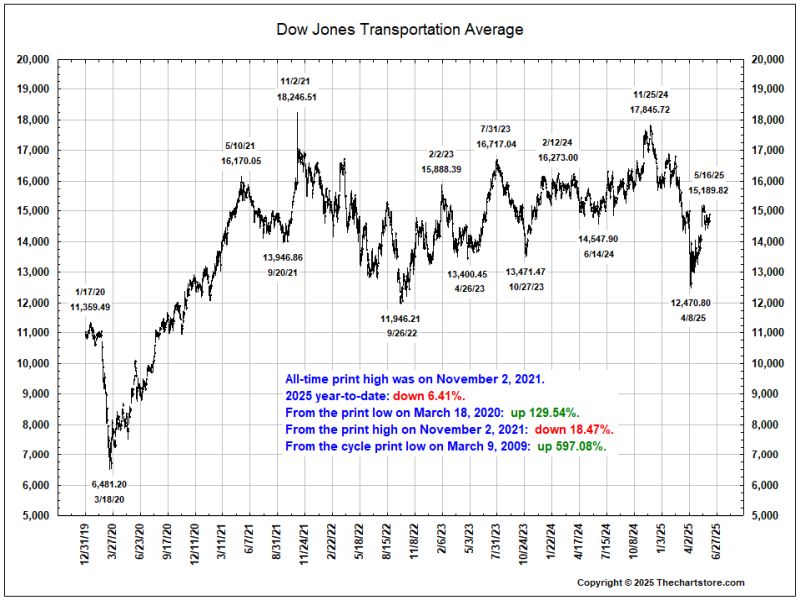

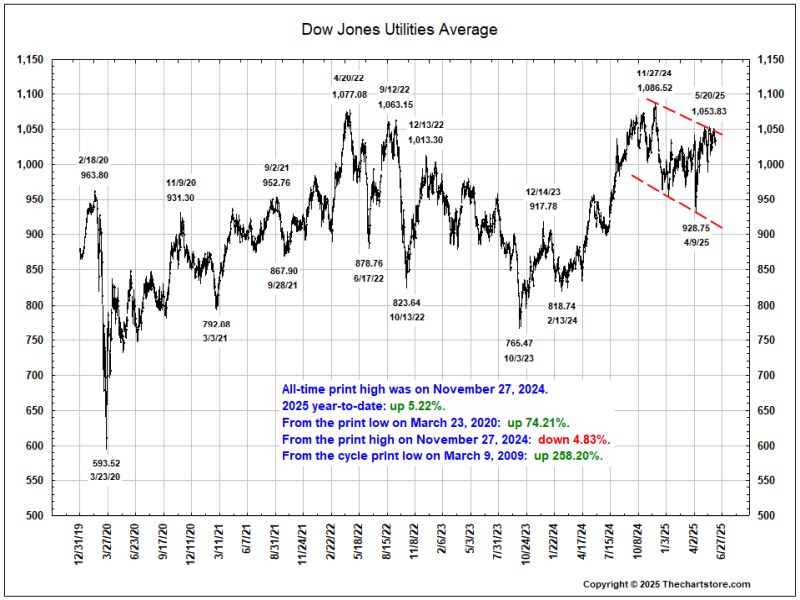

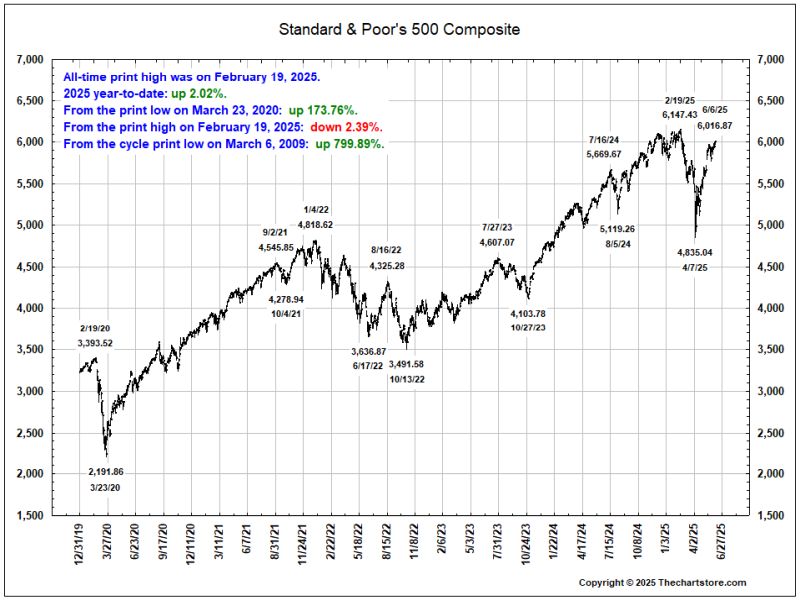

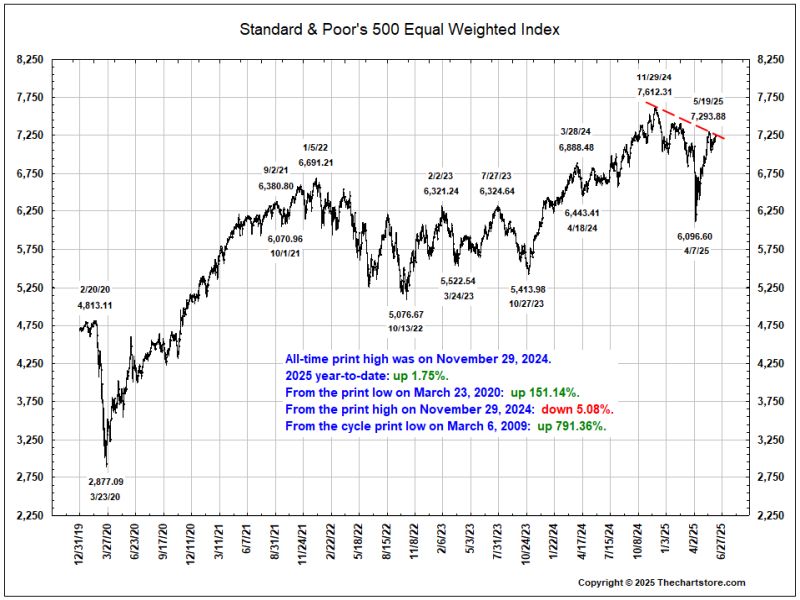

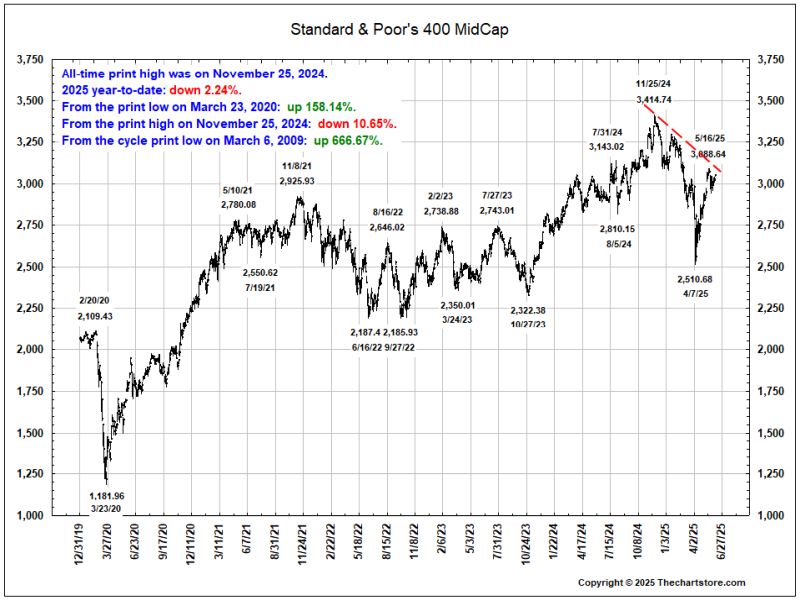

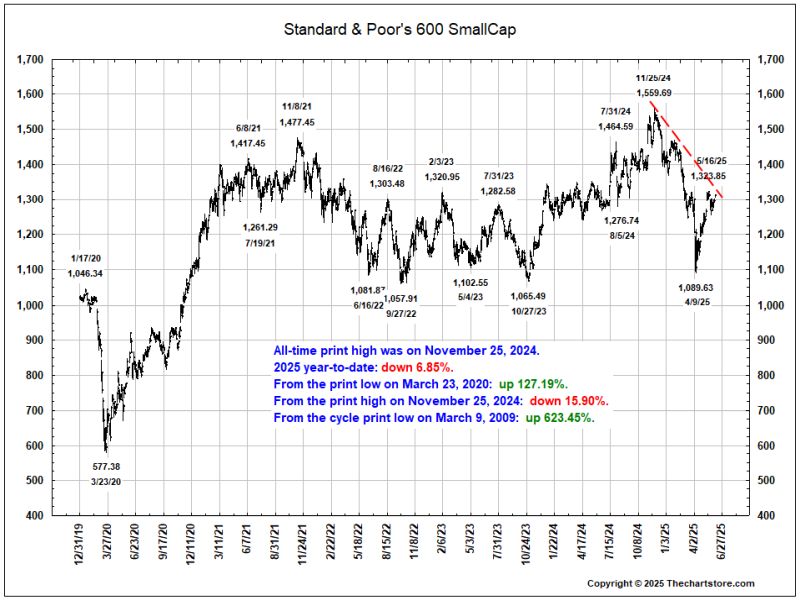

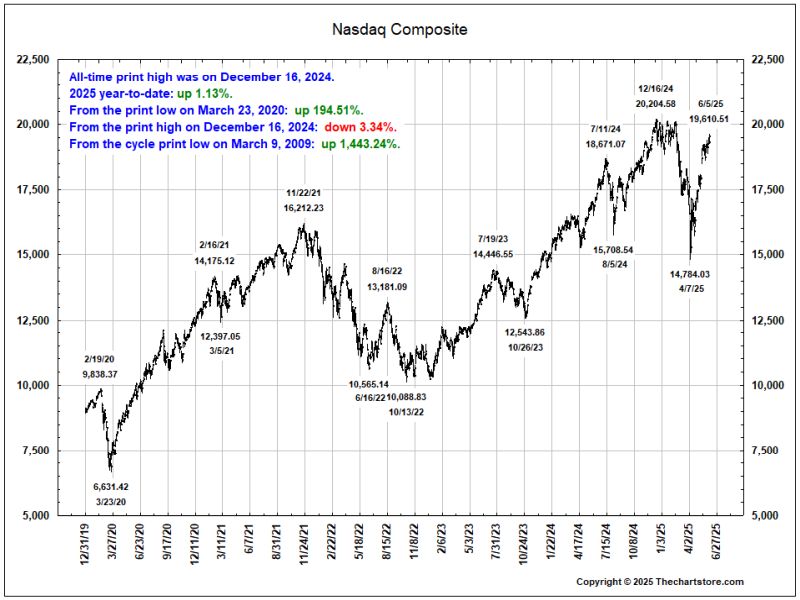

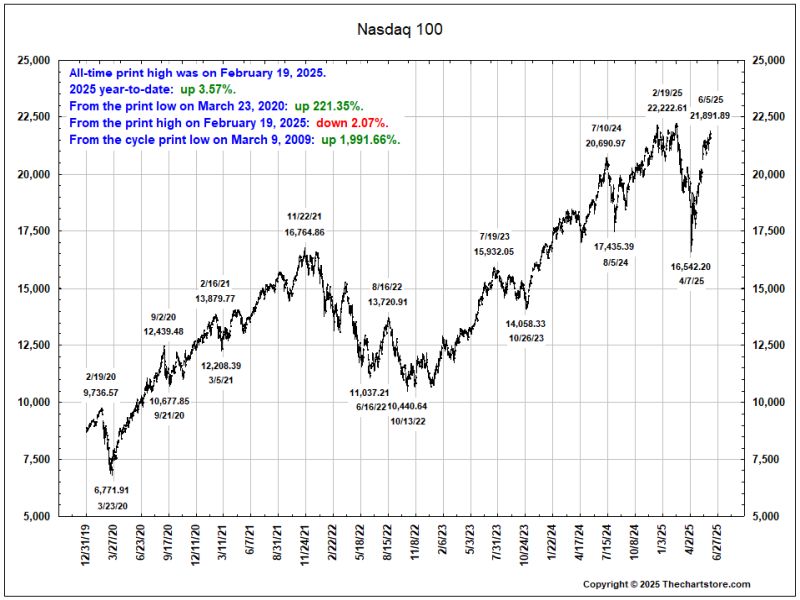

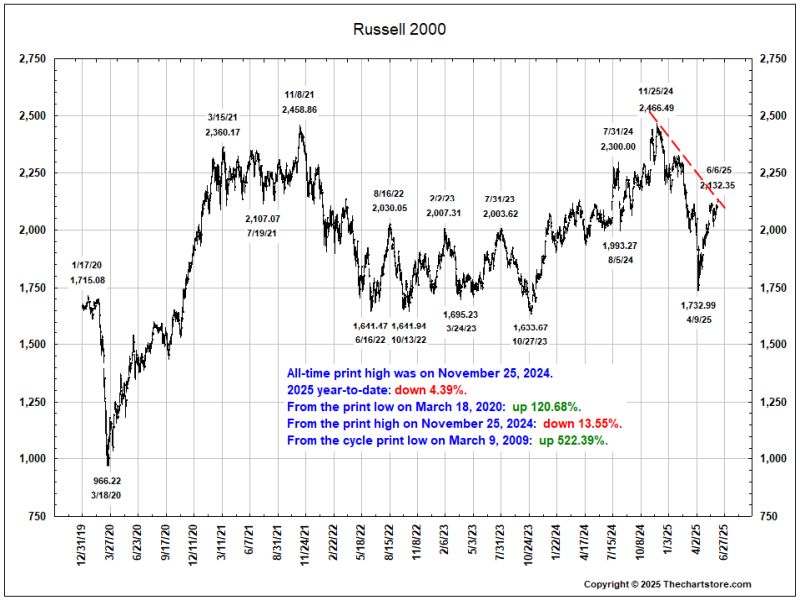

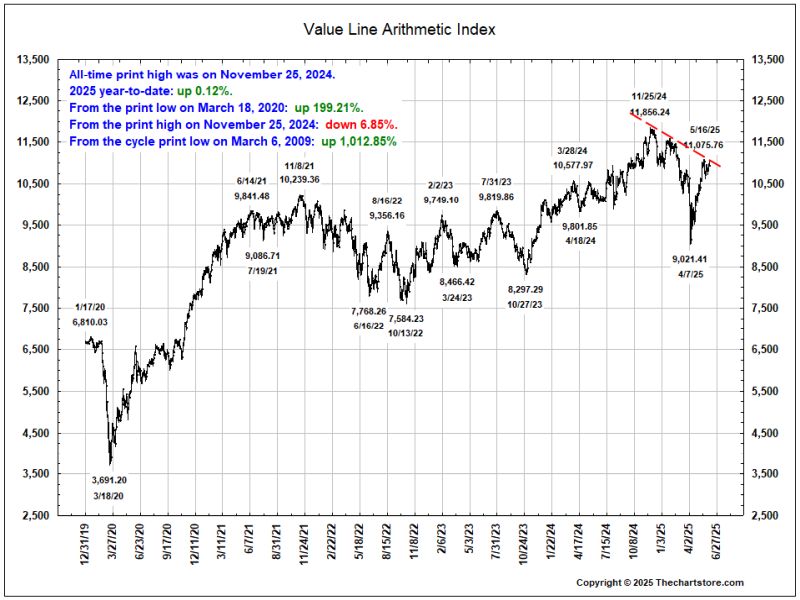

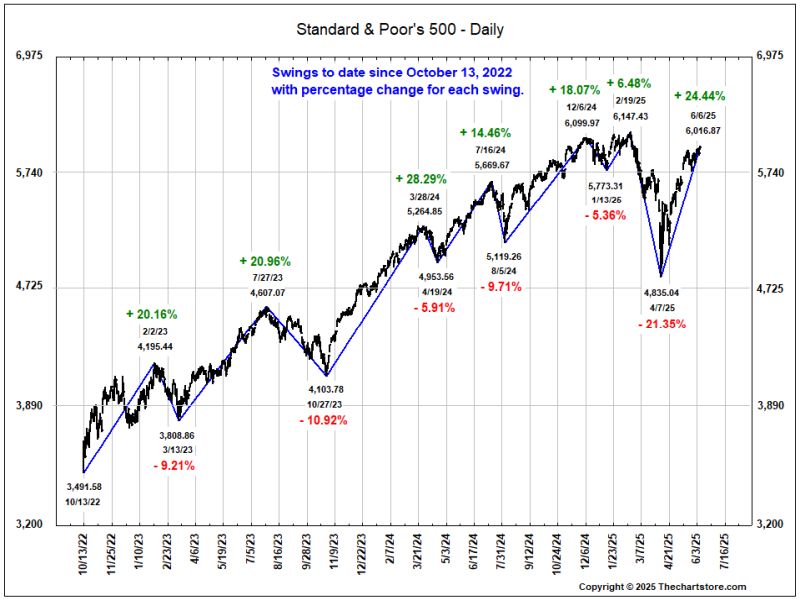

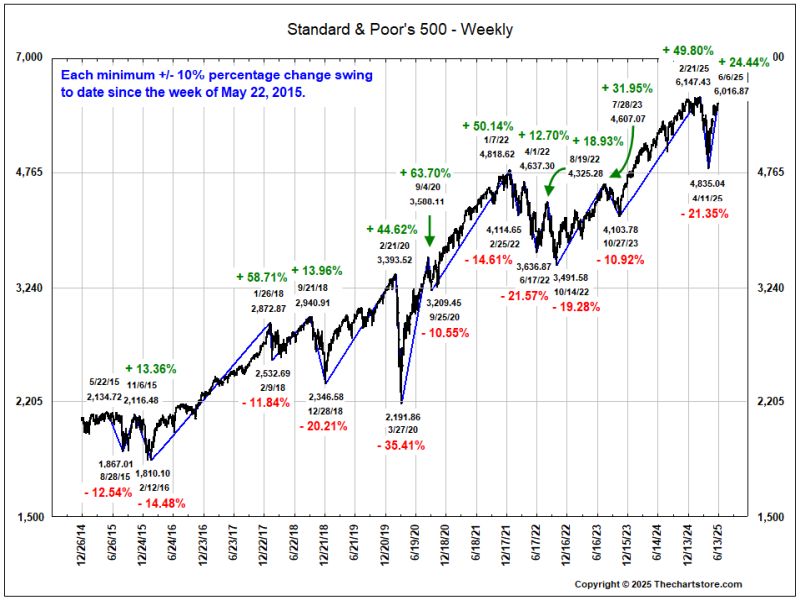

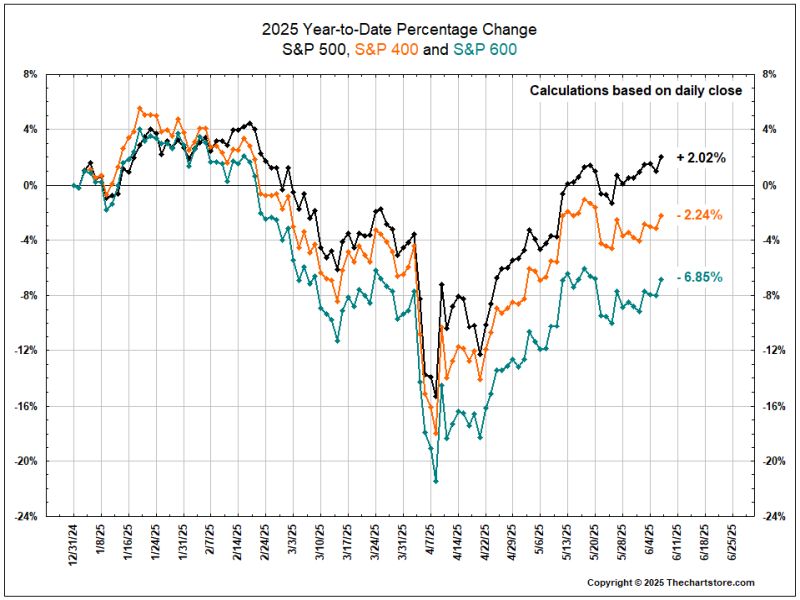

Major U.S. Stock Index Watch

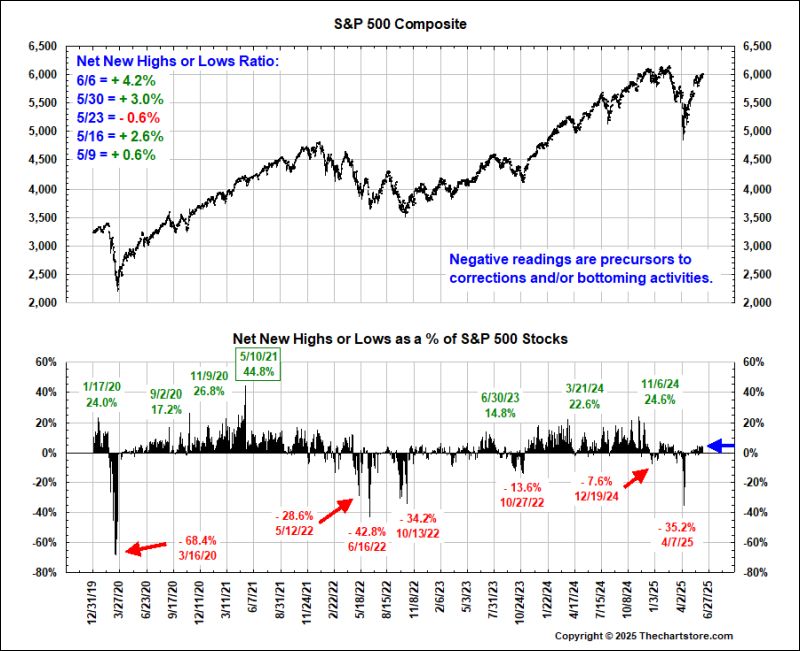

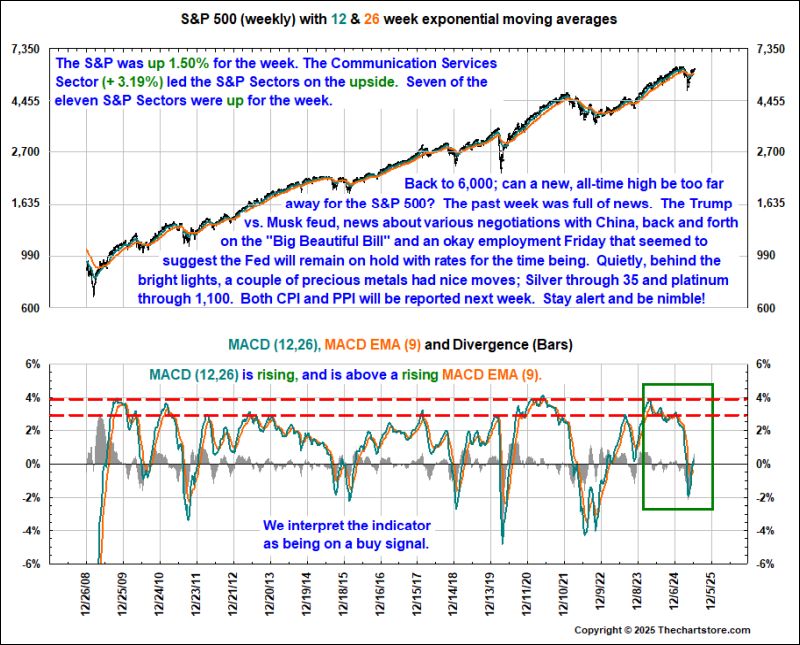

Chart 1

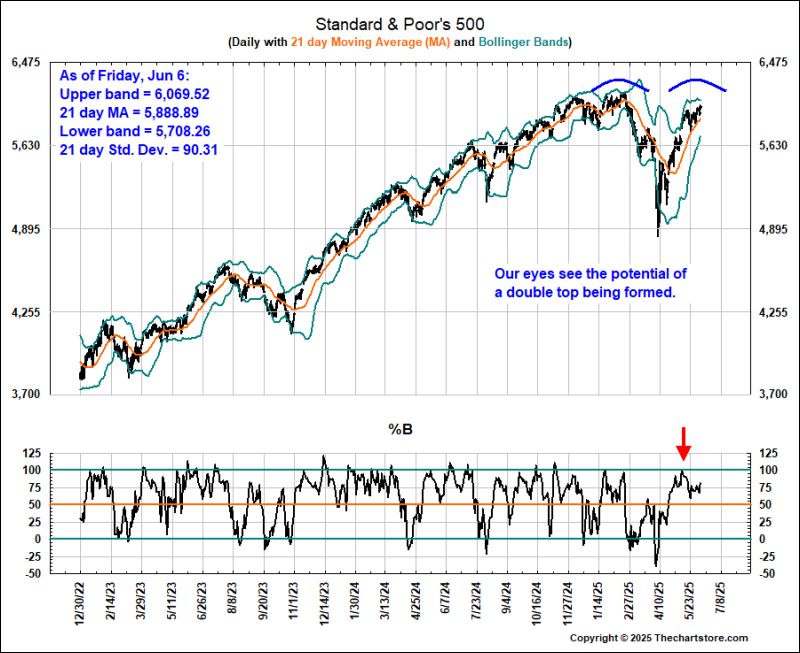

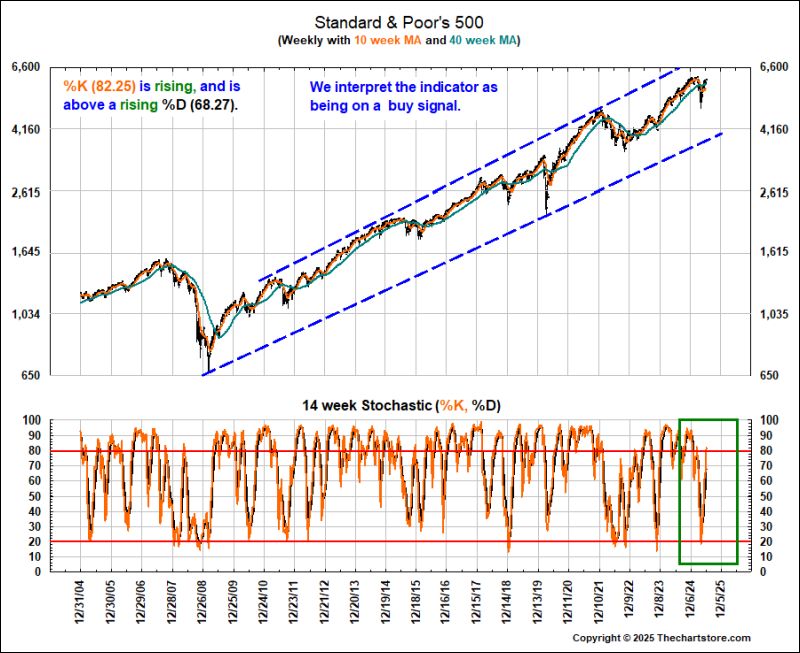

Chart 2

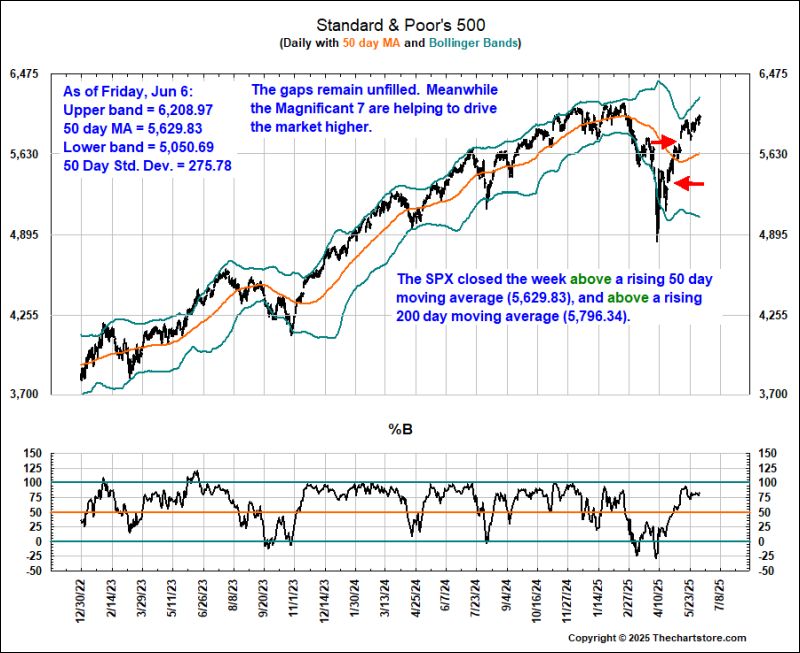

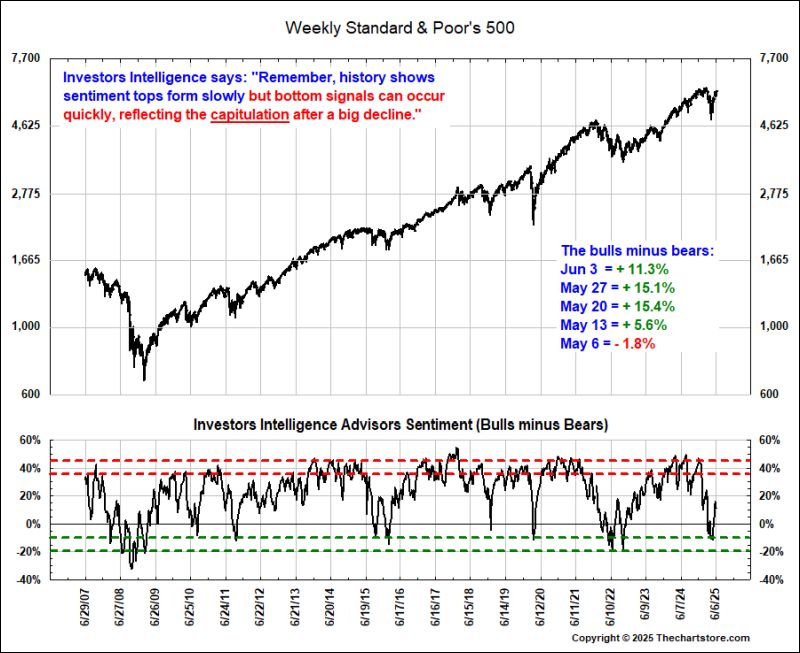

Chart 3

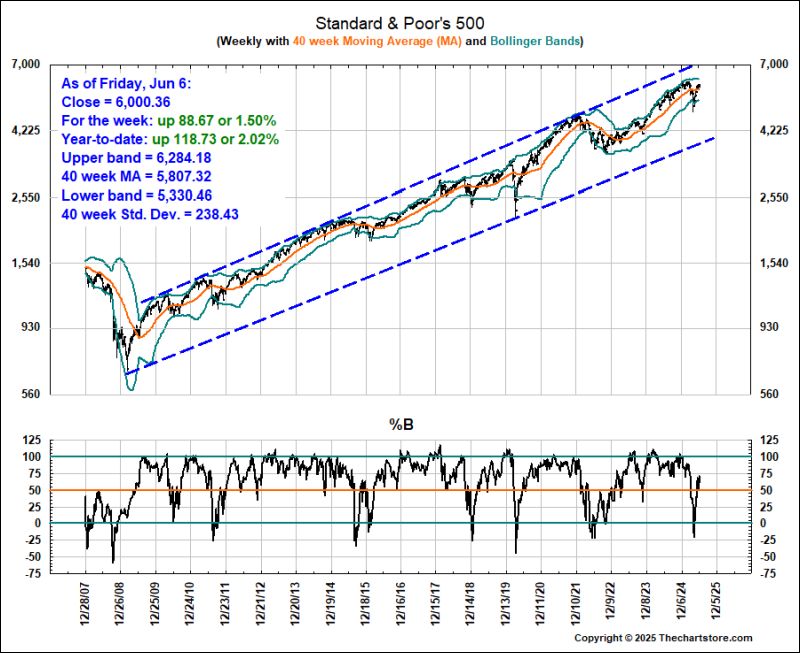

Chart 4

Chart 5

Chart 6

Chart 7

Chart 8

Chart 9

Chart 10

Chart 11

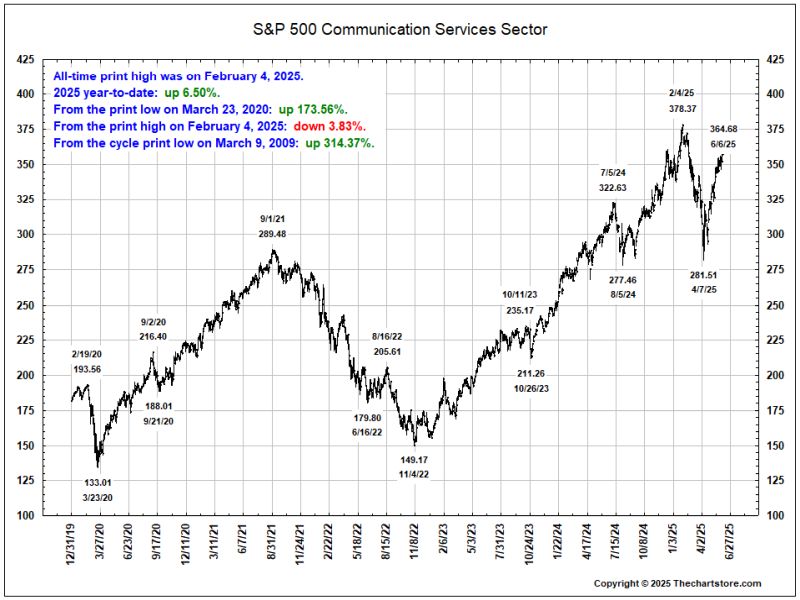

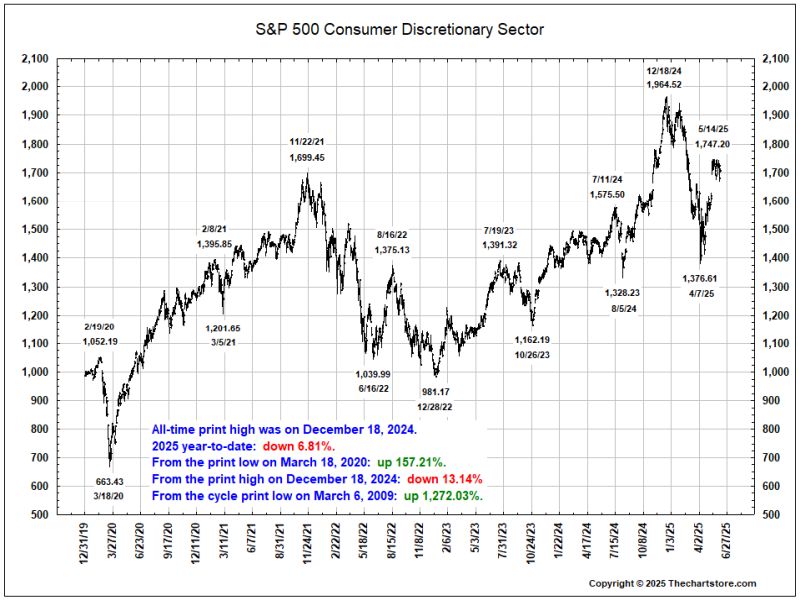

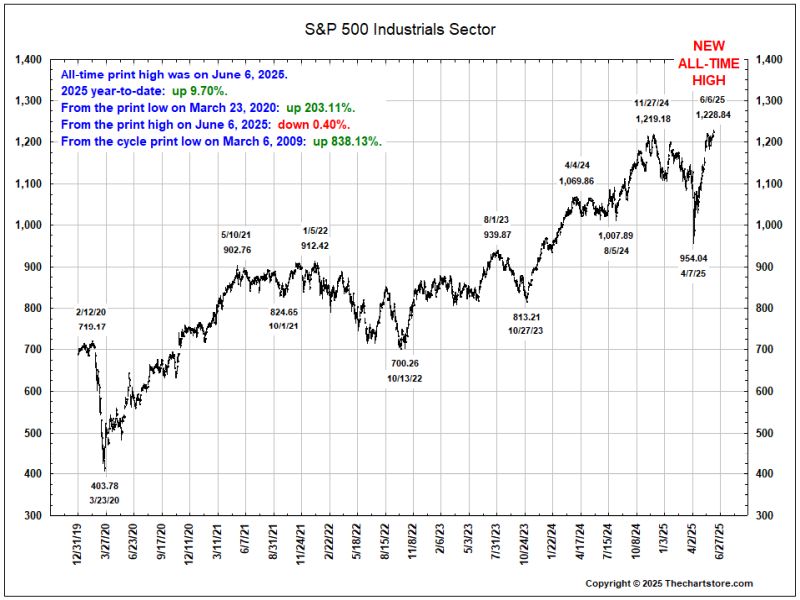

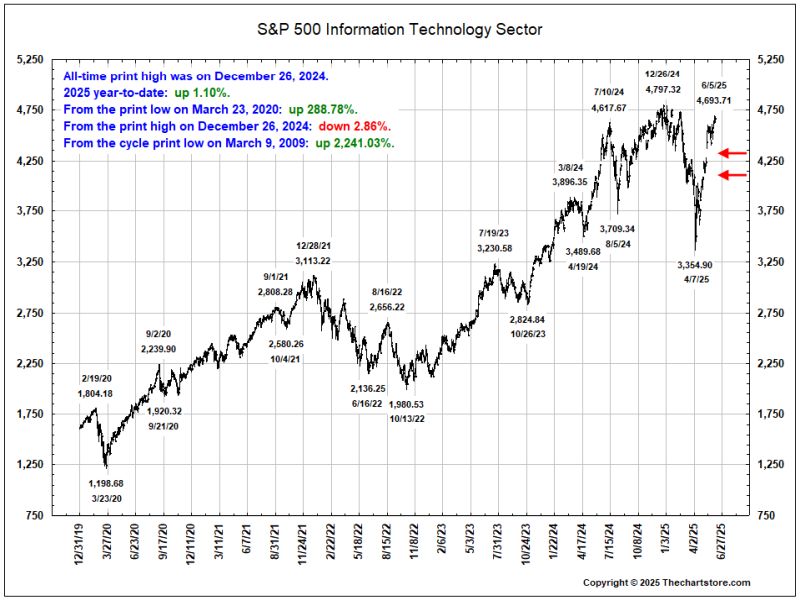

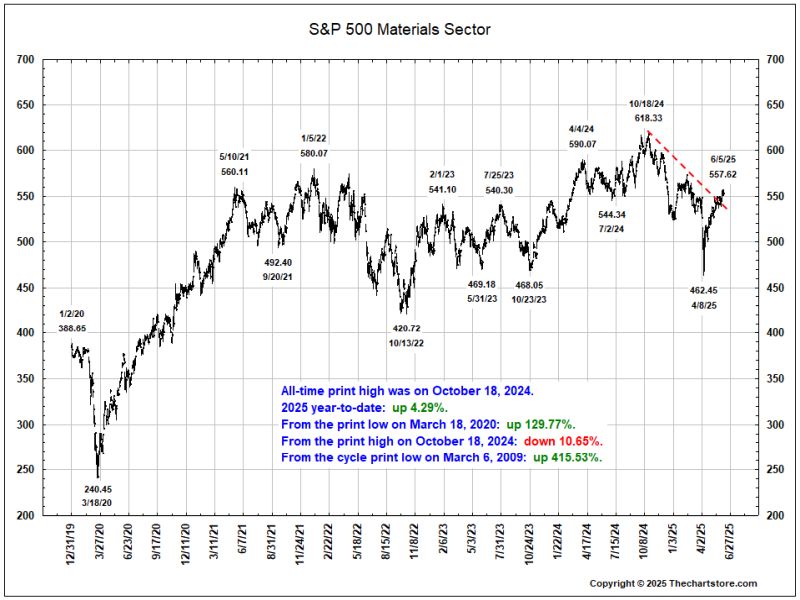

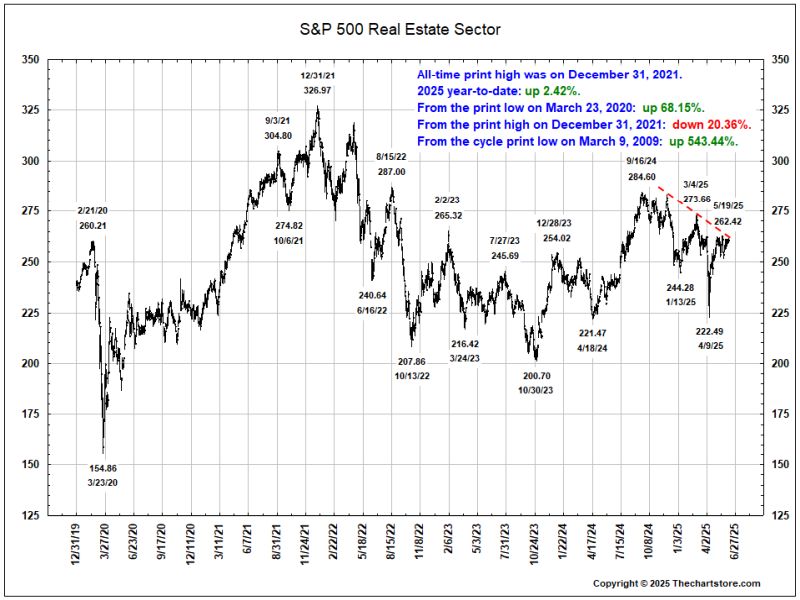

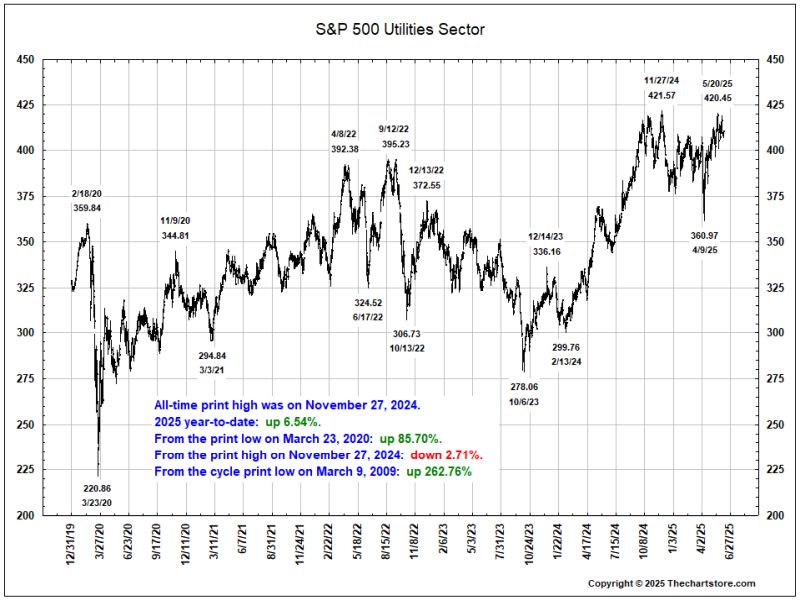

S&P GICS Sector Watch

Chart 12

Chart 13

Chart 14

Chart 15

Chart 16

Chart 17

Chart 18

Chart 19

Chart 20

Chart 21

Chart 22

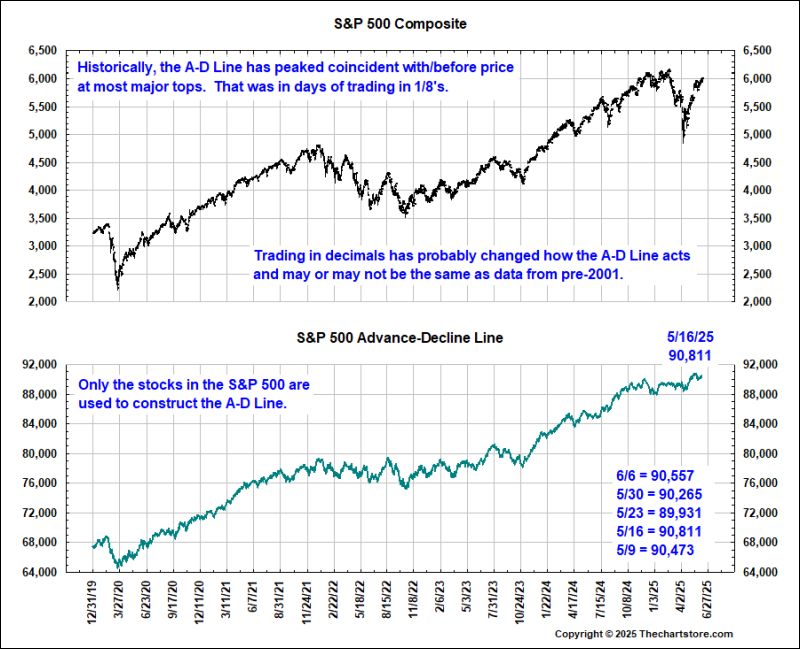

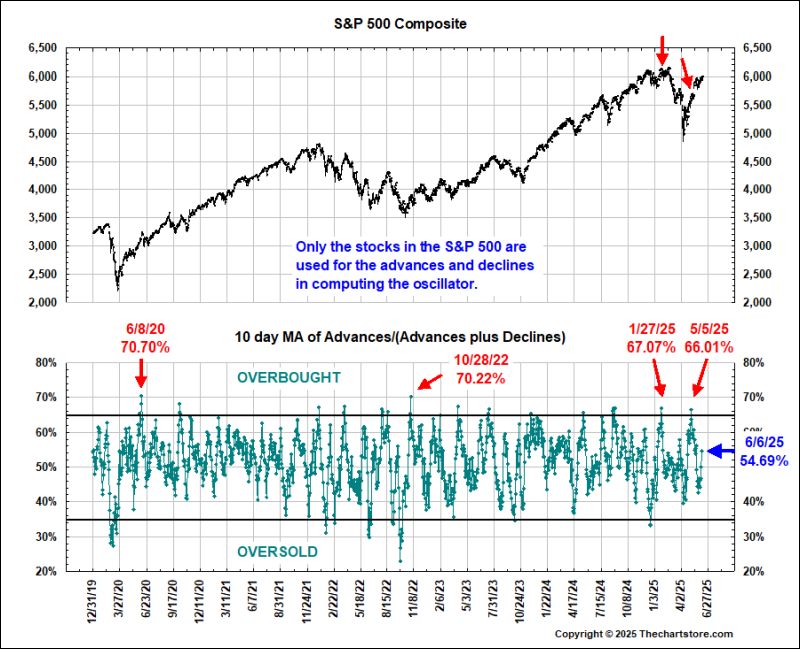

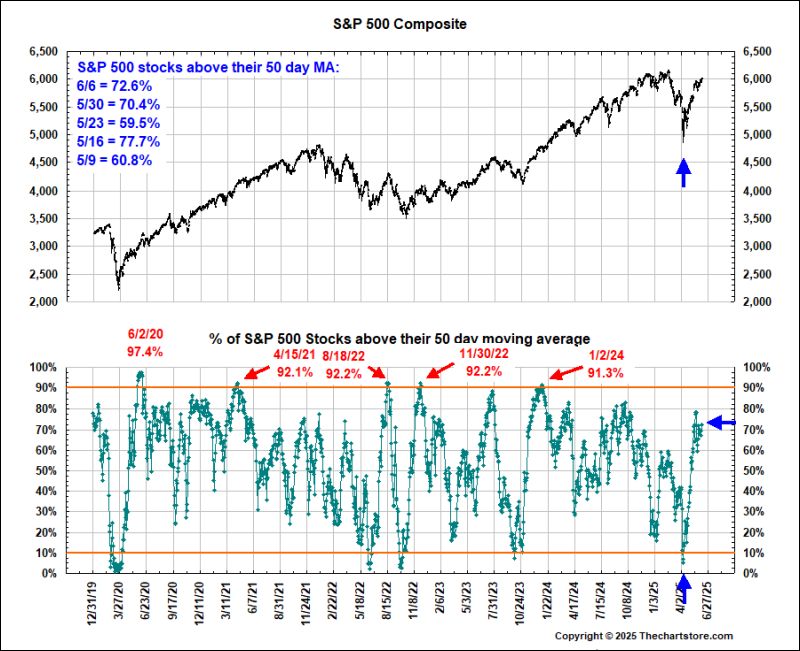

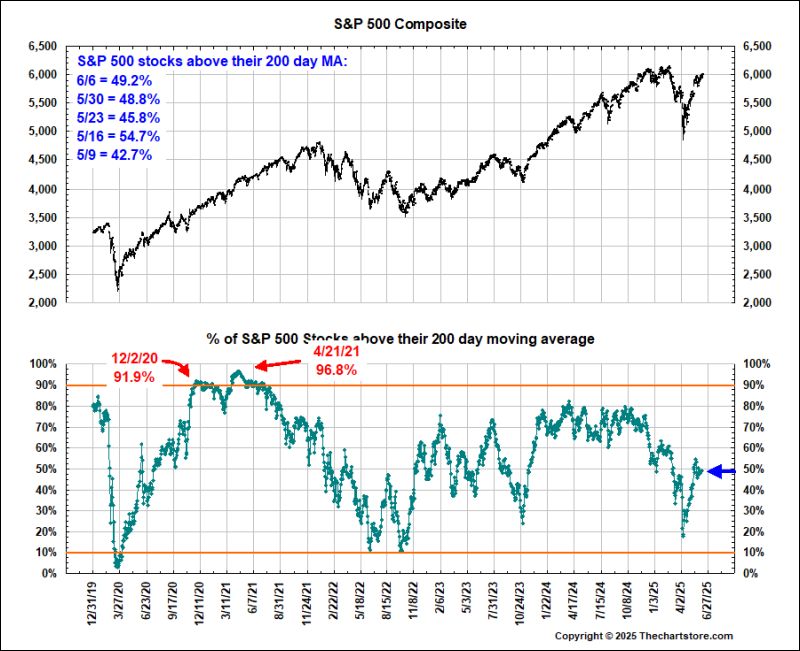

Stock Market Indicator Watch

Chart 23

Chart 24

Chart 25

Chart 26

Chart 27

Chart 28

Chart 29

Chart 30

Chart 31

Chart 32

Chart 33

Chart 34

Chart 35

Chart 36

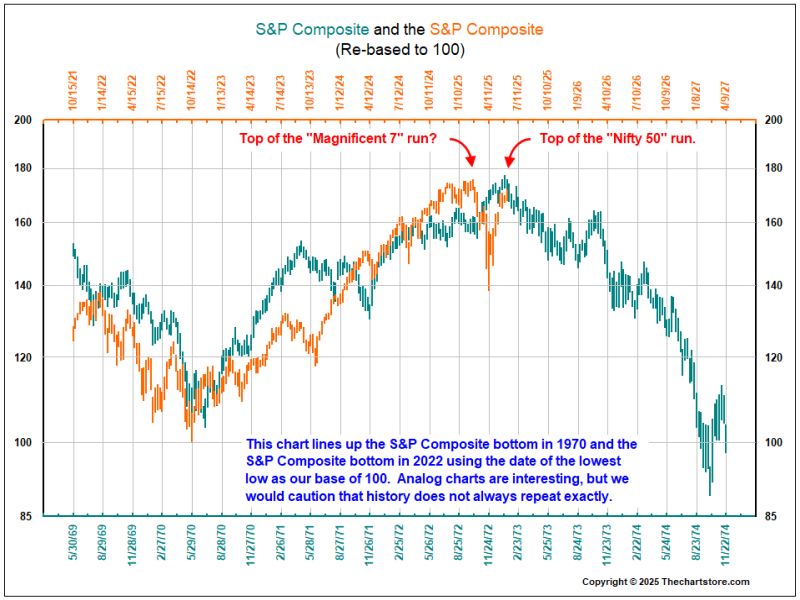

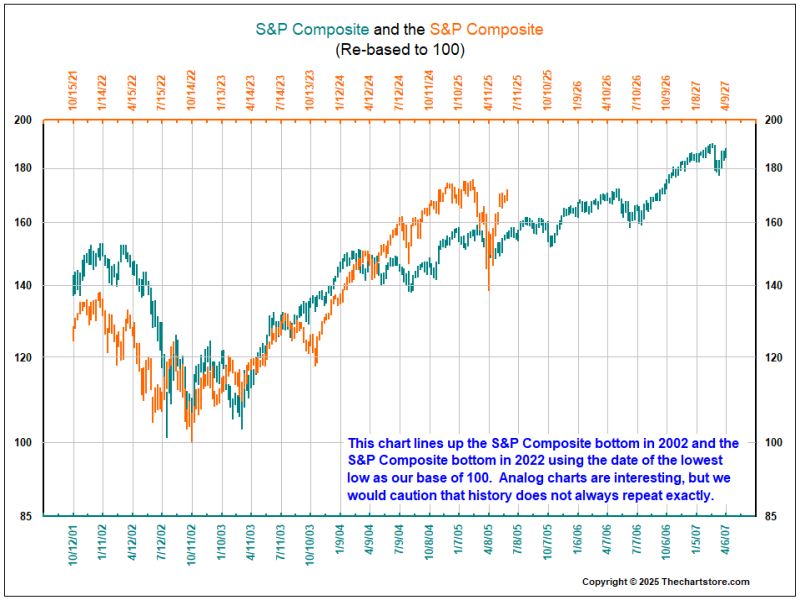

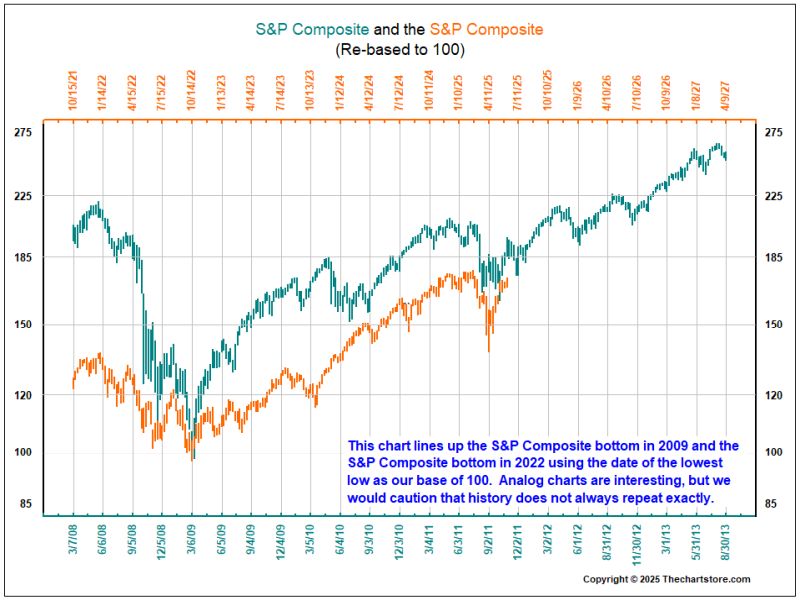

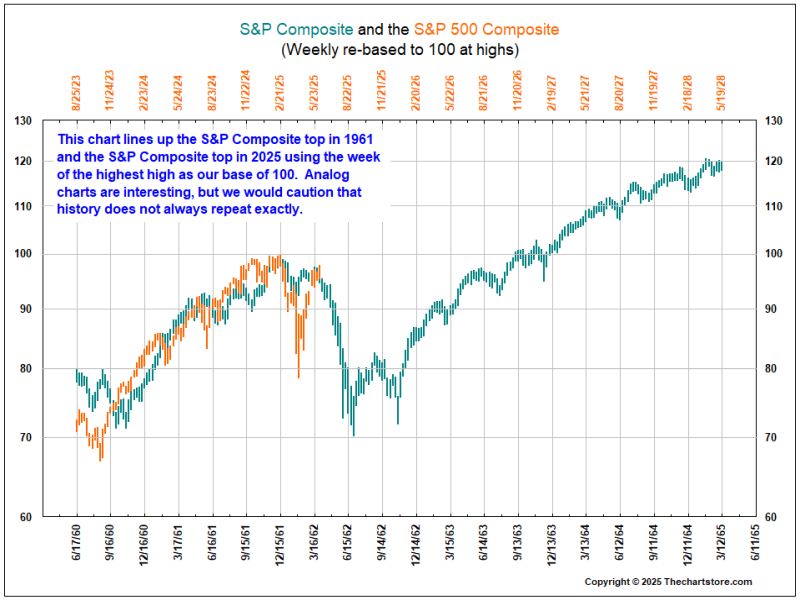

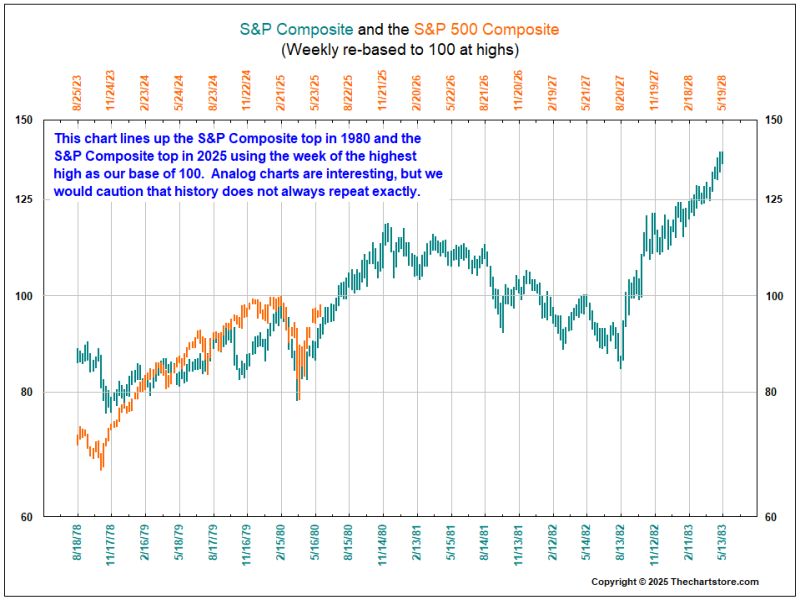

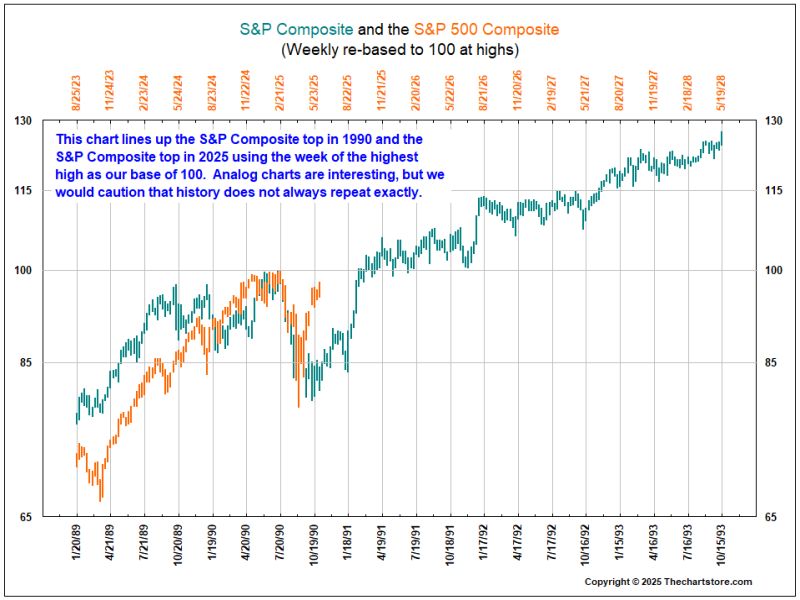

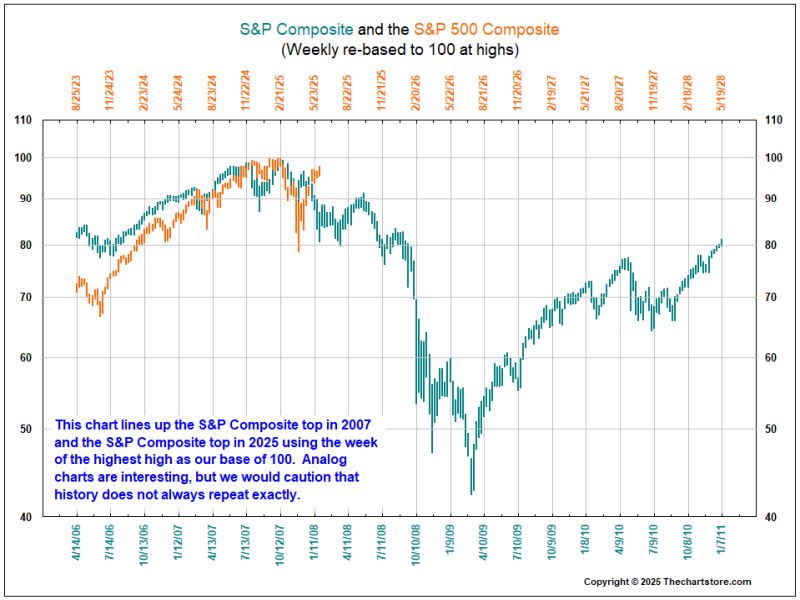

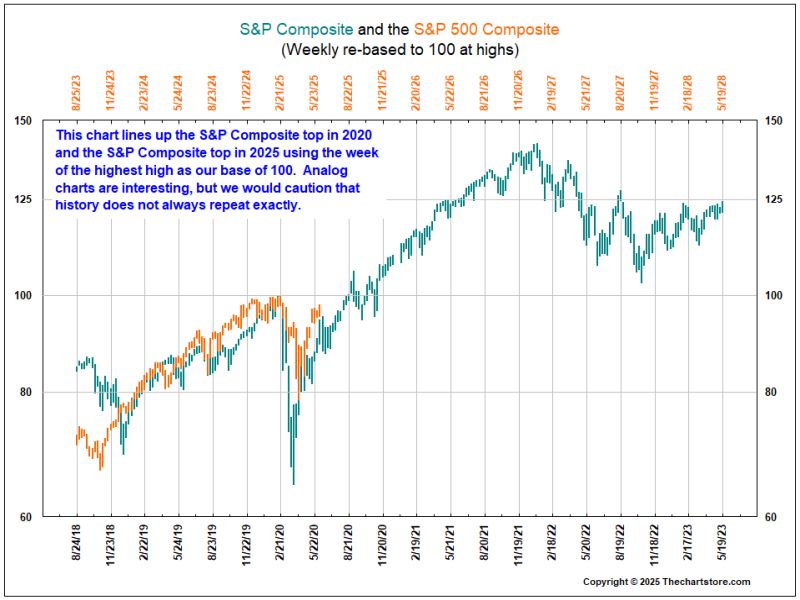

Analog Chart I Watch

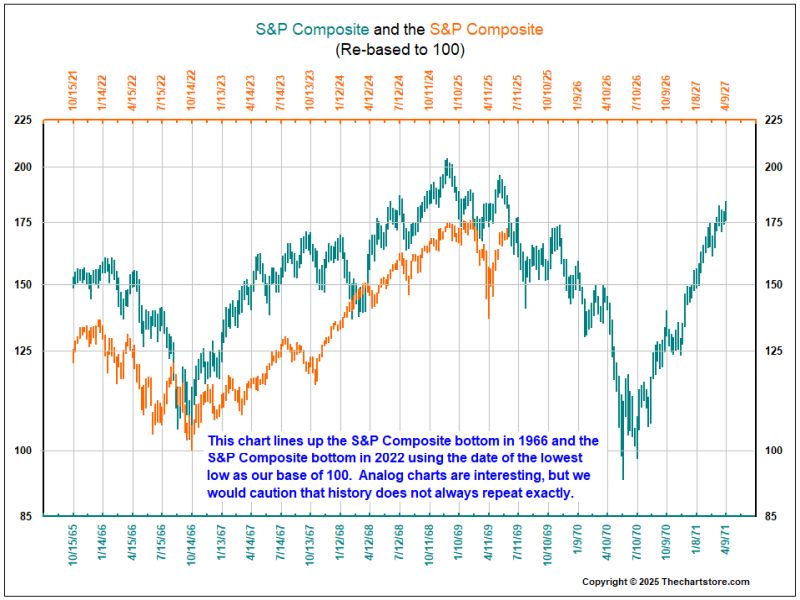

Chart 37

Chart 38

Chart 39

Chart 40

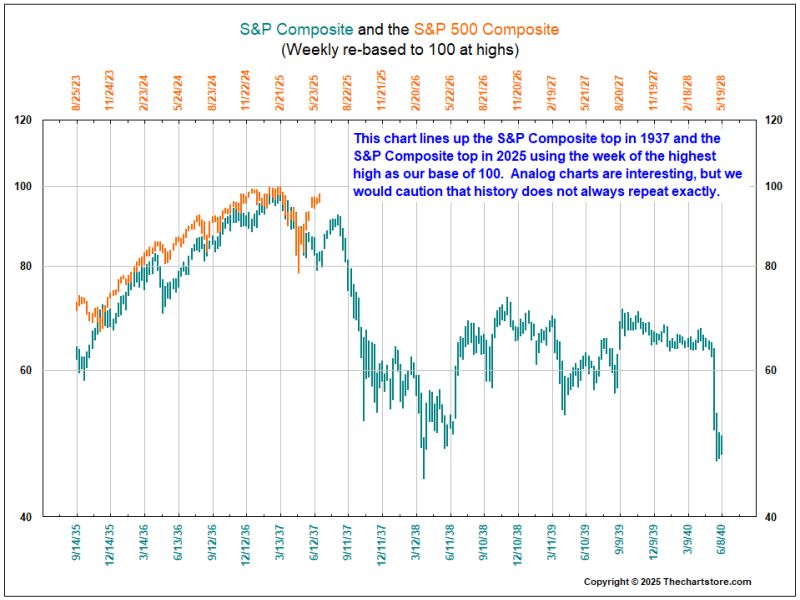

Analog Chart II Watch

Chart 41

Chart 42

Chart 43

Chart 44

Chart 45

Chart 46

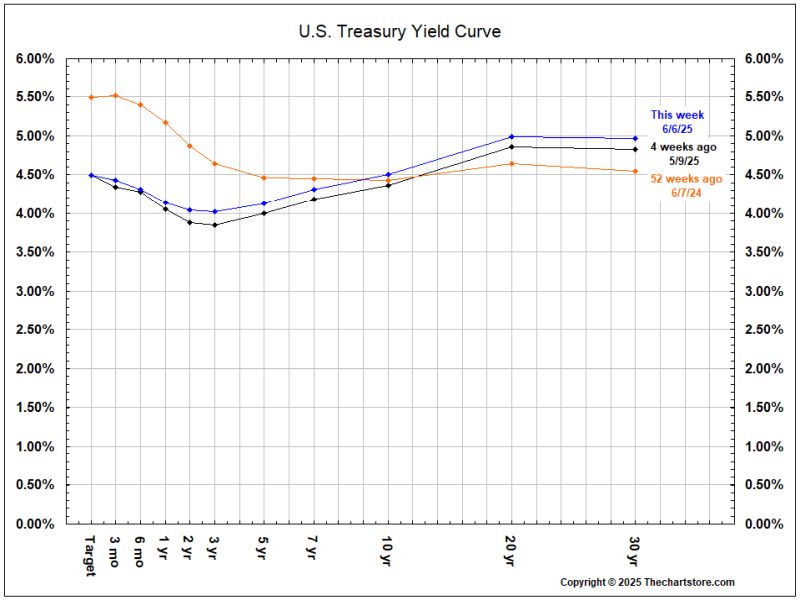

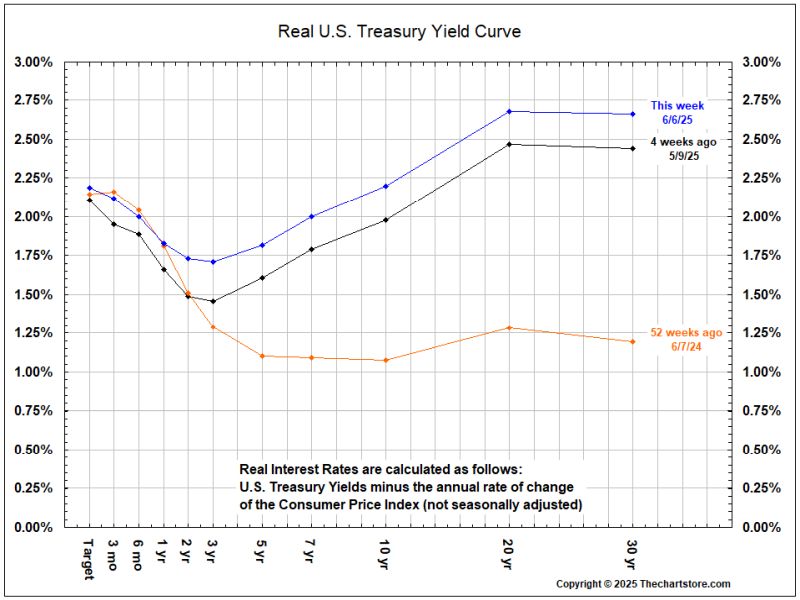

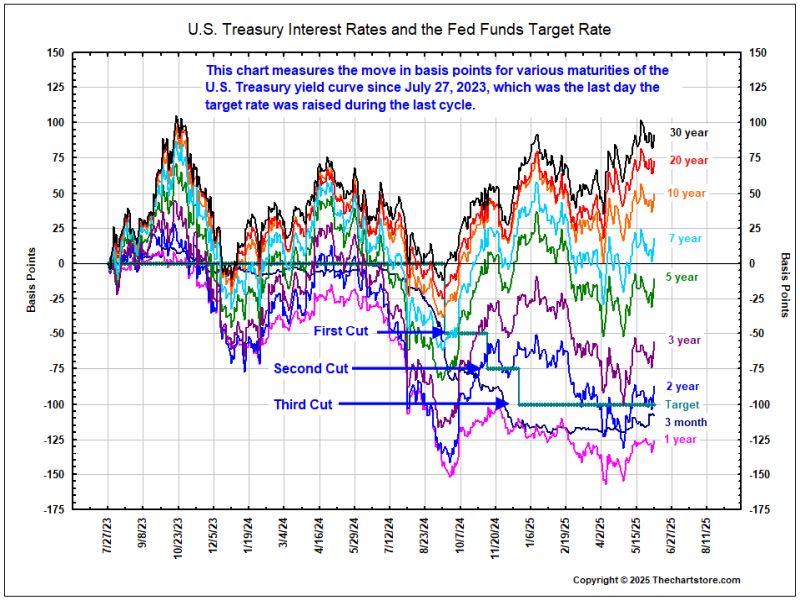

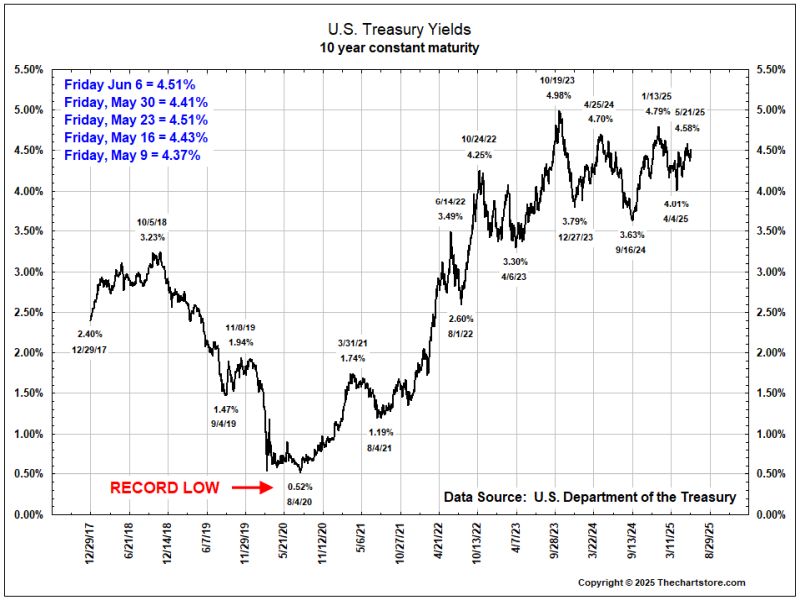

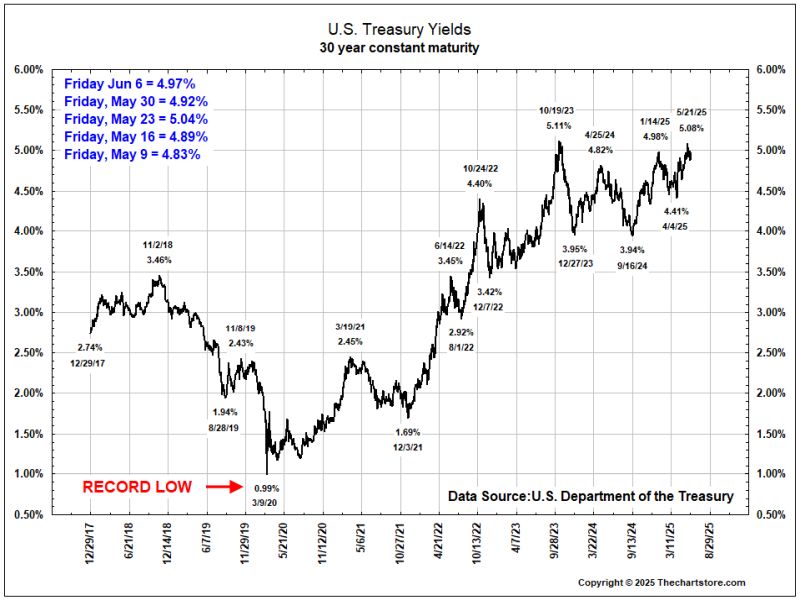

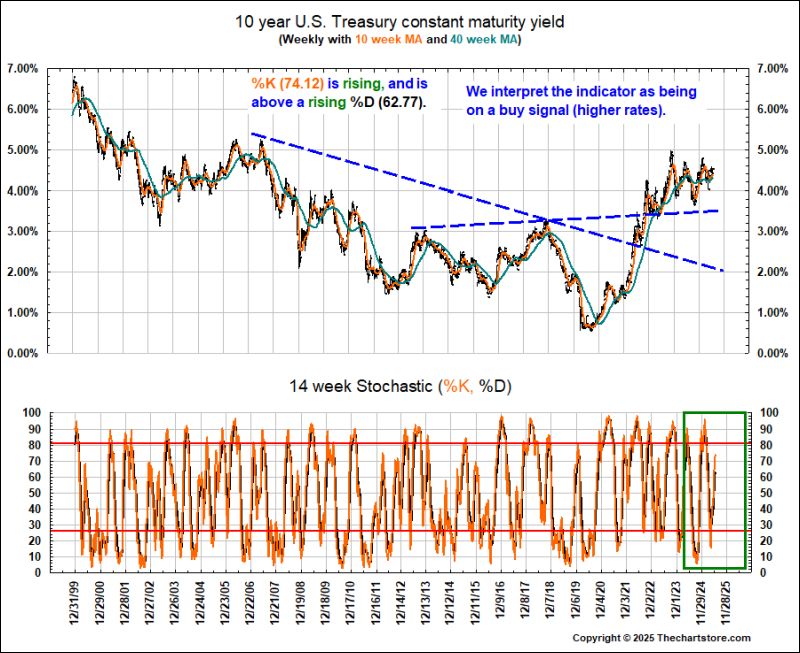

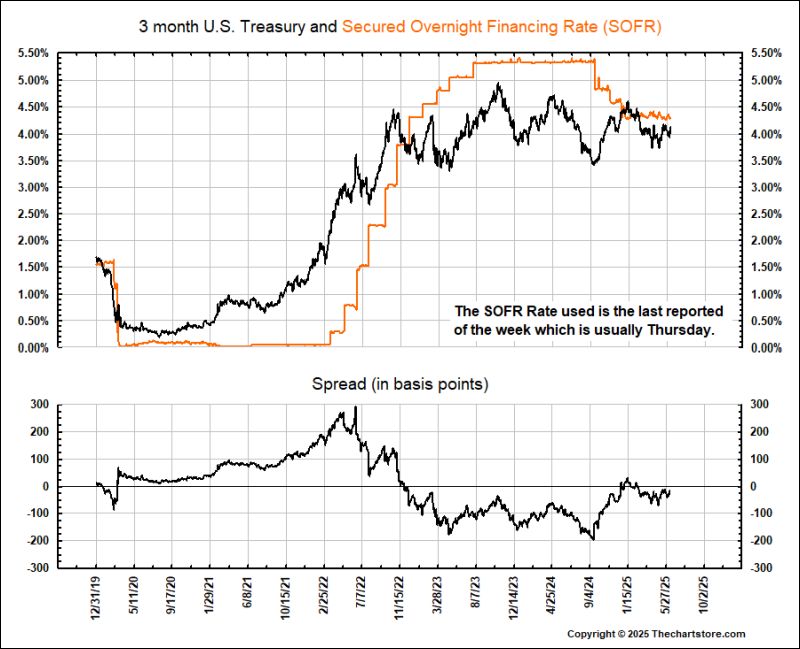

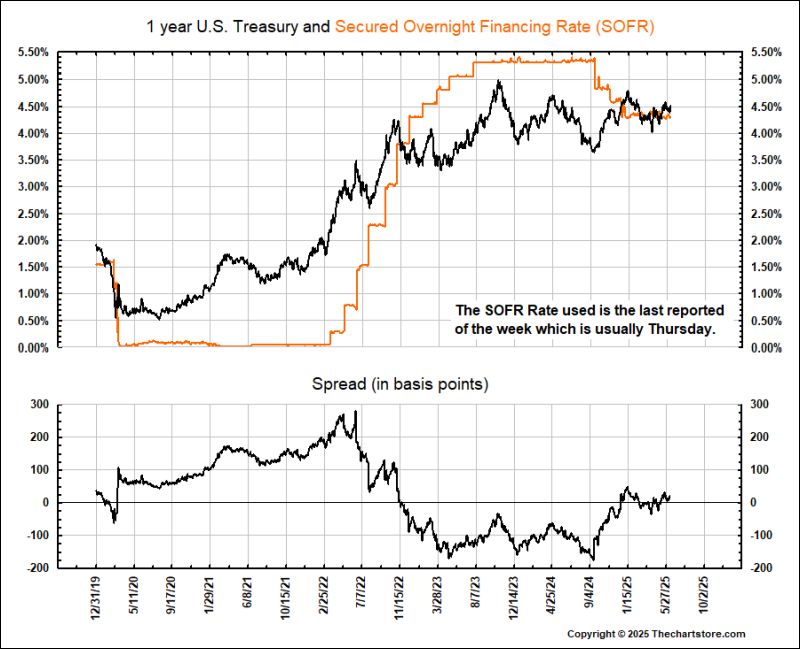

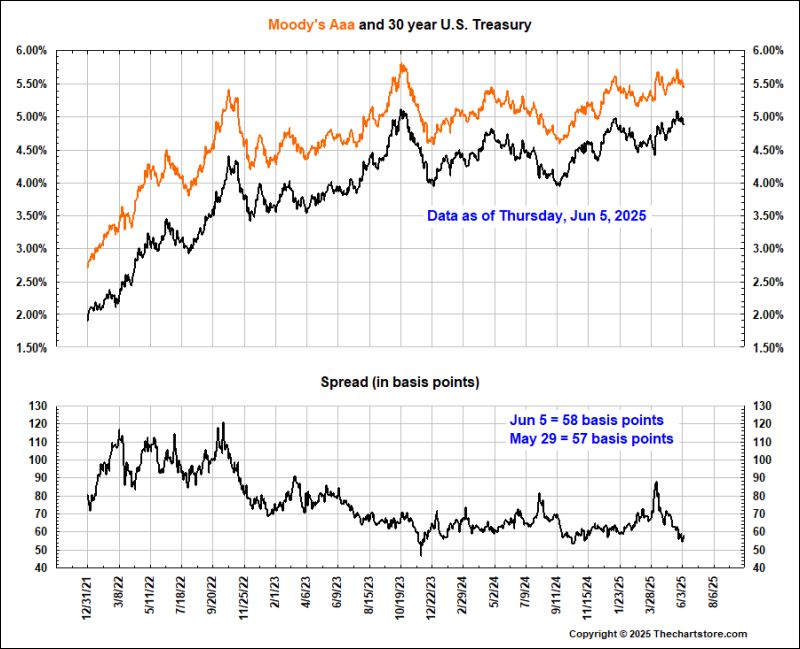

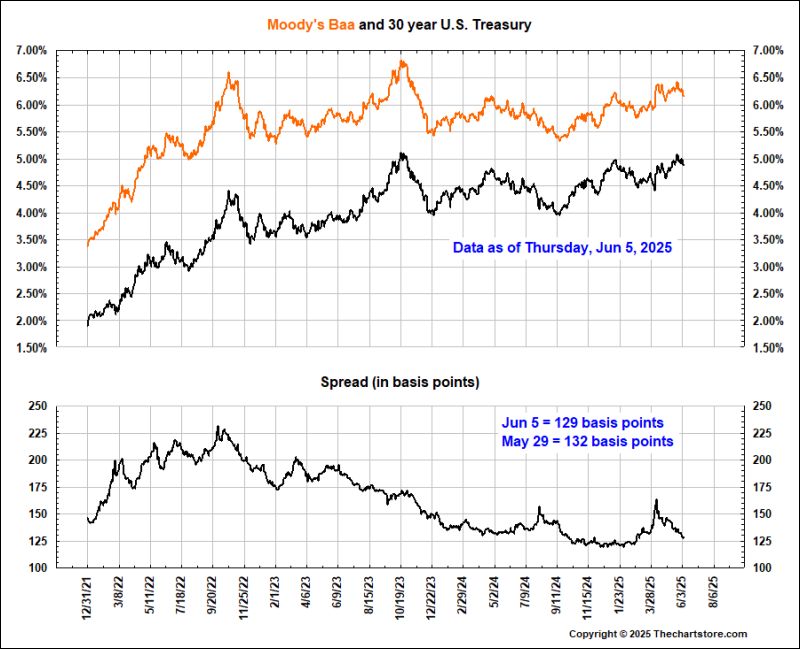

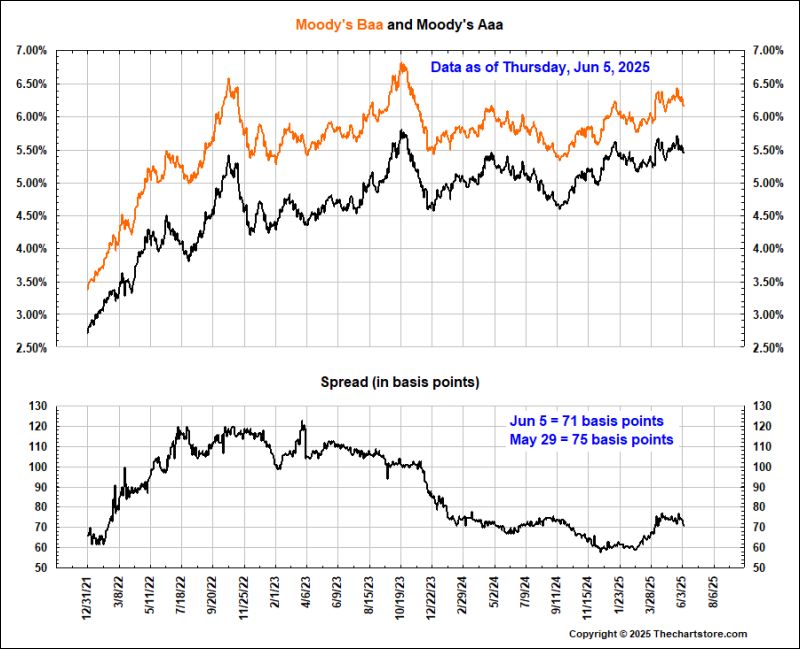

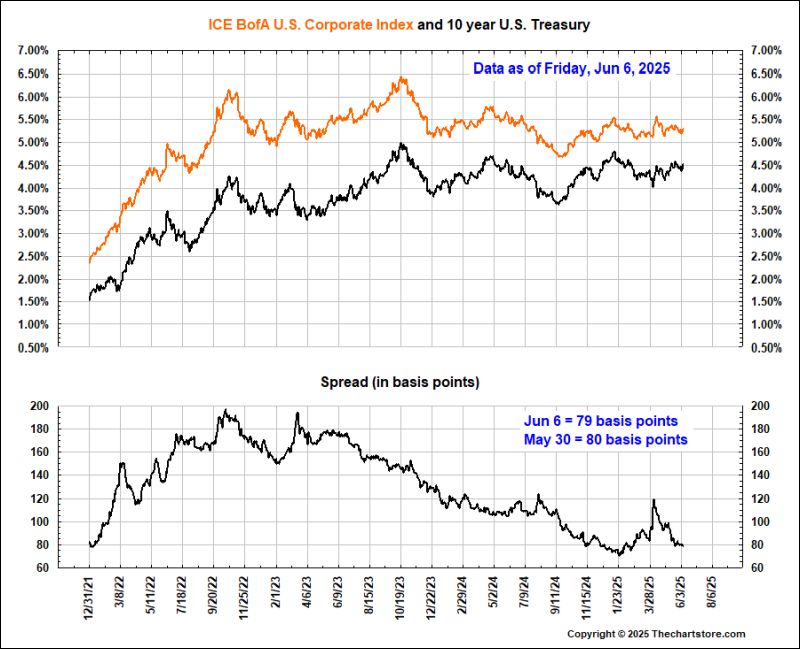

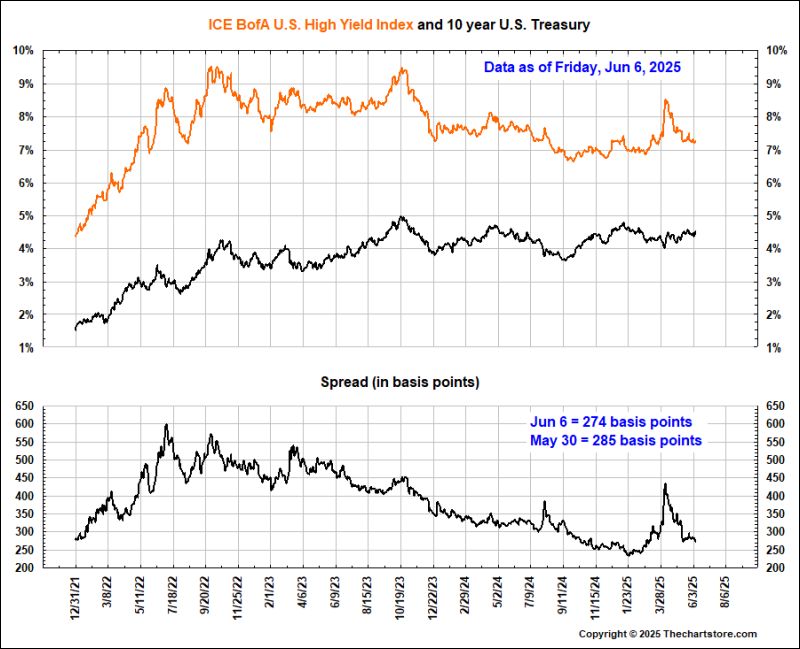

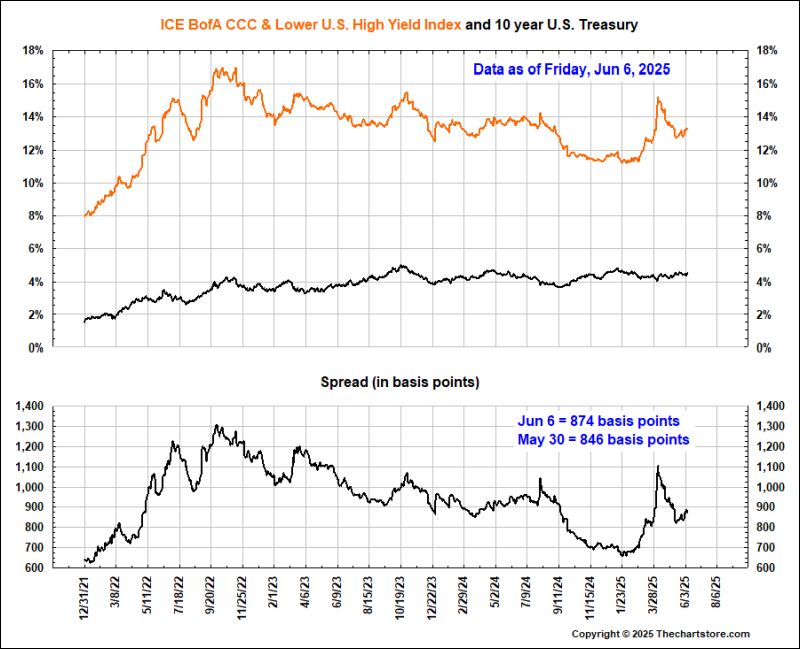

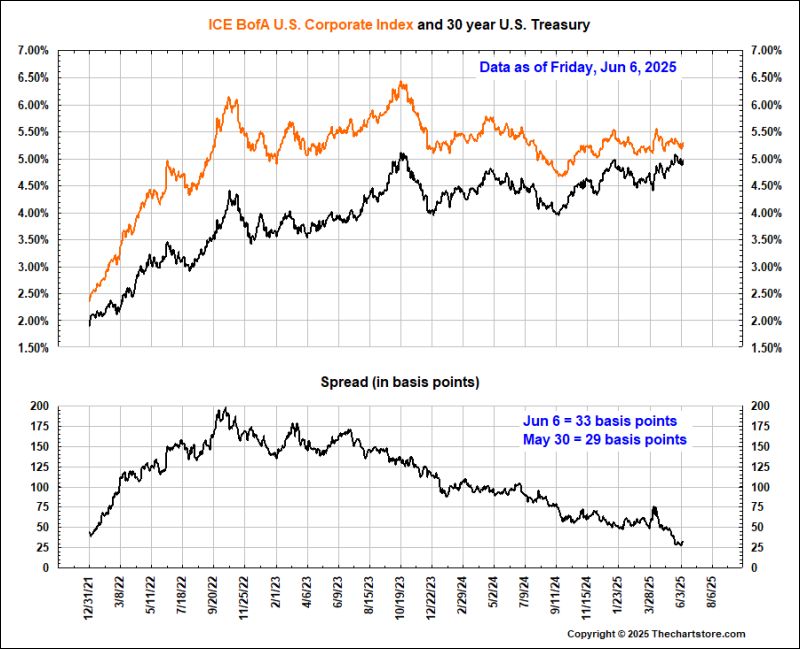

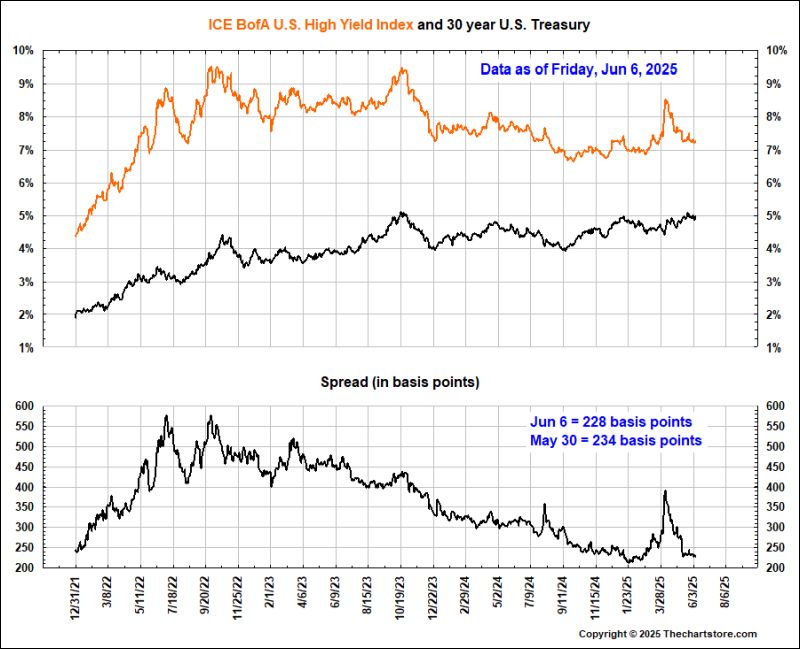

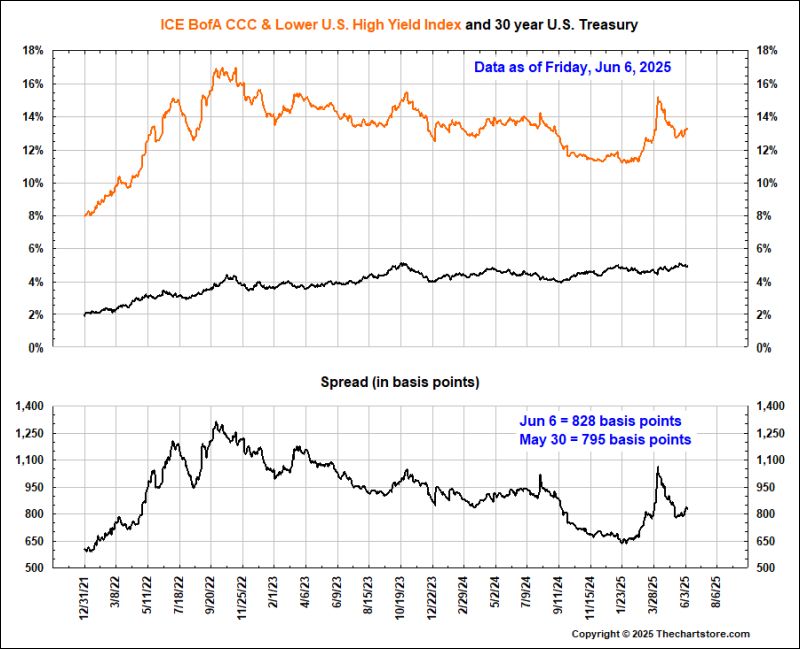

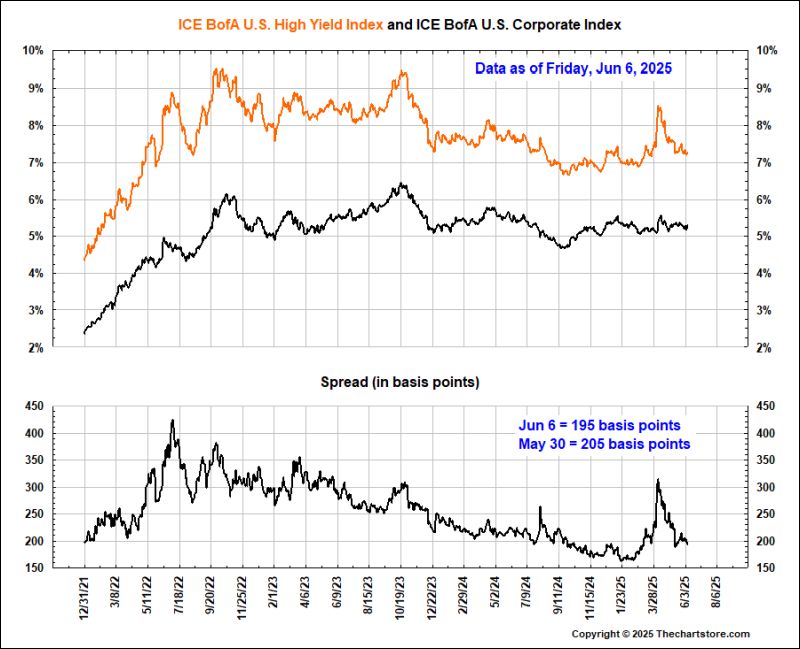

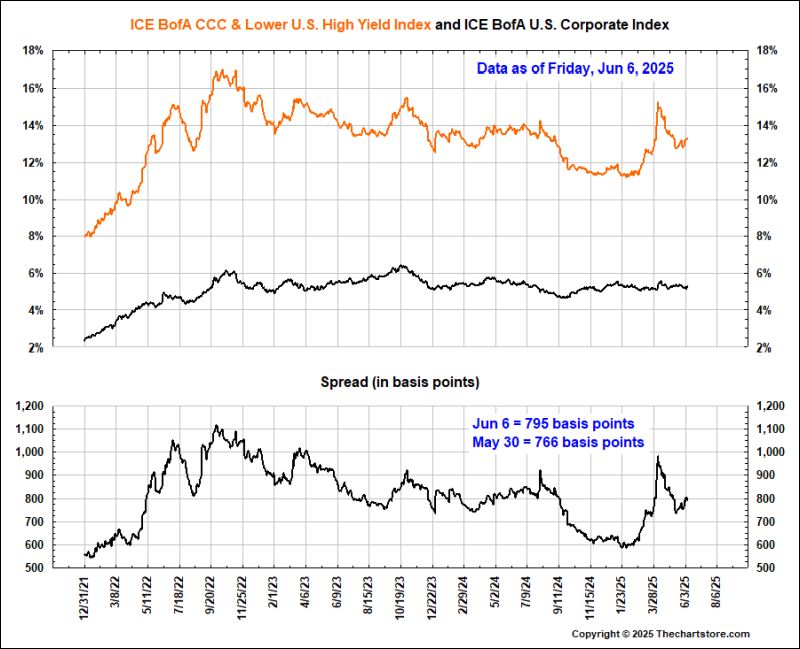

Interest Rate Watch

Chart 47

Chart 48

Chart 49

Chart 50

Chart 51

Chart 52

Chart 53

Chart 54

Chart 55

Chart 56

Chart 57

Chart 58

Chart 59

Chart 60

Chart 61

Chart 62

Chart 63

Chart 64

Chart 65

Chart 66

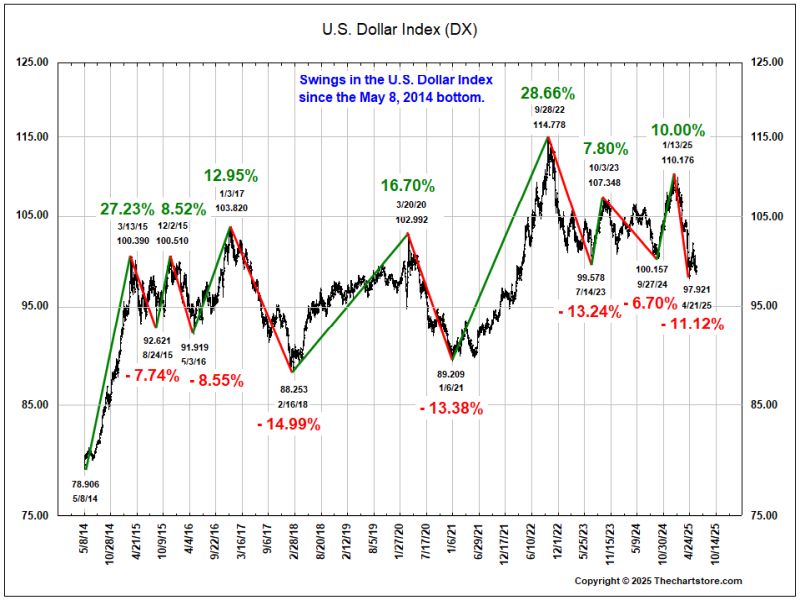

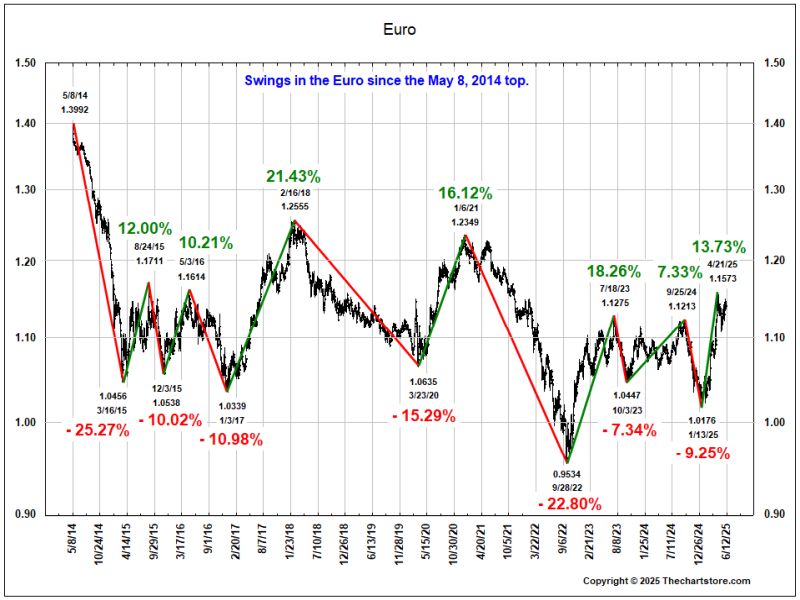

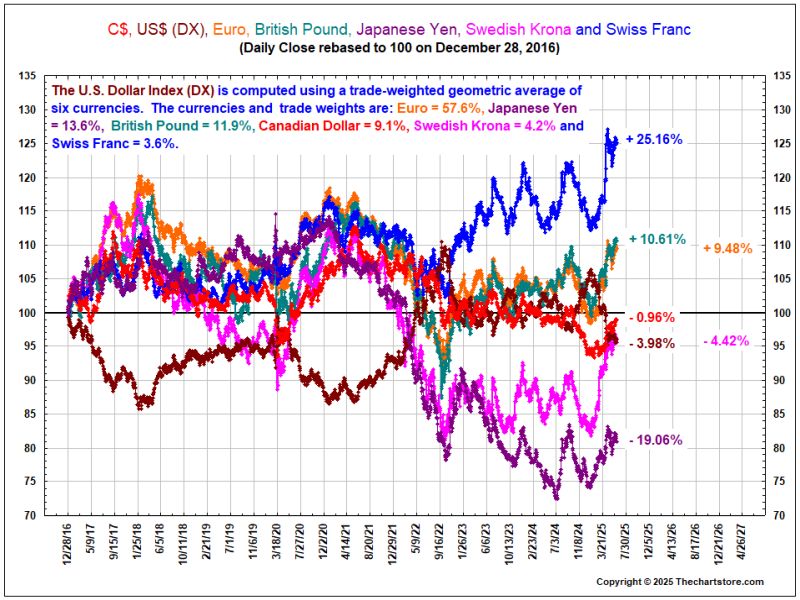

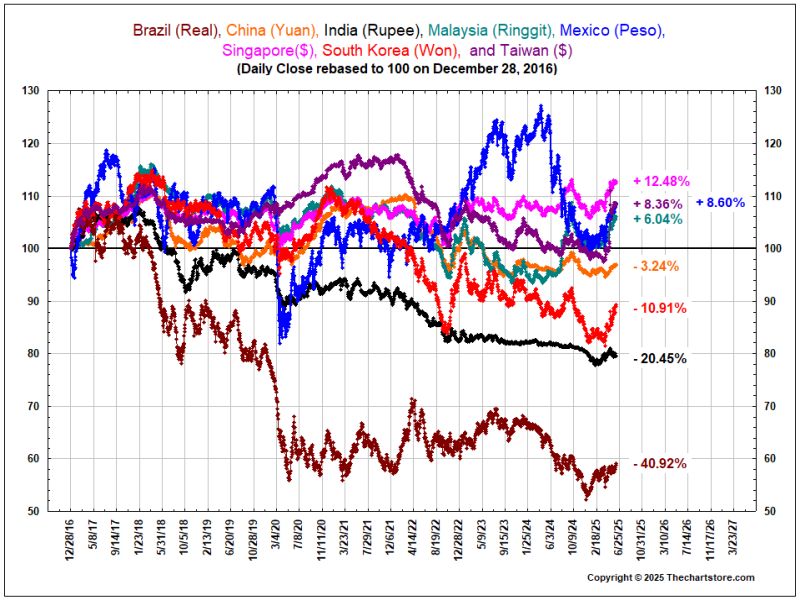

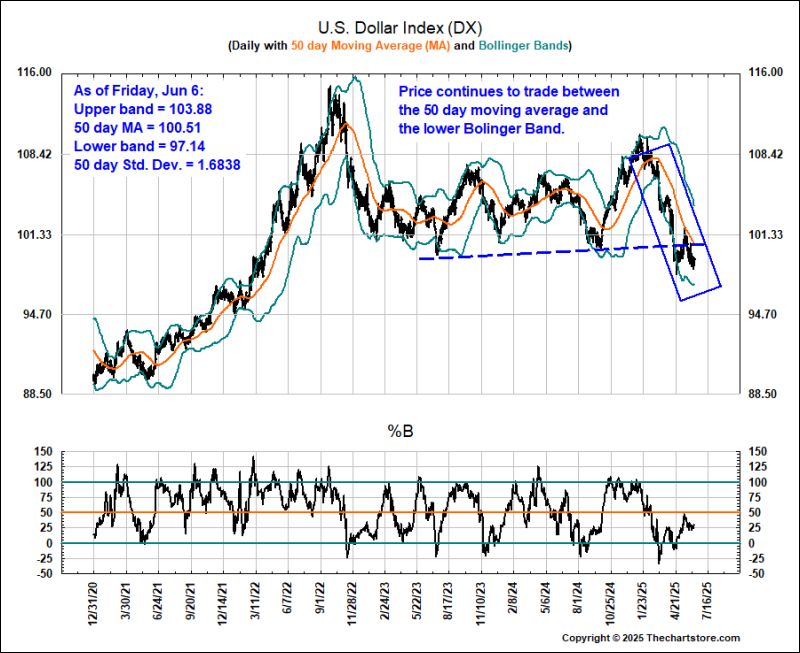

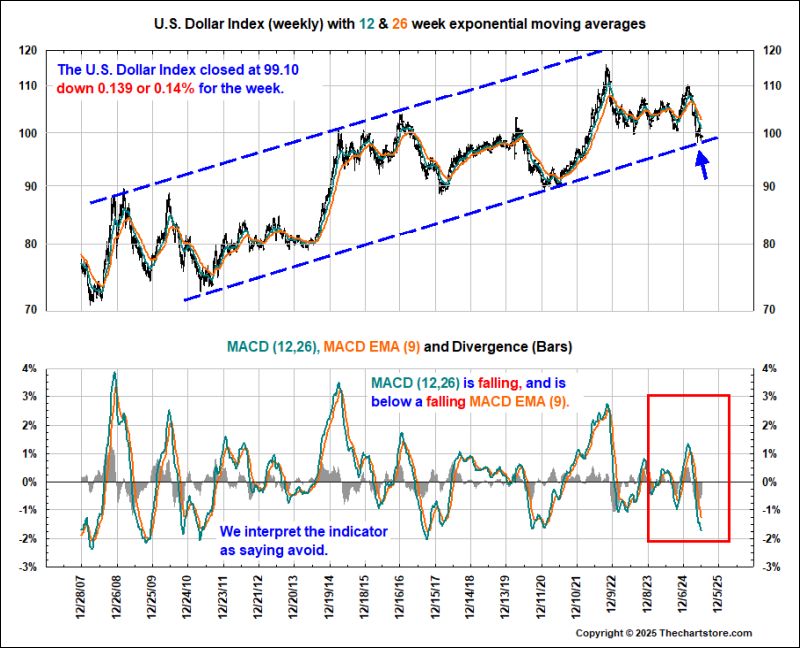

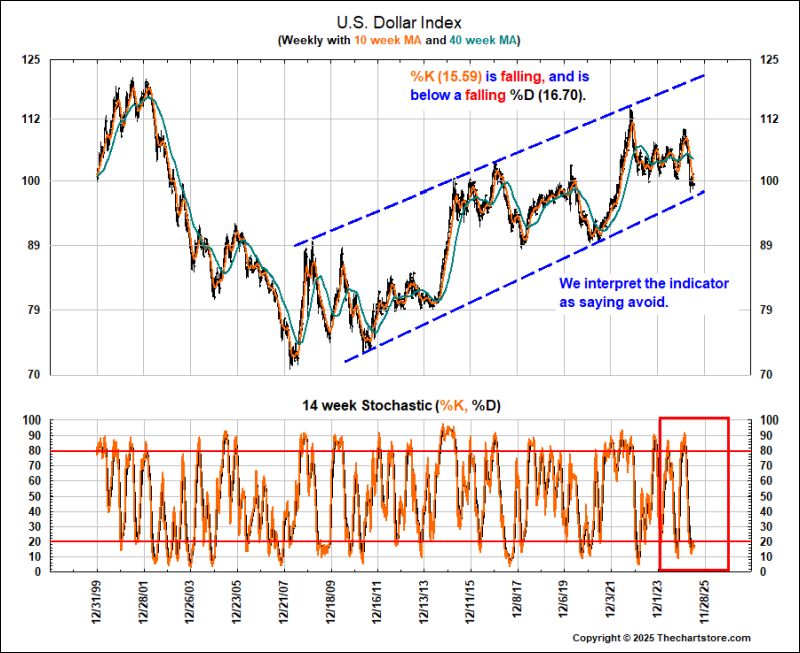

Currency Watch

Chart 67

Chart 68

Chart 69

Chart 70

Chart 71

Chart 72

Chart 73

Chart 74

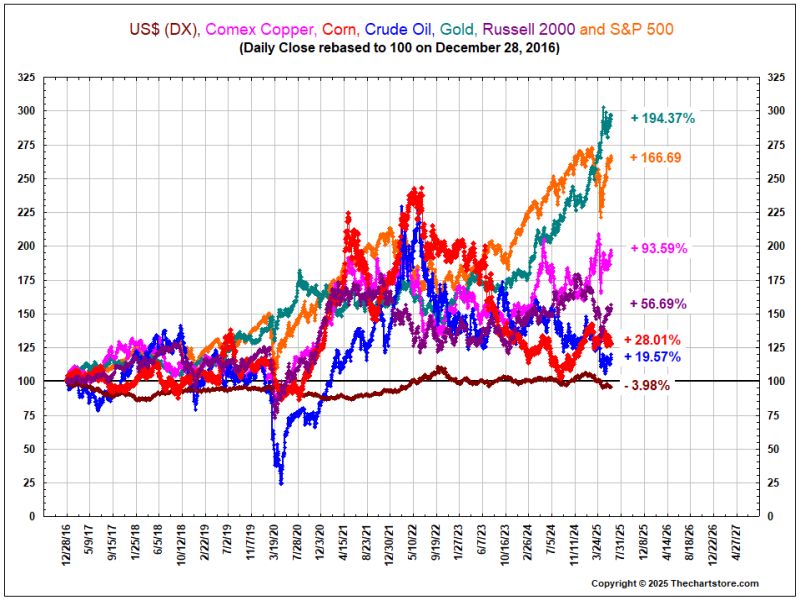

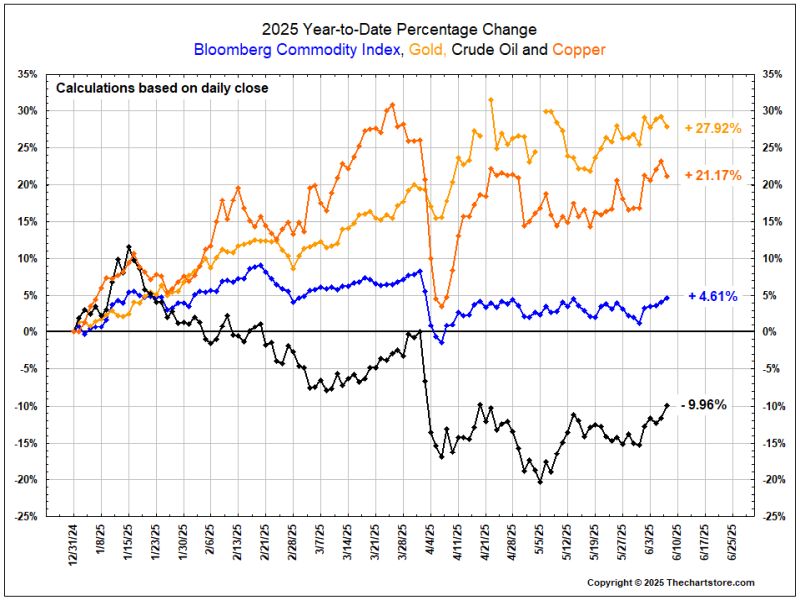

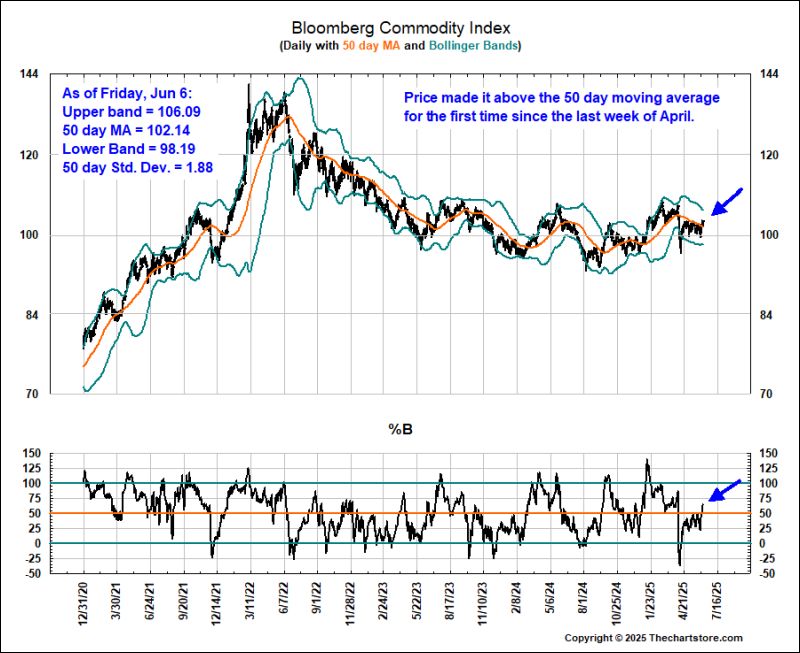

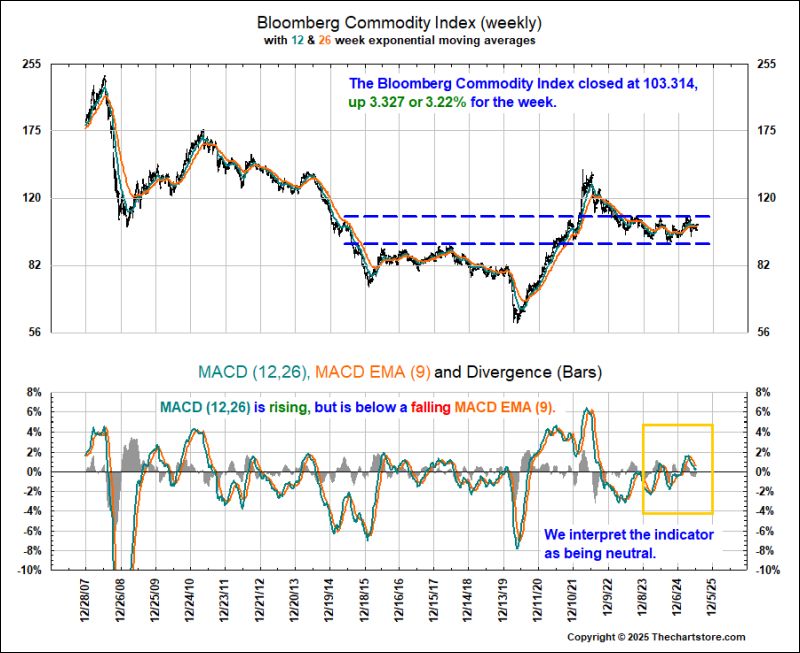

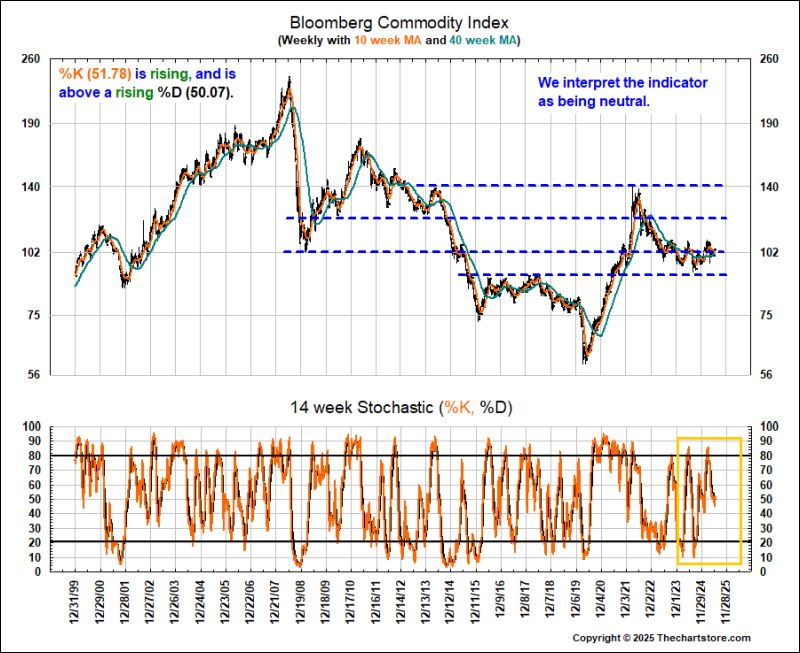

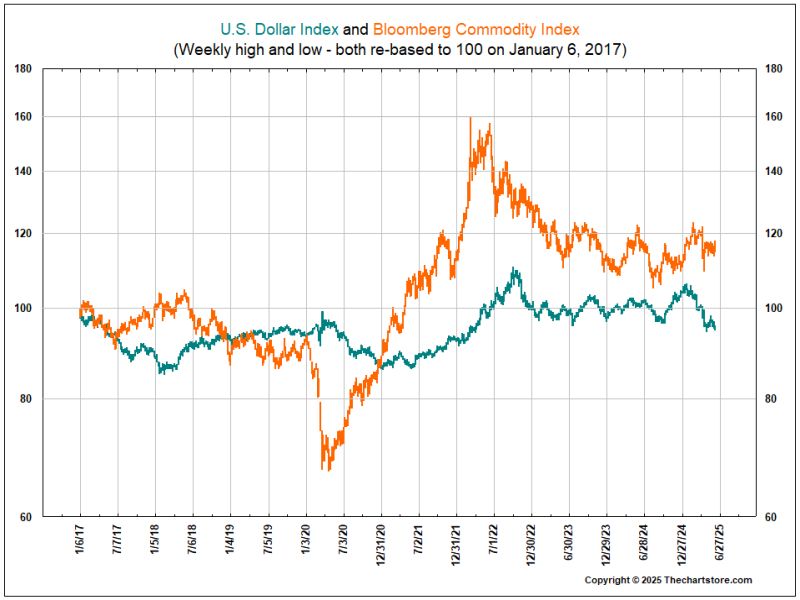

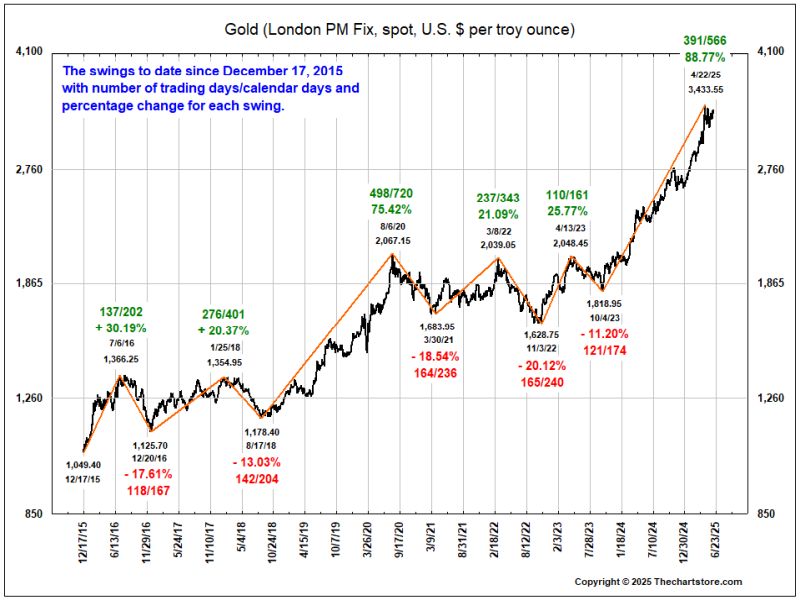

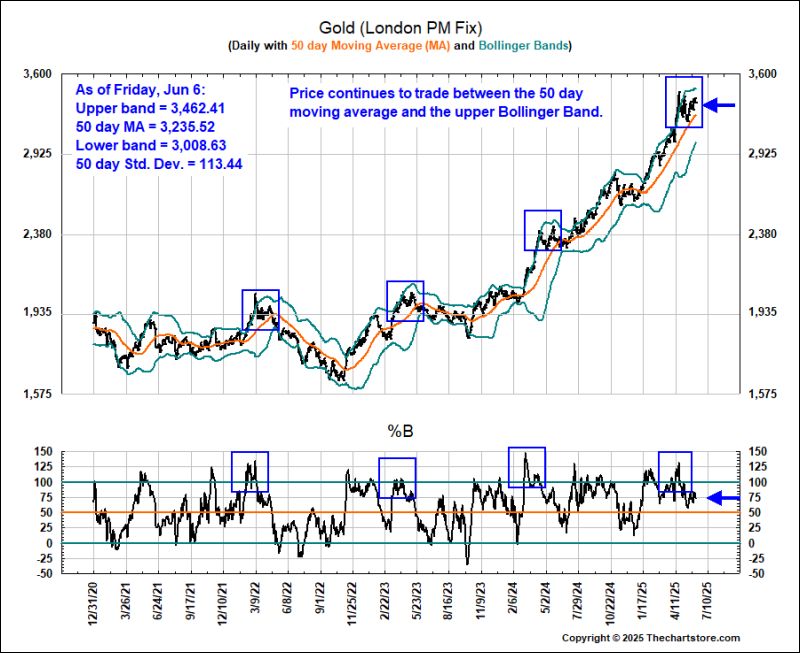

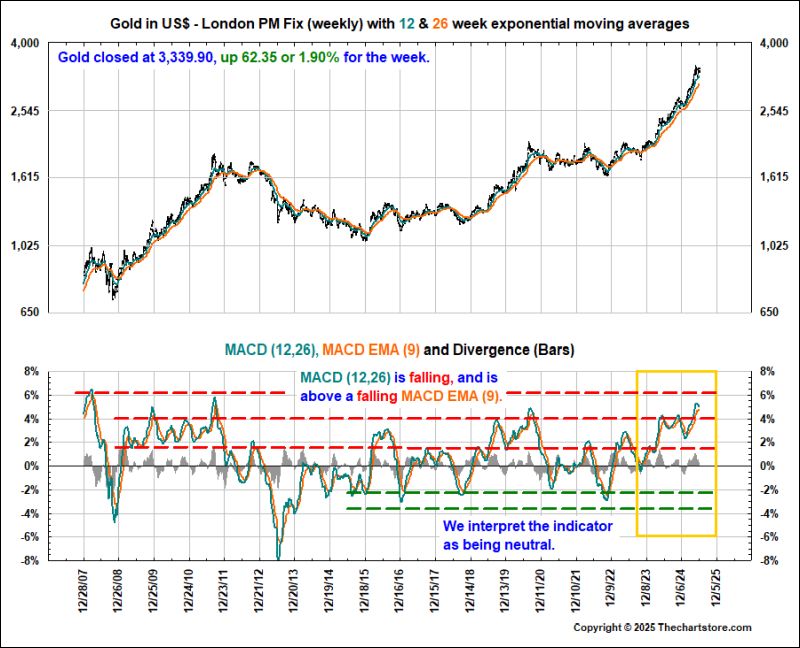

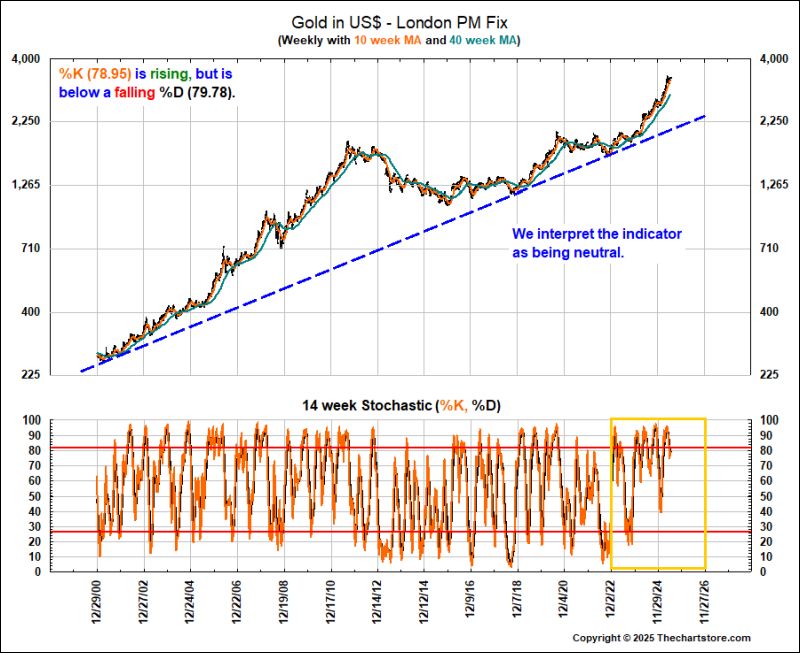

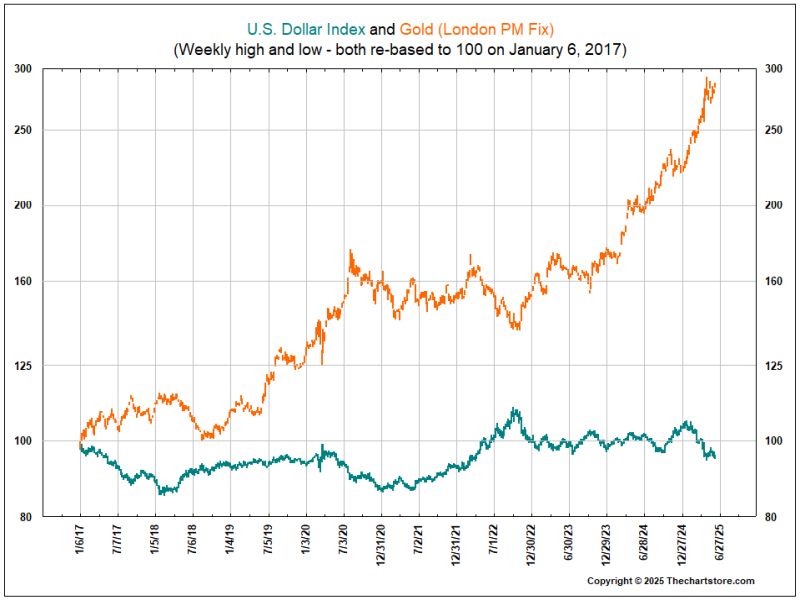

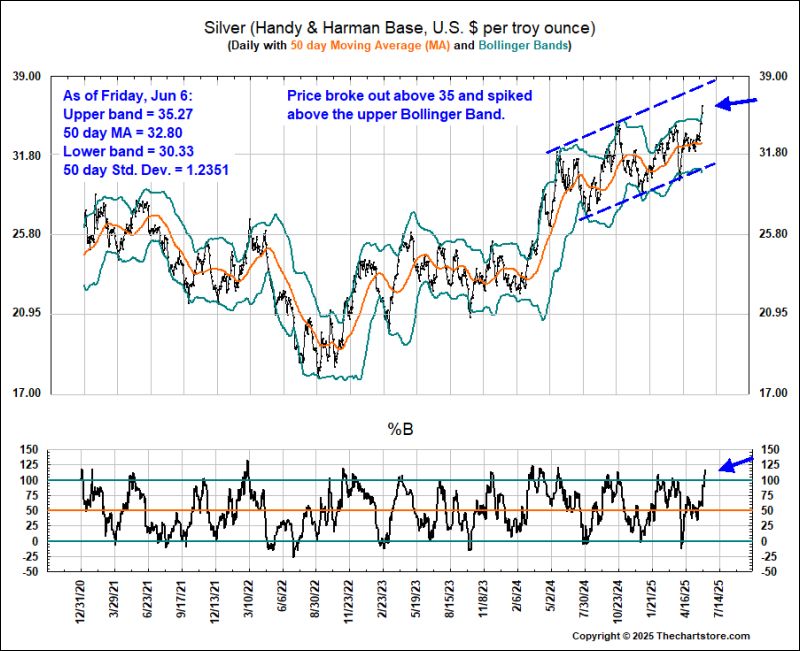

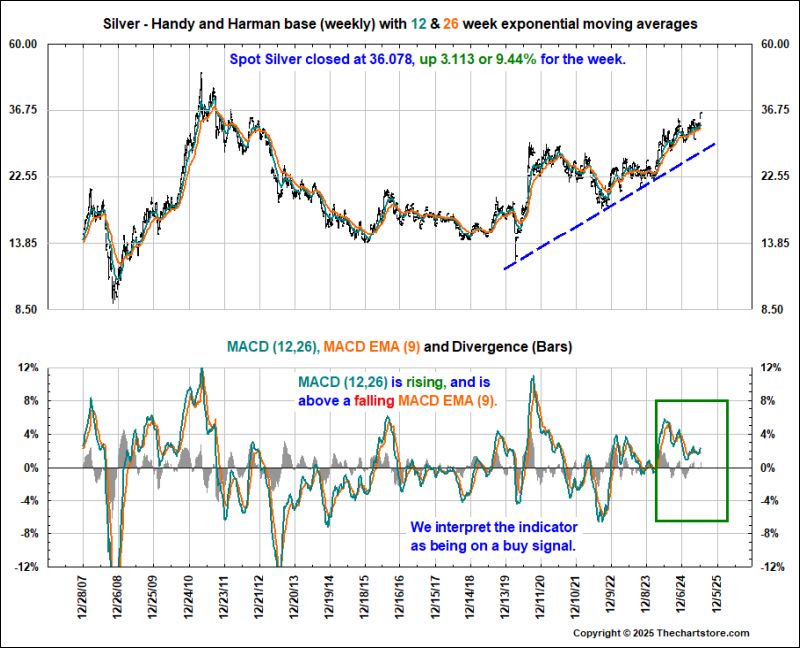

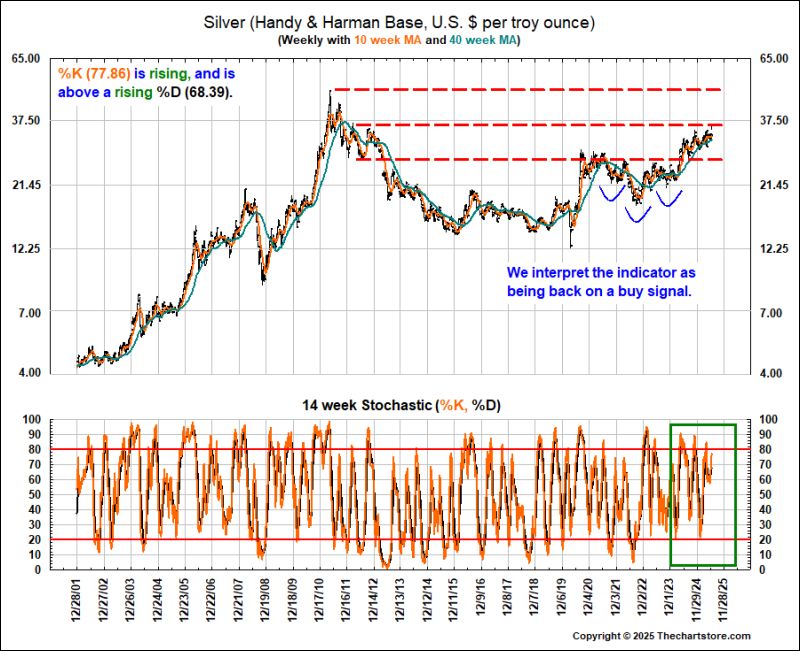

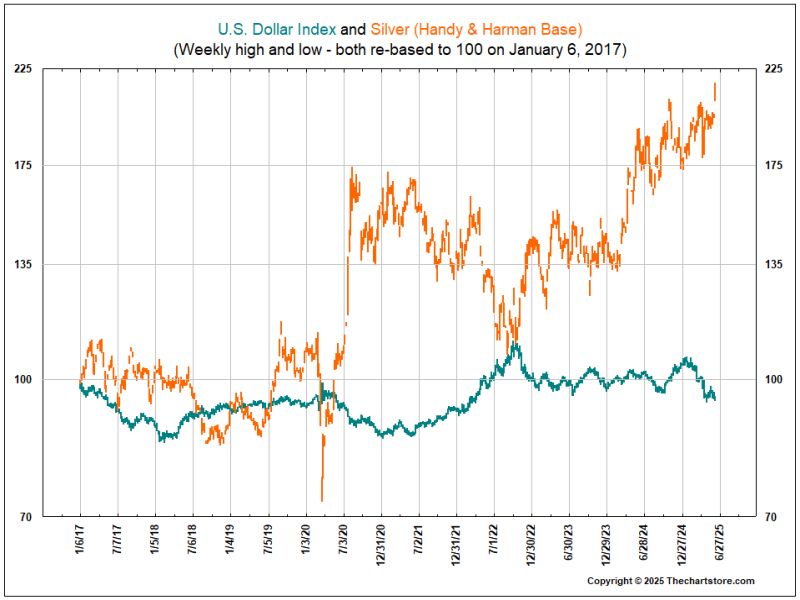

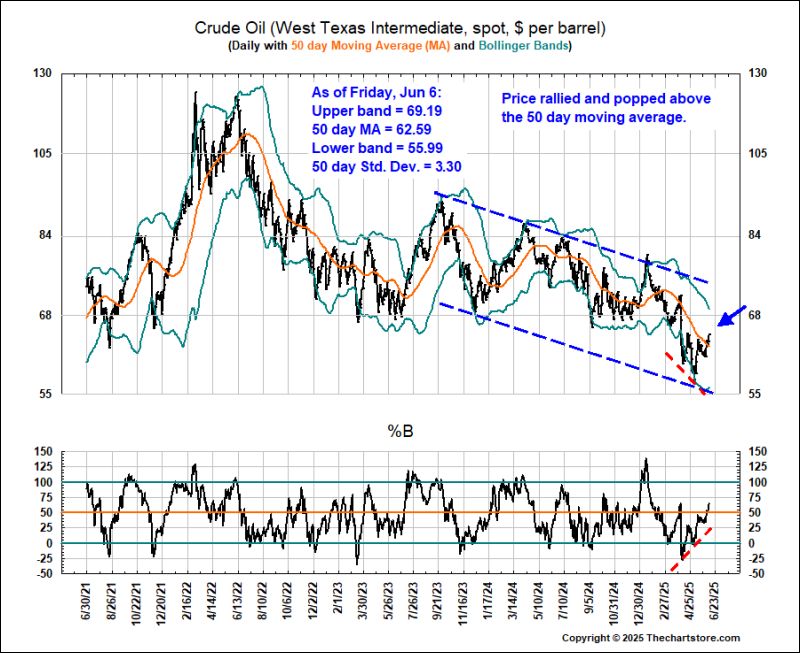

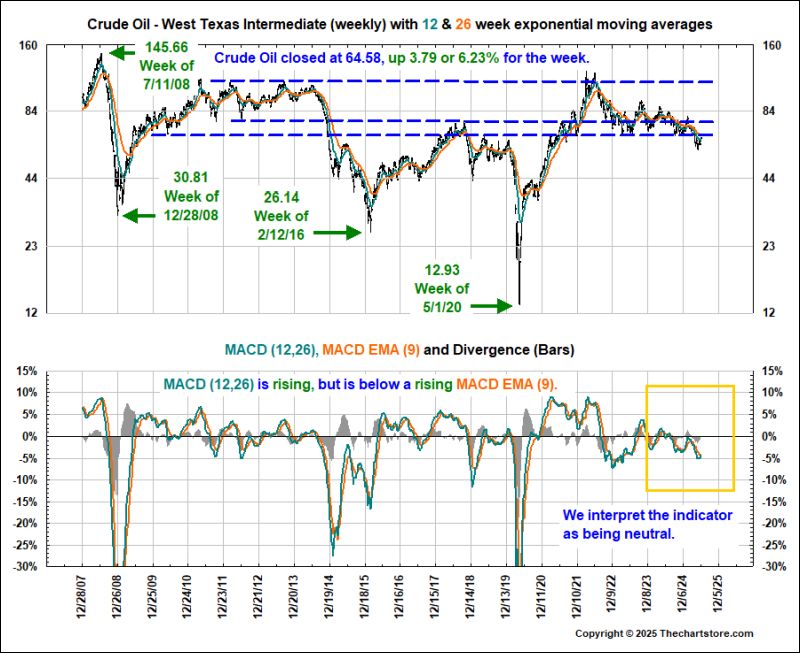

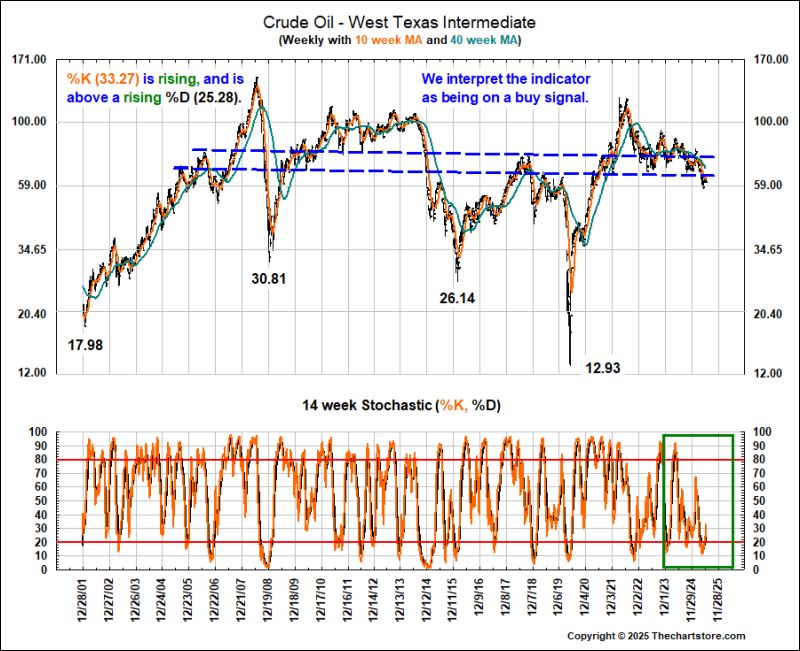

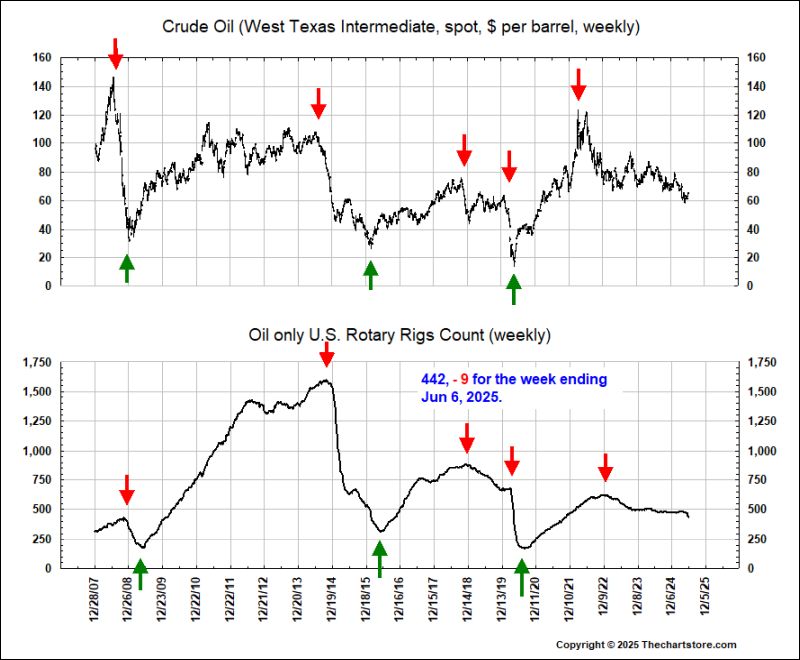

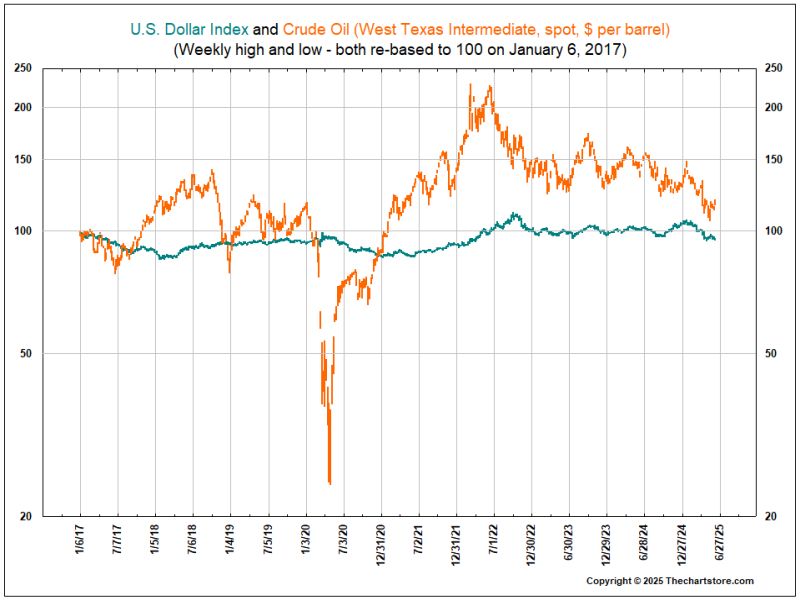

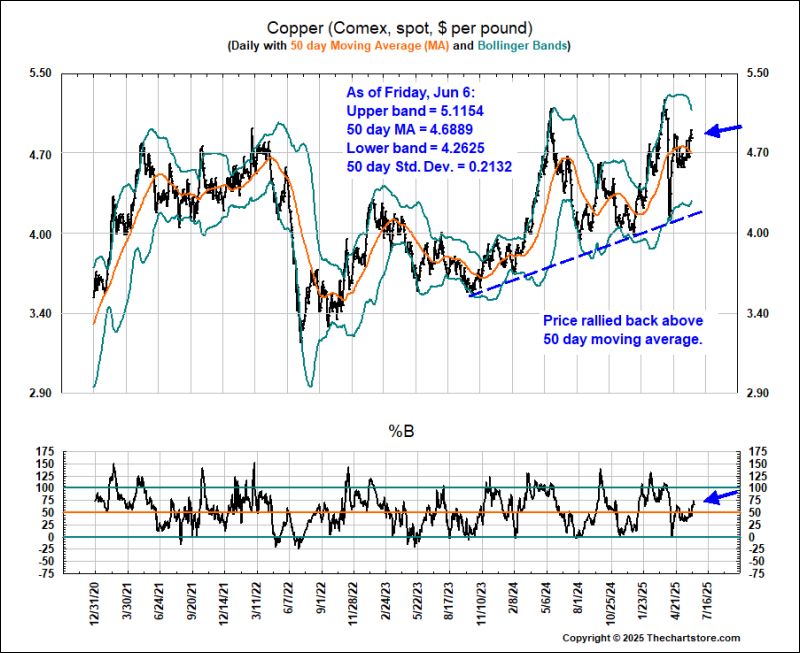

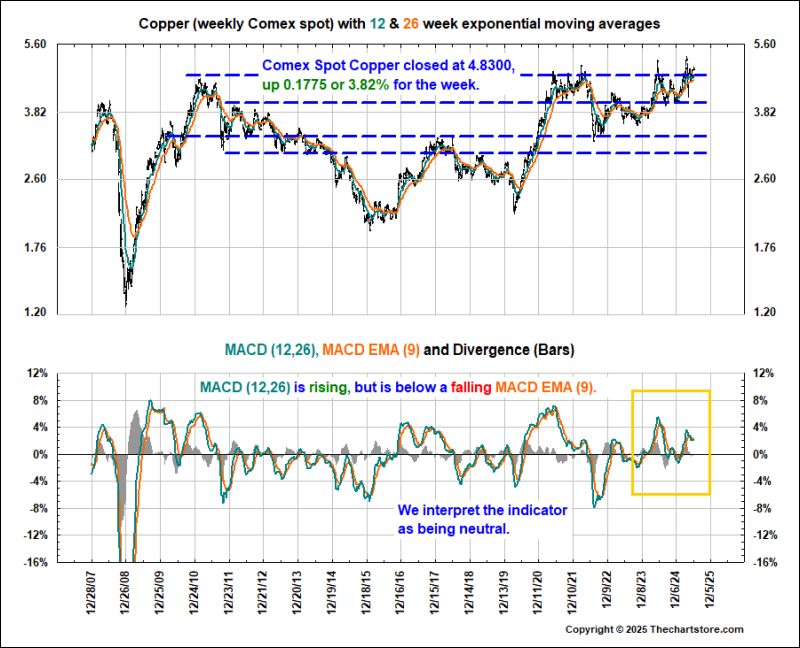

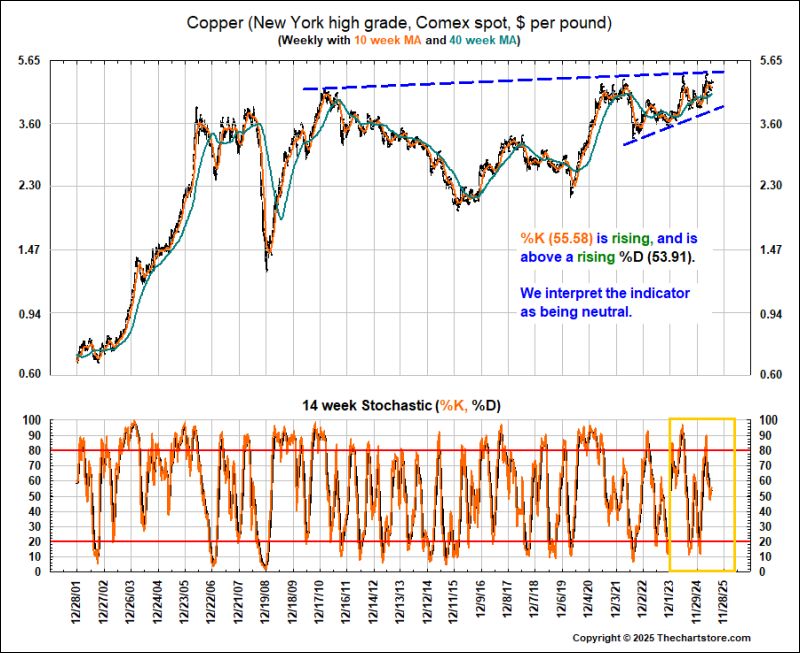

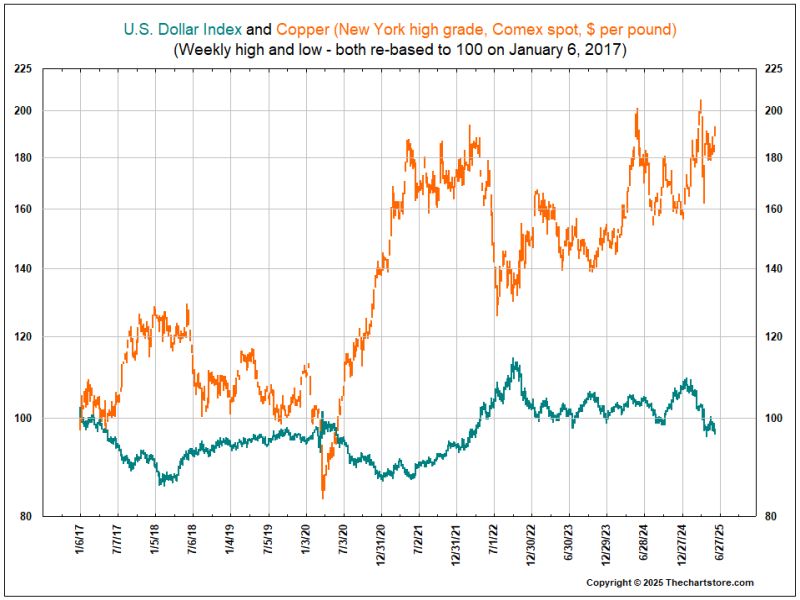

Commodity Watch

Chart 75

Chart 76

Chart 77

Chart 78

Chart 79

Chart 80

Chart 81

Chart 82

Chart 83

Chart 84

Chart 85

Chart 86

Chart 87

Chart 88

Chart 89

Chart 90

Chart 91

Chart 92

Chart 93

Chart 94

Chart 95

Chart 96

Chart 97

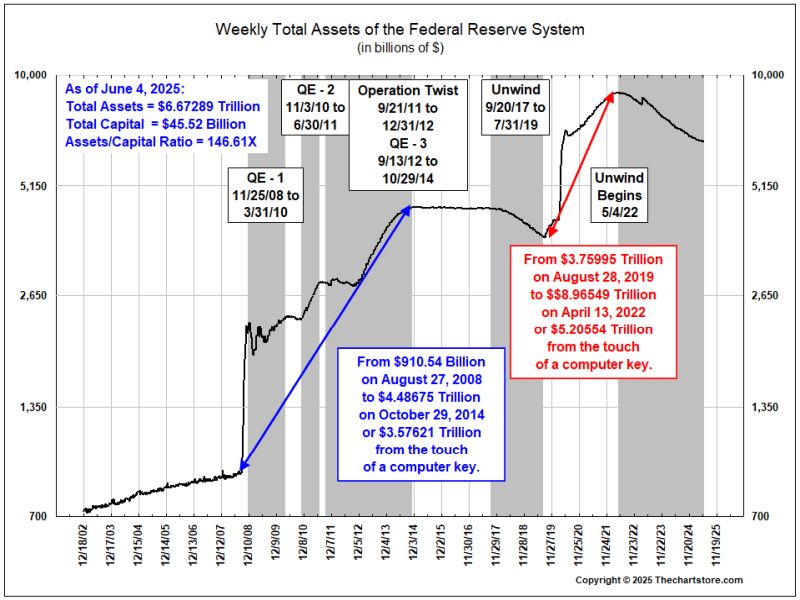

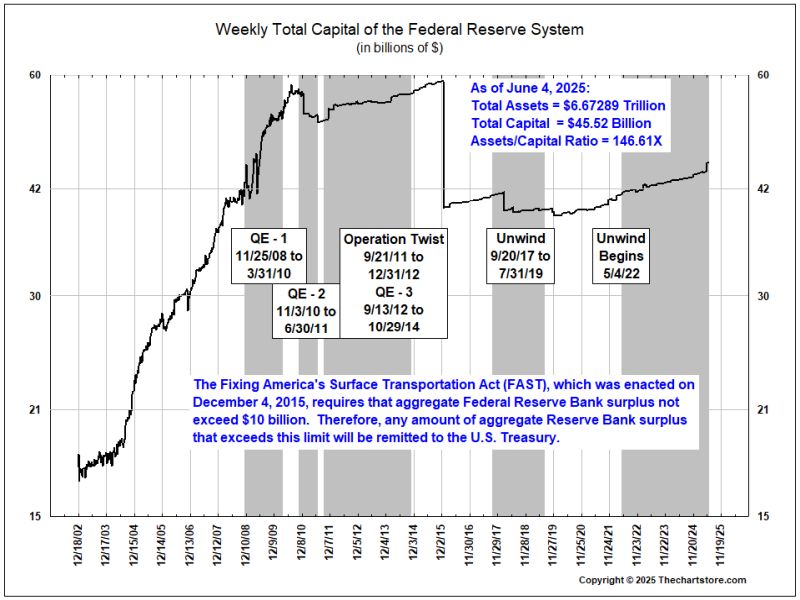

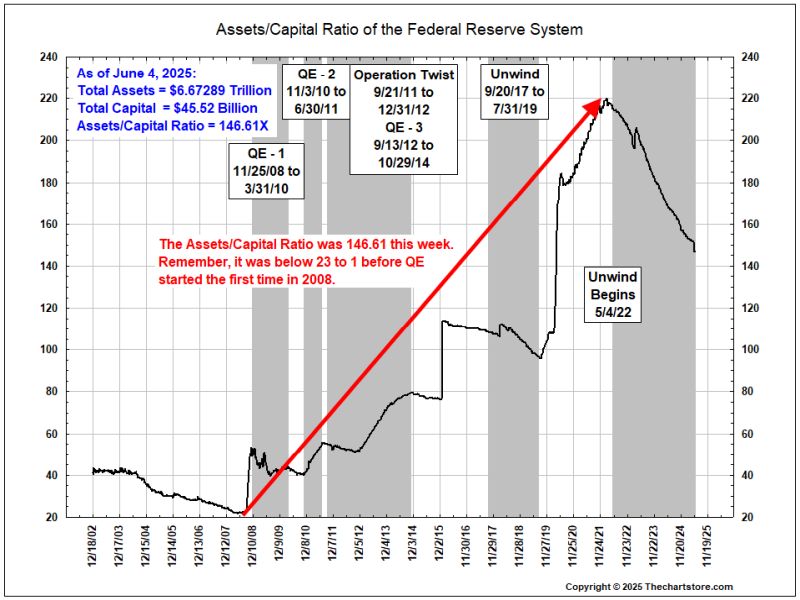

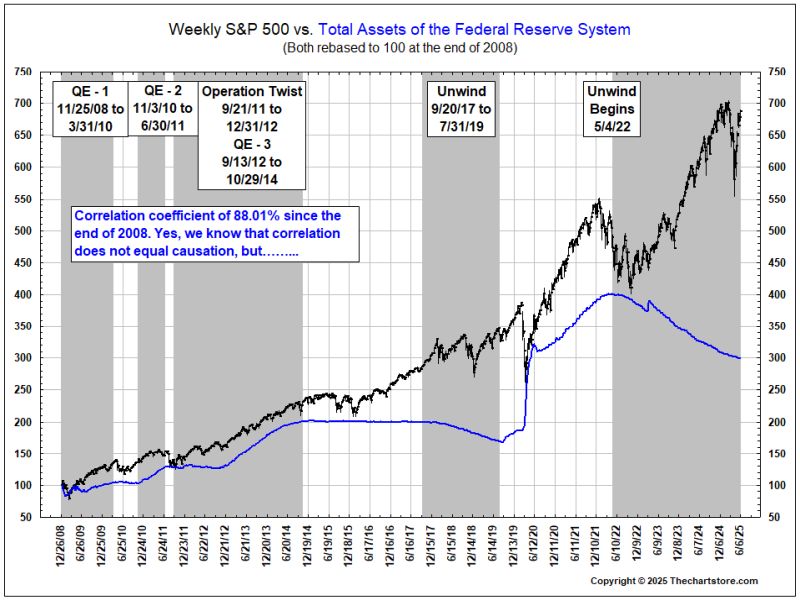

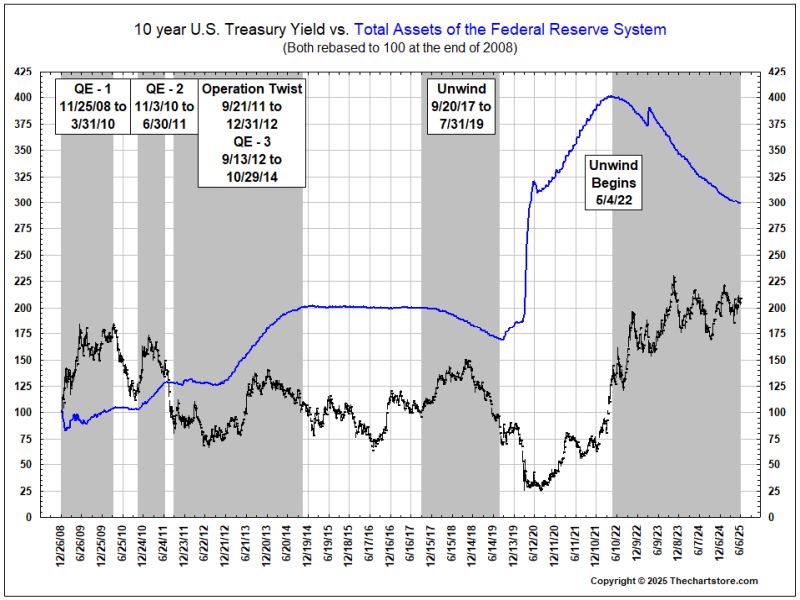

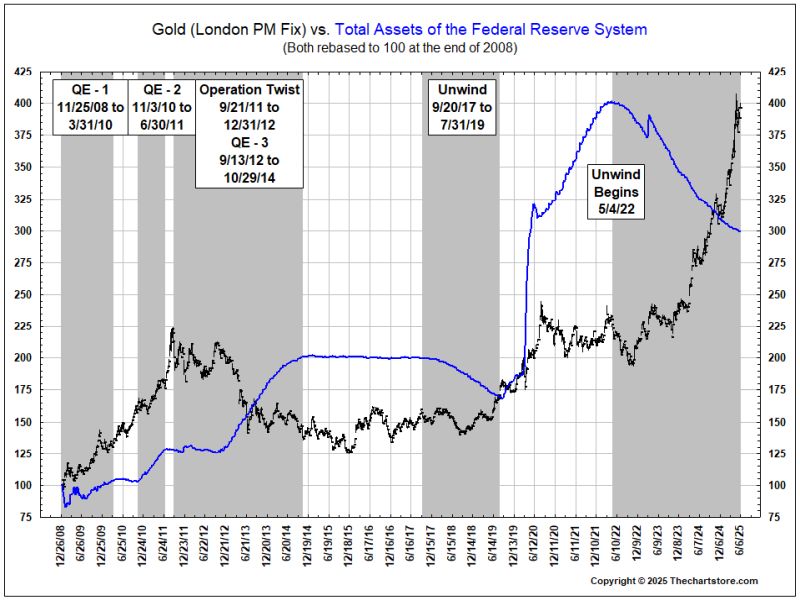

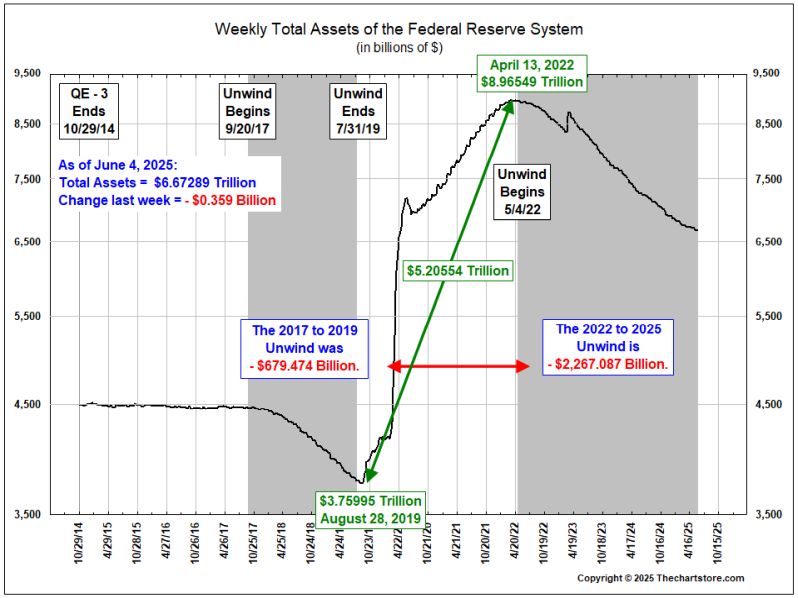

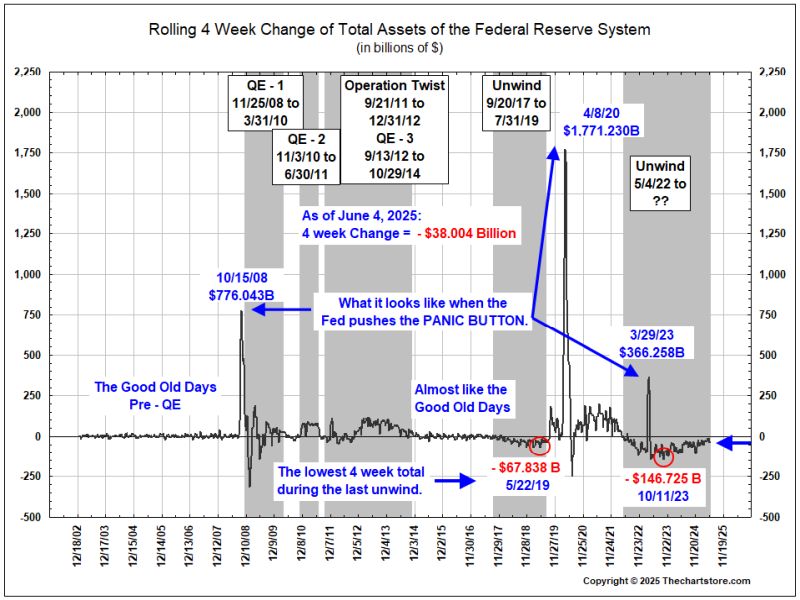

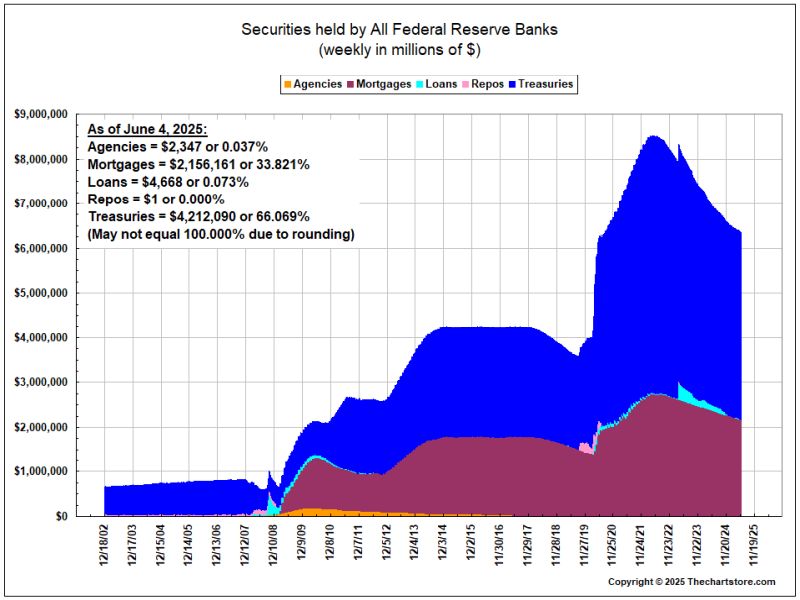

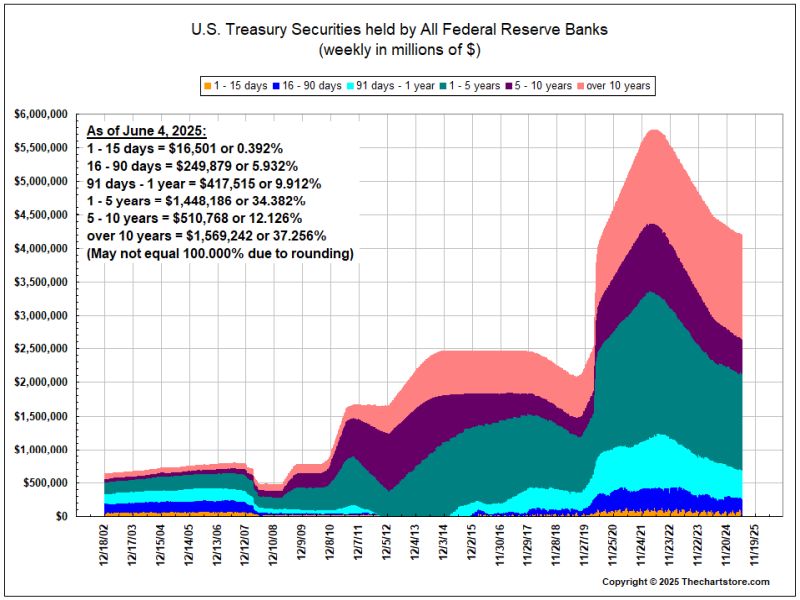

Fed Watch

Chart 98

Chart 99

Chart 100

Chart 101

Chart 102

Chart 103

Chart 104

Chart 105

Chart 106

Chart 107

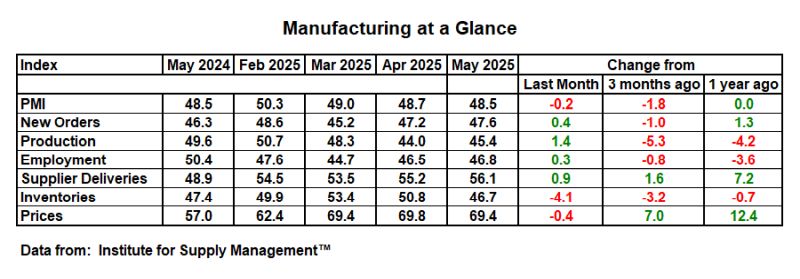

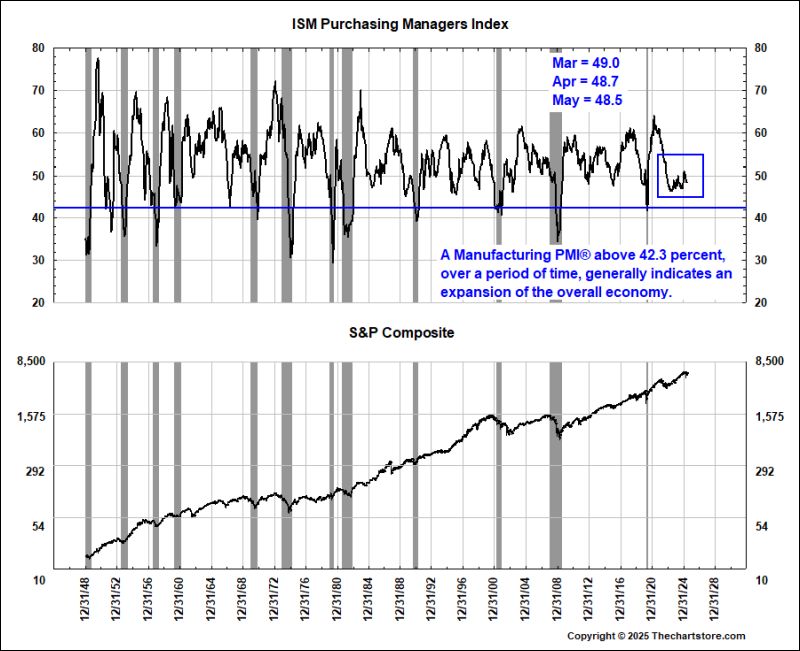

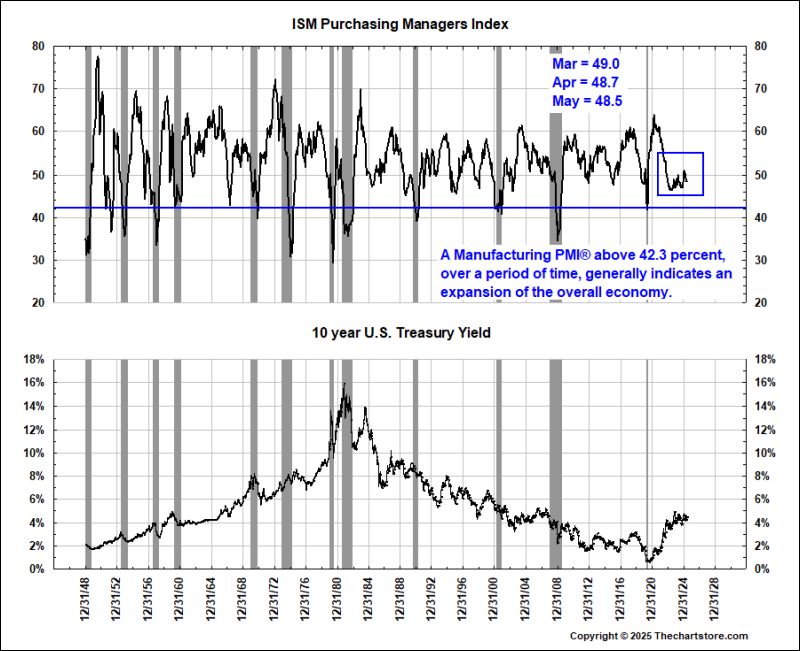

ISM Manufacturing Purchasing Manager's Index Watch

MAY 2025 MANUFACTURING INDEX SUMMARIES

Manufacturing PMI®

The U.S. manufacturing sector contracted in May for the third consecutive month after two months of expansion preceded by 26 months of contraction. The Manufacturing PMI® registered 48.5 percent, 0.2 percentage point lower compared to the 48.7 percent reported in April. “The Manufacturing PMI® decreased to its lowest reading since November, when it registered 48.4 percent. Of the five subindexes that directly factor into the Manufacturing PMI®, only one (Supplier Deliveries) was in expansion territory, down from two in April. Slower supplier deliveries have been driven by tariff concerns and advancing material deliveries; such shipments slowed or stopped after tariffs were deployed, leading to a drawdown of manufacturing inventories. Although the Employment and New Orders indexes both improved for the second consecutive month, they remained in contraction. Of the six biggest manufacturing industries, two (Petroleum & Coal Products; and Machinery) registered growth,” says Spence. A reading above 50 percent indicates that the manufacturing sector is generally expanding; below 50 percent indicates that it is generally contracting.

A Manufacturing PMI® above 42.3 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the May Manufacturing PMI® indicates the overall economy grew for the 61st straight month after last contracting in April 2020. “The past relationship between the Manufacturing PMI® and the overall economy indicates that the May reading (48.5 percent) corresponds to a change of plus-1.7 percent in real gross domestic product (GDP) on an annualized basis,” says Spence.

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/may/

Chart 108

Chart 109

Trade Balance Watch

Chart 110

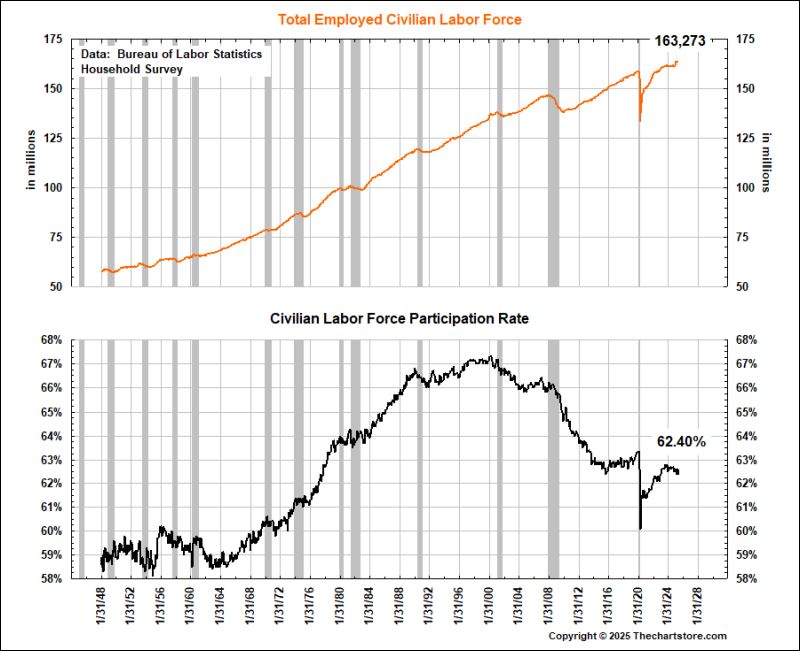

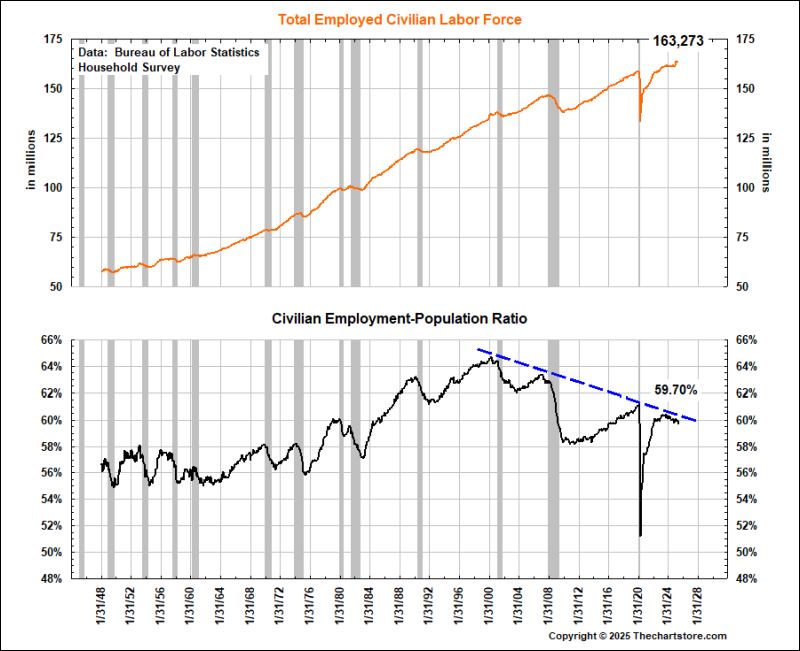

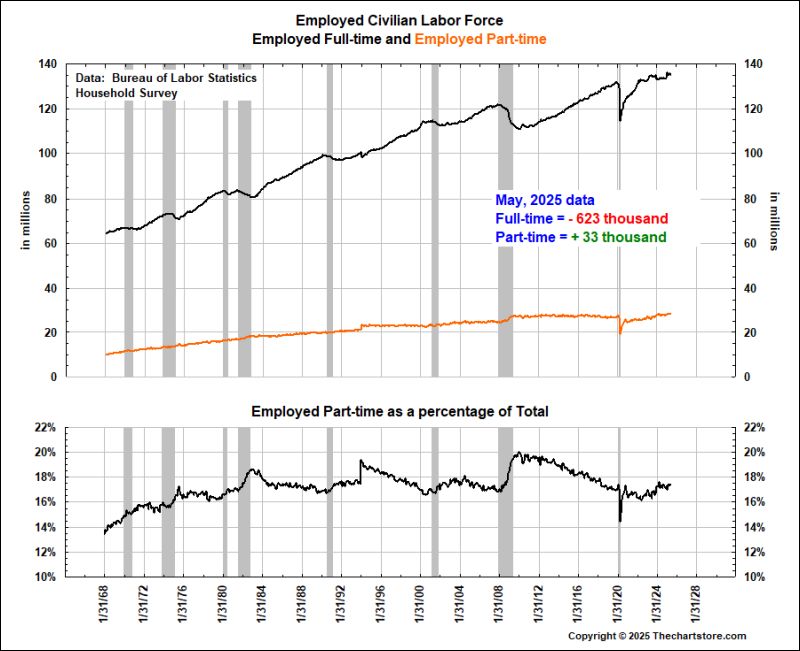

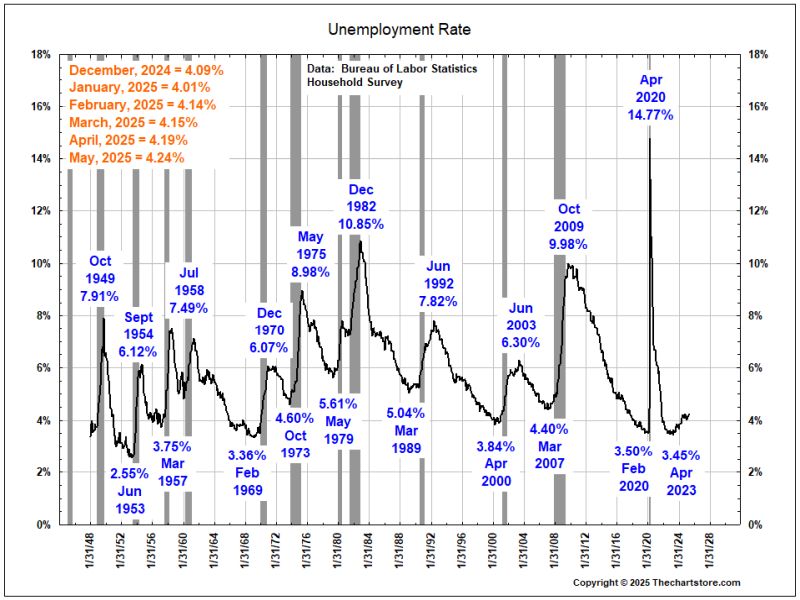

The Employment Situation Watch

Chart 111

Chart 112

Chart 113

Chart 114

Chart 115

Chart 116

Chart 117

Chart 118

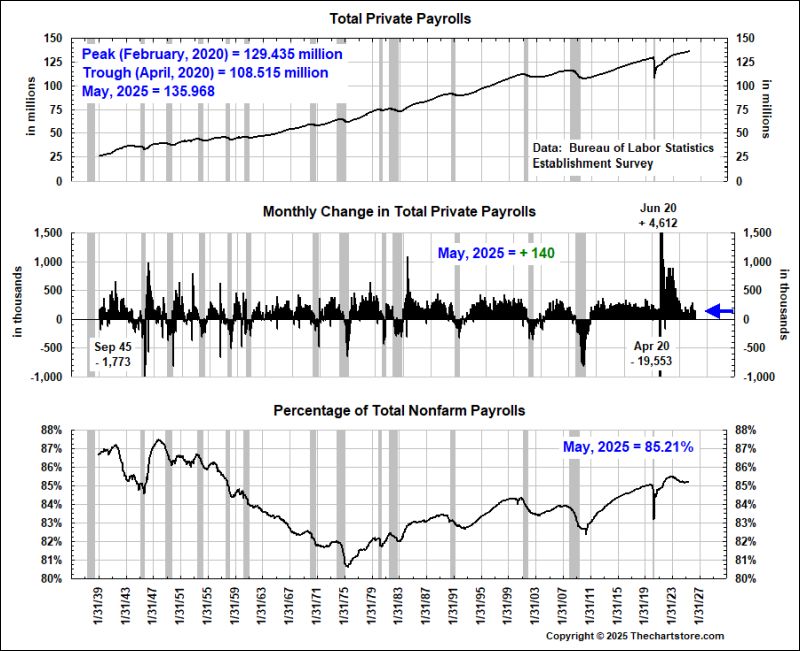

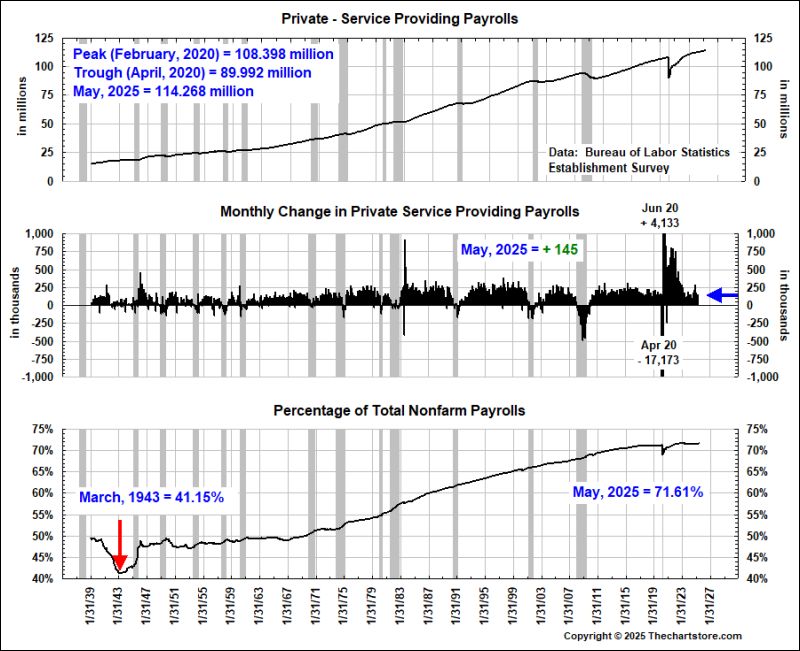

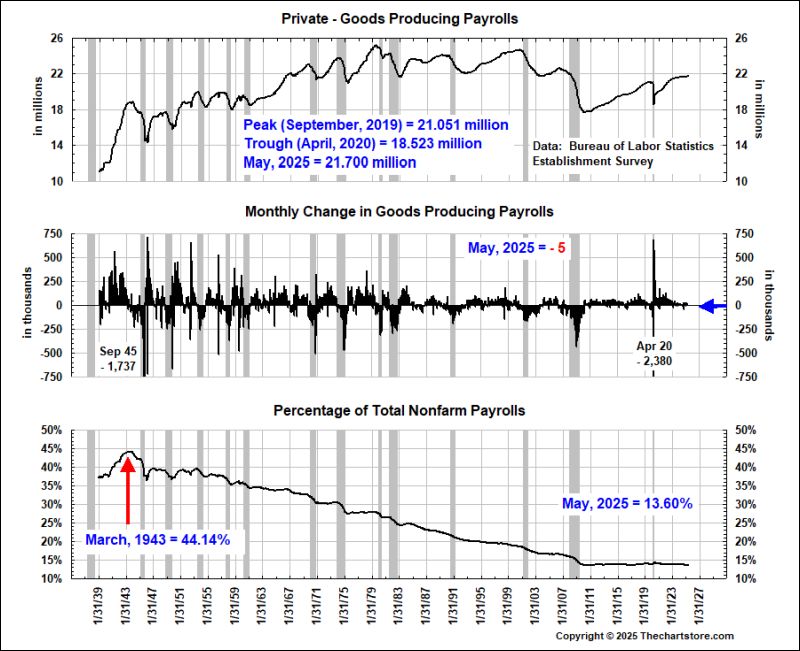

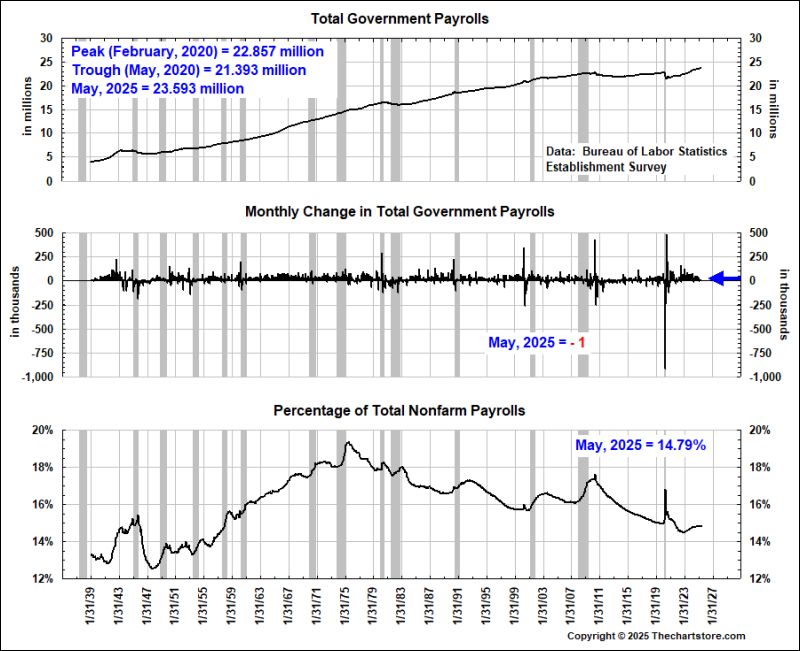

Nonfarm Payroll Watch

Chart 119

Chart 120

Chart 121

Chart 122

Chart 123

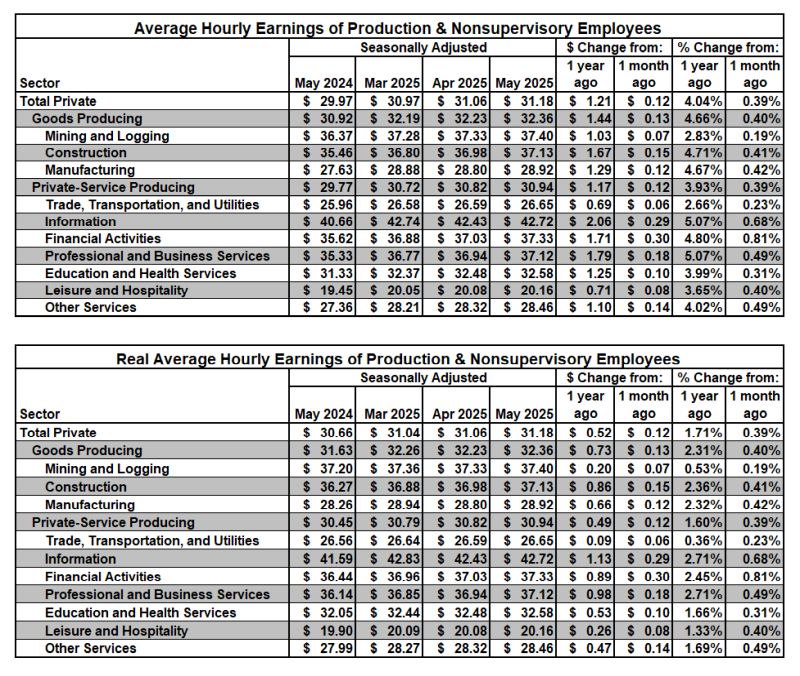

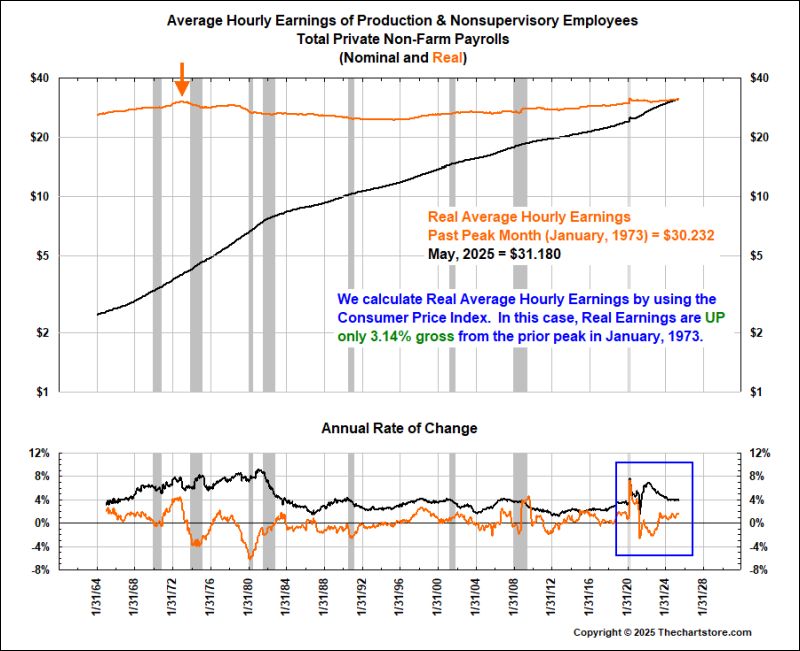

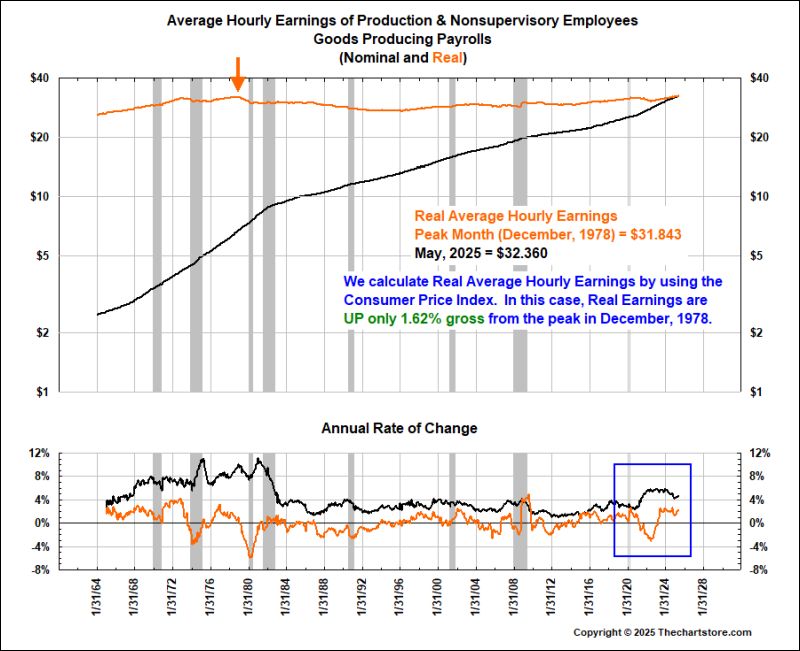

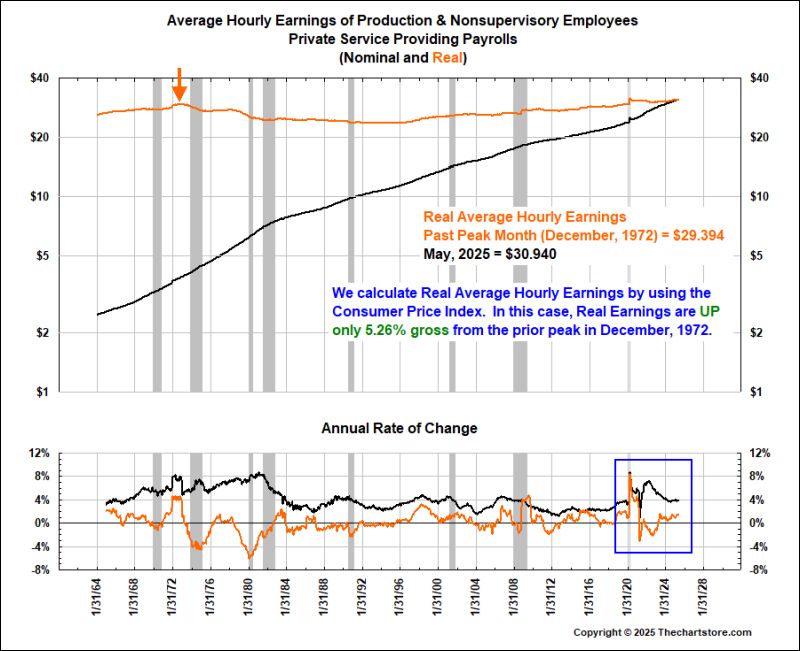

Employee Compensation Watch

Chart 124

Chart 125

Chart 126

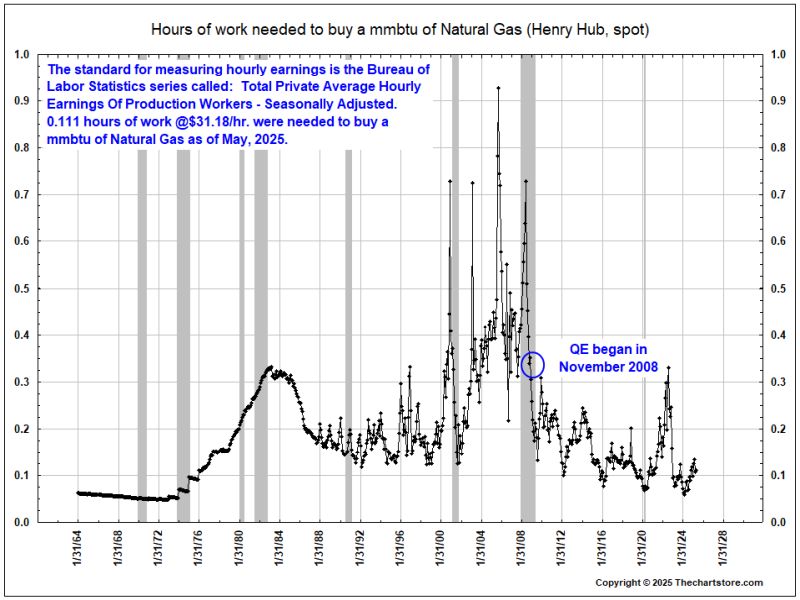

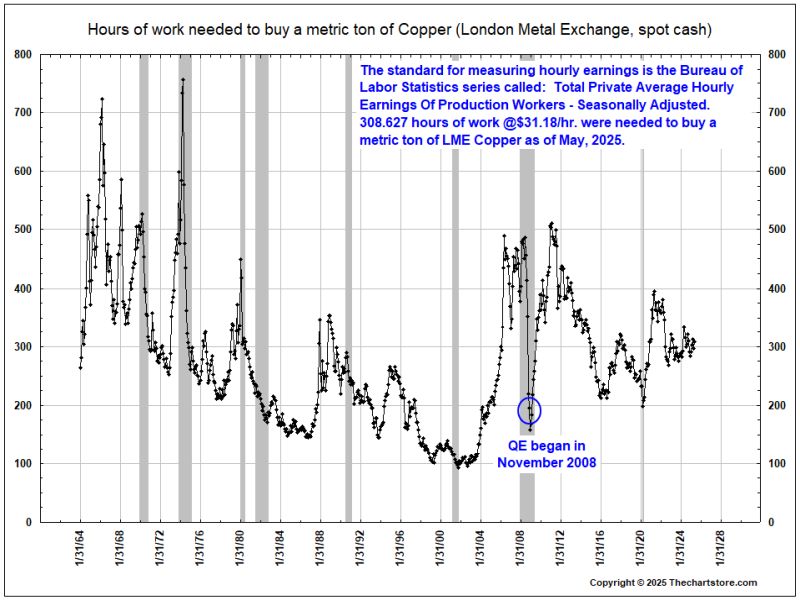

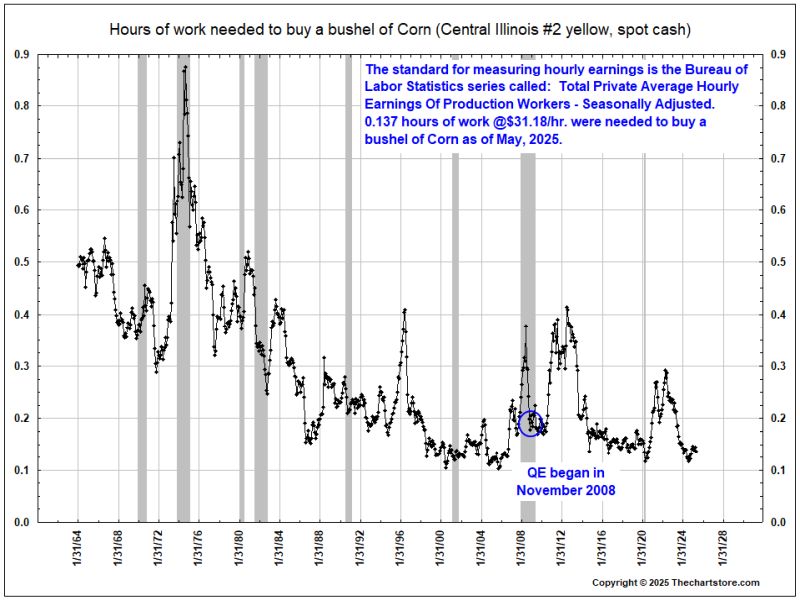

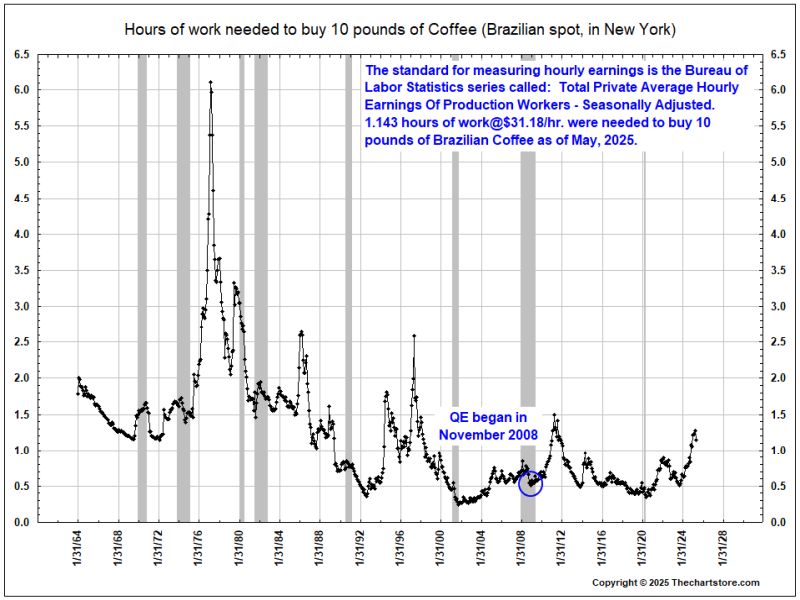

Hours of Work to Buy Watch

Chart 127

Chart 128

Chart 129

Chart 130

Chart 131

Chart 132

Chart 133

Chart 134

Chart 135

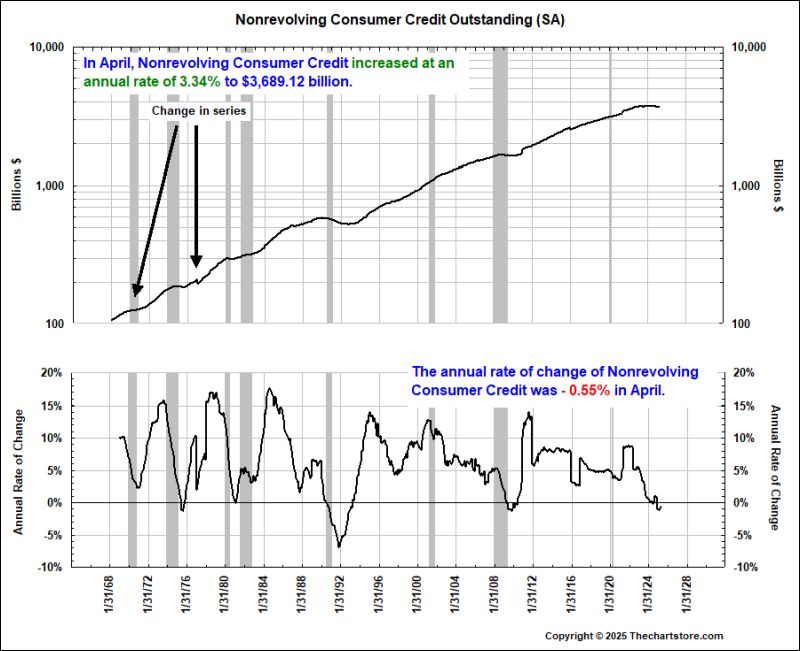

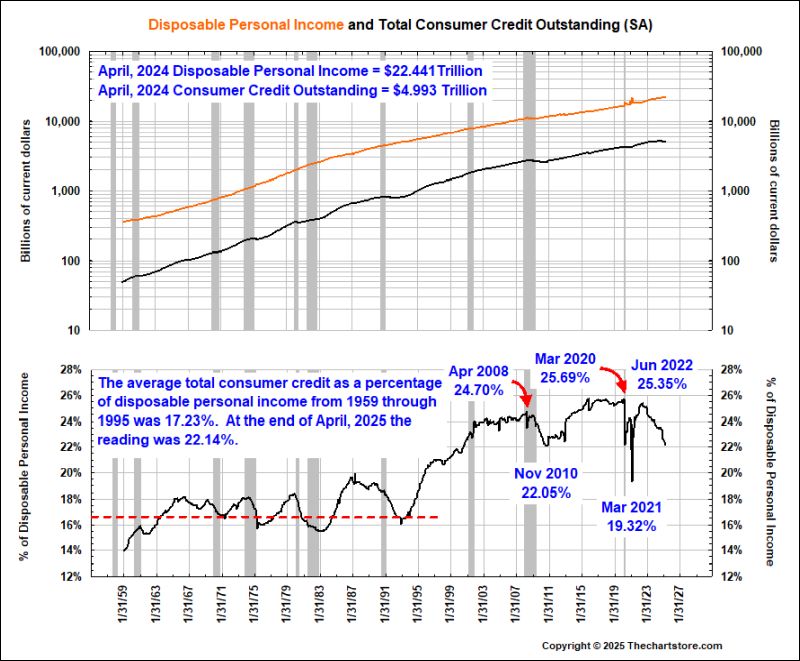

Consumer Credit Watch

Chart 136

Chart 137

Chart 138

Chart 139

That's it for this week.....

To send us an email with a comment on this blog, click here.

Thechartstore.com does not promote the use of the information contained herein for any specific purpose, and makes no representations or warranties that the information contained in this publication is suitable for the particular purposes of the subscriber or any other party. Thechartstore.com assumes no responsibility or liability of any kind for the use of the information contained herein by the subscriber or any other party. Reproduction of any or all of the Weekly Chart Blog without prior permission is prohibited.